|

|---|

A three-part constitutional referendum was held in the Northern Mariana Islands on 1 November 1997. All three proposals were approved by voters. [1] [2] [3]

|

|---|

A three-part constitutional referendum was held in the Northern Mariana Islands on 1 November 1997. All three proposals were approved by voters. [1] [2] [3]

All three proposals had been approved by a three-quarter majority in both houses of the Commonwealth Legislature. [1] [2] [3]

Chapter II, article 16 would be amended to read:

There shall be a ceiling on the budget of the legislature.

a) Appropriations, or obligations and expenditures, for the operations and activities of the legislature and legislative bureau, other than the salaries of members of the legislature, any payments required by law to be made as an employer contribution to any Commonwealth government retirement fund, and major capital improvement projects, may not exceed in any fiscal year the budget ceiling provided in this section.

g) Obligations and expenditures for the operations and activities of the legislature for the period October 1 through the second Monday in January of a fiscal year in which there is a regular general election may not exceed seven hundred thousand dollars or twenty provided by law consistent with this section. This ceiling shall apply to the various offices and activities in the same proportions as the annual spending authority provided by law consistent with this section.

It also involved deleting Chapter II, article 17, section f. [1]

Section b of Chapter III, article 20 would be amended to read: [3]

An employee who has acquired not less than twenty years of creditable service under the Commonwealth retirement system shall be credited an additional five years and shall be eligible to retire. An employee who elects to retire under this provision may not be reemployed by the Commonwealth Government or any of its instrumentalities or agencies, for more than 60 days in any fiscal year without losing his or her retirement benefits for the remainder of that fiscal year, except that the legislature may by law exempt reemployment of retirees as classroom teachers, doctors, nurses, and other medical professionals from this limitation, for reemployment not exceeding two (2) years. No retiree may have their retirement benefits recomputed based on any reemployment during which retirement benefits are drawn, but every such reemployed retiree shall nevertheless be required to contribute to the retirement fund during the period of reemployment, at the same rate as other government employees. The legislature may prohibit recomputation of retirement benefits based on reemployment after retirement in any event or under any circumstances.

The proposed amendments to Chapter IV were intended to ensure that federal courts had a constitutional basis, and to clarify their powers and procedures. [2]

A pension is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement.

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The original Social Security Act was enacted in 1935, and the current version of the Act, as amended, encompasses several social welfare and social insurance programs.

The government of the Commonwealth of Puerto Rico is a republican form of government with separation of powers, subject to the jurisdiction and sovereignty of the United States. Article I of the Constitution of Puerto Rico defines the government and its political power and authority. The powers of the government of Puerto Rico are all delegated by the United States Congress and lack full protection under the U.S. Constitution. Because of this, the head of state of Puerto Rico is the President of the United States.

The Spanish Constitution is the supreme law of the Kingdom of Spain. It was enacted after its approval in a constitutional referendum; it represents the culmination of the Spanish transition to democracy.

Commonwealth is a term used by two unincorporated territories of the United States in their full official names, which are the Northern Mariana Islands, whose full name is Commonwealth of the Northern Mariana Islands, and Puerto Rico, which is named Commonwealth of Puerto Rico in English and Estado Libre Asociado de Puerto Rico in Spanish, translating to "Free Associated State of Puerto Rico." The term was also used by the Philippines during most of its period under U.S. sovereignty, when it was officially called the Commonwealth of the Philippines.

A balanced budget amendment is a constitutional rule requiring that a state cannot spend more than its income. It requires a balance between the projected receipts and expenditures of the government.

The Constitution of the State of Michigan is the governing document of the U.S. state of Michigan. It describes the structure and function of the state's government.

The pensions crisis or pensions timebomb is the predicted difficulty in paying for corporate or government employment retirement pensions in various countries, due to a difference between pension obligations and the resources set aside to fund them. The basic difficulty of the pension problem is that institutions must be sustained over far longer than the political planning horizon. Shifting demographics are causing a lower ratio of workers per retiree; contributing factors include retirees living longer, and lower birth rates. An international comparison of pension institution by countries is important to solve the pension crisis problem. There is significant debate regarding the magnitude and importance of the problem, as well as the solutions. One aspect and challenge of the "Pension timebomb" is that several countries' governments have a constitutional obligation to provide public services to its citizens, but the funding of these programs, such as healthcare are at a lack of funding, especially after the 2008 recession and the strain caused on the dependency ratio by an ageing population and a shrinking workforce, which increases costs of elderly care.

The Northern Mariana Islands Commonwealth Legislature is the territorial legislature of the U.S. commonwealth of the Northern Mariana Islands. The legislative branch of the territory is bicameral, consisting of a 20-member lower House of Representatives, and an upper house Senate with nine senators. Representatives serve two-year terms and senators serve four-year terms, both without term limits. The territorial legislature meets in the commonwealth capital of Saipan.

The New York State Comptroller is an elected constitutional officer of the U.S. state of New York and head of the New York state government's Department of Audit and Control. Sixty-one individuals have held the office of State Comptroller since statehood. The incumbent is Thomas DiNapoli, a Democrat.

Teacher Retirement System of Texas (TRS) is a public pension plan of the State of Texas. Established in 1937, TRS provides retirement and related benefits for those employed by the public schools, colleges, and universities supported by the State of Texas and manages a $180 billion trust fund established to finance member benefits. More than 1.6 million public education and higher education employees and retirees participate in the system. TRS is the largest public retirement system in Texas in both membership and assets and the sixth largest public pension fund in America. The agency is headquartered at 1000 Red River Street in the capital city of Austin.

Froilan Cruz "Lang" Tenorio was a Northern Mariana Islander politician who was the fourth governor of the Northern Mariana Islands. Elected in 1993, he served one term from January 10, 1994 to January 12, 1998. During his governorship and most of his political career, Tenorio was a member of the Democratic Party of the Northern Mariana Islands, which was not then affiliated with the American Democratic Party. However, he later switched his affiliation to the Covenant Party. As of 2021, he is the last Democrat to serve as governor of the territory.

Lesbian, gay, bisexual, and transgender (LGBT) rights in the Northern Mariana Islands have evolved substantially in recent years. Same-sex marriage and adoption became legal with the Supreme Court's ruling in the case of Obergefell v. Hodges in June 2015. However, the U.S. territory does not ban discrimination based on sexual orientation and gender identity, except in relation to government employees. Gender changes are legal in the Northern Mariana Islands, provided the applicant has undergone sex reassignment surgery.

A constitutional referendum was held in the Northern Mariana Islands on 4 November 1989. Voters were asked whether they approved of two amendments to the constitution. One on putting a limit on spending by the Legislature was approved, whilst the other was rejected.

A constitutional referendum was held in the Northern Mariana Islands on 2 November 2010, alongside the election for the islands' representative to the United States House of Representatives. Voters were asked whether they approved of three proposed amendments to the constitution. All three were rejected.

A constitutional referendum was held in the Northern Mariana Islands on 6 November 1995. Voters were asked whether they approved of two proposed amendments to the constitution; one limiting the rights to vote on constitutional amendments that affected land ownership to native islanders, and one on establishing an Office of Finance to regulate the spending of the Legislature. The first proposal was approved by voters and the second rejected.

A constitutional referendum was held in the Northern Mariana Islands on 6 November 2012, alongside the election for the islands' representative to the United States House of Representatives. Voters were asked whether they approved of three proposed amendments to the constitution. All three were approved.

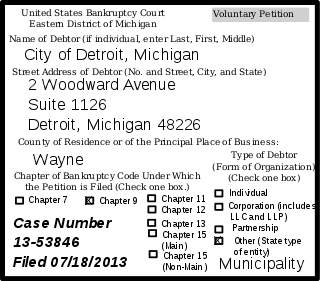

The city of Detroit, Michigan, filed for Chapter 9 bankruptcy on July 18, 2013. It is the largest municipal bankruptcy filing in U.S. history by debt, estimated at $18–20 billion, exceeding Jefferson County, Alabama's $4-billion filing in 2011. Detroit is also the largest city by population in U.S. history to file for Chapter 9 bankruptcy, more than twice as large as Stockton, California, which filed in 2012. While Detroit's population had declined from a peak of 1.8 million in 1950, its July 2013 population was reported by The New York Times as a city of 700,000.

The Michigan Office of Retirement Services (ORS) administers retirement programs for Michigan's state employees, public school employees, judges, state police, and National Guard. ORS also provides various retiree healthcare benefits, including traditional insurance plans, Personal Healthcare Funds, and Health Reimbursement Accounts. ORS serves over 530,000 customers, representing one out of every fourteen Michigan adults. ORS customers live in approximately one out of every nine Michigan households. The state employee system and the public school employee system administered by ORS make up 95 percent of all active plan membership in Michigan. ORS is responsible for the 18th largest public pension system in the United States and the 47th largest pension system in the world, managing combined net assets of nearly $67.8 billion. In fiscal year 2017, ORS paid out over $7.3 billion in pension and health benefits. According to the Pensionomics 2016 report from the National Institute on Retirement Security, pensions paid to Michigan retirees generated $11.1 billion in total spending in the state of Michigan. A Pew study ranks ORS in the top ten state pension systems for paying the highest percentage of their annual required contribution for pension plans, which demonstrates a commitment to fiscal responsibility. ORS is a division of Michigan's Department of Technology, Management, and Budget (DTMB).

The Illinois pension crisis refers to the rising gap between the pension benefits owed to eligible state employees and the amount of funding set aside by the state to make these future pension payments. As of 2020, the size of Illinois' pension obligation is $237B, but the state's pension funds have only $96B available for payouts to retirees.