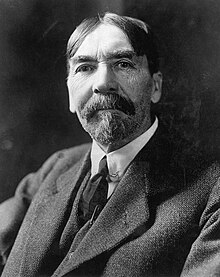

Thorstein Bunde Veblen was an American economist and sociologist who, during his lifetime, emerged as a well-known critic of capitalism.

Consumerism is a social and economic order in which the aspirations of many individuals include the acquisition of goods and services beyond those necessary for survival or traditional displays of status. It emerged in Western Europe before the Industrial Revolution and became widespread around 1900. In economics, consumerism refers to policies that emphasize consumption. It is the consideration that the free choice of consumers should strongly orient the choice by manufacturers of what is produced and how, and therefore orient the economic organization of a society. Consumerism has been criticized by both individuals who choose other ways of participating in the economy and environmentalists concerned about its impact on the planet. Experts often assert that consumerism has physical limits, such as growth imperative and overconsumption, which have larger impacts on the environment. This includes direct effects like overexploitation of natural resources or large amounts of waste from disposable goods and significant effects like climate change. Similarly, some research and criticism focuses on the sociological effects of consumerism, such as reinforcement of class barriers and creation of inequalities.

A Veblen good is a type of luxury good, named after American economist Thorstein Veblen, for which the demand increases as the price increases, in apparent contradiction of the law of demand, resulting in an upward-sloping demand curve. The higher prices of Veblen goods may make them desirable as a status symbol in the practices of conspicuous consumption and conspicuous leisure. A product may be a Veblen good because it is a positional good, something few others can own.

In microeconomics, an Engel curve describes how household expenditure on a particular good or service varies with household income. There are two varieties of Engel curves. Budget share Engel curves describe how the proportion of household income spent on a good varies with income. Alternatively, Engel curves can also describe how real expenditure varies with household income. They are named after the German statistician Ernst Engel (1821–1896), who was the first to investigate this relationship between goods expenditure and income systematically in 1857. The best-known single result from the article is Engel's law which states that as income grows, spending on food becomes a smaller share of income; therefore, the share of a household's or country's income spent on food is an indication of their affluence.

The Theory of the Leisure Class: An Economic Study of Institutions (1899), by Thorstein Veblen, is a treatise of economics and sociology, and a critique of conspicuous consumption as a function of social class and of consumerism, which are social activities derived from the social stratification of people and the division of labor; the social institutions of the feudal period that have continued to the modern era.

The trickle-down effect is a model of product adoption in marketing that affects many consumer goods and services.

In economics, a luxury good is a good for which demand increases more than what is proportional as income rises, so that expenditures on the good become a more significant proportion of overall spending. Luxury goods are in contrast to necessity goods, where demand increases proportionally less than income. Luxury goods is often used synonymously with superior goods.

Positional goods are goods valued only by how they are distributed among the population, not by how many of them there are available in total. The source of greater worth of positional goods is their desirability as a status symbol, which usually results in them greatly exceeding the value of comparable goods.

Conspicuous leisure is a concept introduced by the American economist and sociologist Thorstein Veblen in The Theory of the Leisure Class (1899). Conspicuous or visible leisure is engaged in for the sake of displaying and attaining social status.

Anti-consumerism is a sociopolitical ideology that is opposed to consumerism, the continual buying and consuming of material possessions. Anti-consumerism is concerned with the private actions of business corporations in pursuit of financial and economic goals at the expense of the public welfare, especially in matters of environmental protection, social stratification, and ethics in the governing of a society. In politics, anti-consumerism overlaps with environmental activism, anti-globalization, and animal-rights activism; moreover, a conceptual variation of anti-consumerism is post-consumerism, living in a material way that transcends consumerism.

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes and Pigouvian taxes, where the market consumption of a good is inefficient, and a tax brings consumption closer to the efficient level.

The Robin Hood effect is an economic occurrence where income is redistributed so that economic inequality is reduced. That is a redistribution of economic resources due to which the economically disadvantaged gain at the expense of the economically advantaged. The effect is named after English folkloric figure Robin Hood, said to have stolen from the rich to give to the poor.

Redistribution of income and wealth is the transfer of income and wealth from some individuals to others through a social mechanism such as taxation, welfare, public services, land reform, monetary policies, confiscation, divorce or tort law. The term typically refers to redistribution on an economy-wide basis rather than between selected individuals.

Social class differences in food consumption refers to how the quantity and quality of food varies according to a person's social status or position in the social hierarchy. Various disciplines, including social, psychological, nutritional, and public health sciences, have examined this topic. Social class can be examined according to defining factors — education, income, or occupational status — or subjective components, like perceived rank in society.

Conspicuous conservation describes consumers who purchase environmentally friendly products in order to signal a higher social status.

Theories of consumption have been a part of the field of sociology since its earliest days, dating back, at least implicitly, to the work of Karl Marx in the mid-to-late nineteenth century. Sociologists view consumption as central to everyday life, identity and social order. Many sociologists associate it with social class, identity, group membership, age and stratification as it plays a huge part in modernity. Thorstein Veblen's (1899) The Theory of the Leisure Class is generally seen as the first major theoretical work to take consumption as its primary focus. Despite these early roots, research on consumption began in earnest in the second half of the twentieth century in Europe, especially Great Britain. Interest in the topic among mainstream US sociologists was much slower to develop and it is still not a focal concern of many American sociologists. Efforts are currently underway to form a section in the American Sociological Association devoted to the study of consumption.

Justice and the market is an ethical perspective based upon the allocation of scarce resources within a society. The allocation of resources depends upon governmental policies and the societal attitudes of the individuals who exist within the society. Personal perspectives are based upon ones circle of moral concern or those who the individual deems worthy of moral consideration.

Optimal capital income taxation is a subarea of optimal tax theory which studies the design of taxes on capital income such that a given economic criterion like utility is optimized.

Guilt-free consumption (GFC) is a pattern of consumption based on the minimization of the sense of guilt which consumers incur when purchasing products or commercial services.

Elizabeth Currid-Halkett is an American academic and author. She is the James Irvine Chair of Urban and Regional Planning and Professor of Public Policy at the University of Southern California.