The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

The NIFTY Next 50 is a stock market index provided and maintained by NSE Indices. It represents the next rung of liquid securities after the NIFTY 50. It consists of 50 companies representing approximately 10% of the traded value of all stocks on the National Stock Exchange of India. It is quoted using the symbol NIFTYJR.

The SSE Composite Index also known as SSE Index is a stock market index of all stocks that are traded at the Shanghai Stock Exchange.

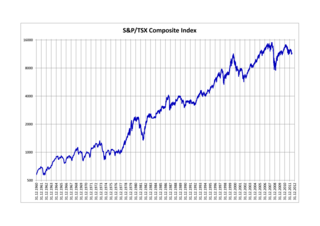

The S&P/TSX Composite Index is the benchmark Canadian stock market index representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX). Having replaced the TSE 300 Composite Index on May 1, 2002, as of September 20, 2021 the S&P/TSX Composite Index comprises 237 of the 3,451 companies listed on the TSX. The index reached an all-time closing high of 25,691.80 on December 6, 2024, and an intraday record high of 25,843.20 on December 9, 2024.

NIFTY 500 is India’s first broad-based stock market index of the Indian stock market. It contains top 500 listed companies on the NSE. The NIFTY 500 index represents about 96.1% of free float market capitalization and about 96.5% of the total turnover on the National Stock Exchange (NSE).

Indonesia Stock Exchange (IDX) is a stock exchange based in Jakarta, Indonesia. It was previously known as the Jakarta Stock Exchange (JSX) before its name changed in 2007 after merging with the Surabaya Stock Exchange (SSX). In recent years, the Indonesian Stock Exchange has seen the fastest membership growth in Asia. As of December 2024, the Indonesia Stock Exchange had 943 listed companies, and total number of investors has already grown to 14.8 million. Indonesia Market Capitalization accounted for 45.2% of its nominal GDP in December 2020. Founded on 30 November 2007, it is ASEAN's largest market capitalization at US$881 billion as of 19 September 2024.

Ho Chi Minh Stock Exchange, formerly the HCMC Securities Trading Center (HoSTC), is a stock exchange in Ho Chi Minh City, Vietnam. It was established in 1998 under Decision No. 127/1998/QD-TTg of the Prime Minister of Vietnam. HCM Securities Trading Center officially opened on July 20, 2000, and had its first trading session on July 28, 2000, with two listed companies and six security company members.

A capitalization-weightedindex, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value, in a capitalization-weighted index. In other types of indices, different ratios are used.

The Santiago Stock Exchange (SSE), founded on November 27, 1893, is Chile's dominant stock exchange, and the third largest stock exchange in Latin America, behind Brazil's BM&F Bovespa, and the Bolsa Mexicana de Valores in Mexico. On December 5, 2014, the Santiago Stock Exchange announced it was joining the United Nations Sustainable Stock Exchanges (SSE) initiative, becoming the 17th Partner Exchange of the initiative.

The Dow Jones Global Titans 50 index is a float-adjusted index of 50 of the largest and best known blue chip companies traded on the New York Stock Exchange, American Stock Exchange, Nasdaq, Euronext, London Stock Exchange, and Tokyo Stock Exchange. The index represents the biggest and most liquid stocks traded in individual countries. It was created by Dow Jones Indexes to reflect the globalization of international blue chip securities in the wake of mergers and the creation of megacorporations.

Amman Stock Exchange (ASE) is a stock exchange private institution in Jordan, based in Amman.

The SET50 and SET100 Indices are the primary stock indices of Thailand. The constituents of both lists are companies listed on the Stock Exchange of Thailand (SET) in Bangkok.

Fundamentally based indexes or fundamental indexes, also called fundamentally weighted indexes, are indexes in which stocks are weighted according to factors related to their fundamentals such as earnings, dividends and assets, commonly used when performing corporate valuations. This fundamental weight may be calculated statically, or it may be adjusted by the security's fundamental to market capitalization ratio to further neutralize the price factor between different securities. Indexes that use a composite of several fundamental factors attempt to average out sector biases that may arise from relying on a single fundamental factor. A key belief behind the fundamental index methodology is that underlying corporate accounting/valuation figures are more accurate estimators of a company's intrinsic value, rather than the listed market value of the company, i.e. that one should buy and sell companies in line with their accounting figures rather than according to their current market prices. In this sense fundamental indexing is linked to so-called fundamental analysis.

PFTS index is a benchmark index of PFTS Ukraine Stock Exchange, Ukraine's leading bourse. Beside PFTS Index, there are also the UX Index of the Ukrainian Exchange and the Ukrainian Average Index 50 (UAI-50) being composed by analysts of internet-publisher fundmarket.ua.

The CBV-Index, or Corporates and Businesses of Vietnam Index, is a market index containing the stocks of 50 leading corporations of Vietnam. Subsets of this index include the CBV 10 and CBV 20.

The S&P/ASX 300, or simply, ASX 300, is a stock market index of Australian stocks listed on the Australian Securities Exchange (ASX). The index is market-capitalisation weighted, meaning each company included is in proportion to the indexes total market value, and float-adjusted, meaning the index only considers shares available to public investors.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

The TA-125 Index, typically referred to as the Tel Aviv 125 and formerly the TA-100 Index, is a stock market index of the 125 most highly capitalised companies listed on the Tel Aviv Stock Exchange (TASE). The index began on 1 January 1992 with a base level of 100. The highest value reached to date is 2152.16, in January 2022. On 12 February 2017, the index was expanded to include 125 instead of 100 stocks, in an attempt to improve stability and therefore reduce risk for trackers and encourage foreign investment.

VN30 Equal Weight Index tracks the total performance of the top 30 large-cap, liquid stocks listed on the Ho Chi Minh City stock exchange along with two popular indices in Vietnam: VN Index and VN30 Index. All index constituents are equal-weighted to help investors deal with liquidity, foreign ownership and state-owned enterprise constraints when investing in Vietnam.