PJSC Gazprom is a Russian majority state-owned multinational energy corporation headquartered in the Lakhta Center in Saint Petersburg. As of 2019, with sales over $120 billion, it was, until 2023, ranked as the largest publicly listed natural gas company in the world and the largest company in Russia by revenue. In the 2020 Forbes Global 2000, Gazprom was ranked as the 32nd largest public company in the world. The Gazprom name is a contraction of the Russian words gazovaya promyshlennost. In January 2022, Gazprom displaced Sberbank from the first place in the list of the largest companies in Russia by market capitalization. In 2022, the company's revenue amounted to 8 trillion rubles. In 2023, the company is delisted from international markets, and continues substantial constriction in its operational results.

The Russia–Ukraine gas disputes refer to a number of disputes between Ukrainian oil and gas company Naftogaz Ukrayiny and Russian gas supplier Gazprom over natural gas supplies, prices, and debts. These disputes have grown beyond simple business disputes into transnational political issues—involving political leaders from several countries—that threaten natural gas supplies in numerous European countries dependent on natural gas imports from Russian suppliers, which are transported through Ukraine. Russia provides approximately a quarter of the natural gas consumed in the European Union; approximately 80% of those exports travel through pipelines across Ukrainian soil prior to arriving in the EU.

Naftogaz of Ukraine is the largest national oil and gas company of Ukraine. It is a state-owned company subordinated to the Government of Ukraine. The vertical-integrated company carries out a complete cycle of exploration operations and development of deposits, operating and exploratory drilling, extraction, transportation, and refinement of natural gas and crude oil, supply of natural and liquefied gas to consumers.

The Yamal–Europe natural gas pipeline is a 4,107-kilometre-long (2,552 mi) pipeline connecting Russian natural gas fields in the Yamal Peninsula and Western Siberia with Poland and Germany, through Belarus. The Poland portion ceased operating in 2022.

Russia's energy policy is presented in the government's Energy Strategy document, first approved in 2000, which sets out the government's policy to 2020. The Energy Strategy outlines several key priorities: increased energy efficiency, reducing the impact on the environment, sustainable development, energy development and technological development, as well as improved effectiveness and competitiveness. Russia's greenhouse gas emissions are large because of its energy policy. Russia is rich in natural energy resources and is one of the world's energy superpowers. Russia is the world's leading net energy exporter, and was a major supplier to the European Union until the Russian invasion of Ukraine. Russia has signed and ratified the Kyoto Protocol and Paris Agreement. Numerous scholars posit that Russia uses its energy exports as a foreign policy instrument towards other countries.

The Petroleum or oil industry in Russia is one of the largest in the world. Russia has the largest reserves and was the largest exporter of natural gas. It has the sixth largest oil reserves, and is one of the largest producers of oil. It is the fourth largest energy user.

Energy consumption across Russia in 2020 was 7,863 TWh. Russia is a leading global exporter of oil and natural gas and is the fourth highest greenhouse emitter in the world. As of September 2019, Russia adopted the Paris Agreement In 2020, CO2 emissions per capita were 11.2 tCO2.

The 2005–06 Russia–Ukraine gas dispute was between Ukrainian state-controlled oil and gas company Naftogaz Ukrainy and Russian national gas supplier Gazprom. The disagreements concerned natural gas supplies, prices and debts. The conflict started in March 2005, ended in January 2006 and, in addition to the gas companies, involved politicians from both countries.

In 2009, Russian natural gas company Gazprom refused to conclude a supply contract unless Ukrainian gas company Naftogaz paid its accumulating debts for previous gas supplies. The dispute began in the closing weeks of 2008 with a series of failed negotiations, and on January 1, 2009 Russia cut off gas supplies to Ukraine. On January 7 the dispute turned to crisis when all Russian gas flows through Ukraine were halted for 13 days, completely cutting off supplies to Southeastern Europe, most of which depends on Russian gas, and partially to other European countries.

Russia supplies a significant volume of fossil fuels to other European countries. In 2021, it was the largest exporter of oil and natural gas to the European Union, (90%) and 40% of gas consumed in the EU came from Russia.

Ukraine has been estimated to possess natural gas reserves of over 670 billions cubic meters (in 2022), and in 2018 was ranked 26th among countries with proved reserves of natural gas. Its total gas reserves have been estimated at 1.870 trillion cubic meters. In 2021, Ukraine produced 19.8 billion cubic meters (bcm or Gm3) of natural gas. To satisfy domestic demand of 27.3 bcm that year, Ukraine relied on gas imports (2.6 bcm) and withdrawal from underground storage (4.9 bcm). Winter demand can reach 150 mcm per day. To meet domestic demand, Ukraine plans to increase domestic natural gas output to 27 bcm.

Energy in Ukraine is mainly from gas and coal, followed by nuclear and oil. The coal industry has been disrupted by conflict. Most gas and oil is imported, but since 2015 energy policy has prioritised diversifying energy supply.

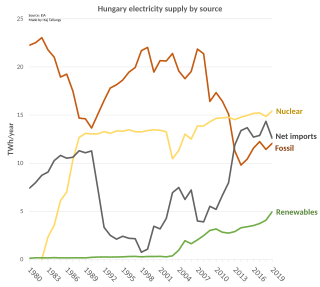

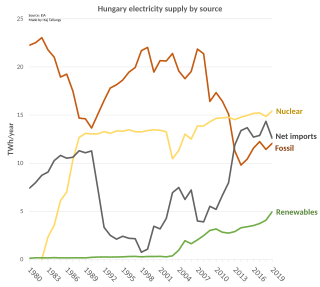

Energy in Hungary describes energy and electricity production, consumption and import in Hungary. Energy policy of Hungary describes the politics of Hungary related to energy.

Andríy Kóbolyev is a Ukrainian politician and businessman, and the former chief executive officer of Ukrainian largest company, the state-owned oil and gas company Naftogaz. In October 2014, Kobolyev was named a global "Top 40 under 40" leader by Fortune in recognition of his anti-corruption reform successes.

The natural gas transmission system of Ukraine is a complex of natural gas transmission pipelines for gas import and transit in Ukraine. It is one of the largest gas transmission systems in the world. The system is linked with natural gas transmission systems of Russia and Belarus on one hand, and with systems of Poland, Romania, Moldova, Hungary and Slovakia on the other hand. The system is owned by Government of Ukraine and operated by Ukrtransgaz. Some local transmission lines together with distribution sets are owned by regional gas companies.

Fossil gas supplies over a quarter of Turkey's energy. The country consumes 50 to 60 billion cubic metres of this natural gas each year, nearly all of which is imported. A large gas field in the Black Sea however started production in 2023.

The 2021–2023 global energy crisis began in the aftermath of the COVID-19 pandemic in 2021, with much of the globe facing shortages and increased prices in oil, gas and electricity markets. The crisis was caused by a variety of economic factors, including the rapid post-pandemic economic rebound that outpaced energy supply, and escalated into a widespread global energy crisis following the Russian invasion of Ukraine. The price of natural gas reached record highs, and as a result, so did electricity in some markets. Oil prices hit their highest level since 2008.

The Russia–EU gas dispute flared up in March 2022 following the invasion of Ukraine on 24 February 2022. Russia and the major EU countries clashed over the issue of payment for natural gas pipelined to Europe by Russia's Gazprom, amidst sanctions on Russia that were expanded in response to Russia's 2022 invasion of Ukraine. In June, Russia cut the flow of gas to Germany by more than half, and in September of that year it stopped it altogether. On 26 September 2022, three of the four pipes of the Nord Stream 1 and 2 gas pipelines ruptured with evidence of sabotage.

The 2021–2022 global energy crisis has caused varying effects in different parts of the world.

As part of the sanctions imposed on the Russian Federation as a result of the Russo-Ukrainian War, on 3 December 2022, the European Union (EU) agreed to cap the price of natural gas in order to reduce the volatility created by Russia in the gas market.