Related Research Articles

Antigua and Barbuda is a sovereign archipelagic country composed of Antigua, Barbuda, and numerous other small islands. Antigua and Barbuda has a total area of 440 km2, making it one of the smallest countries in the Caribbean. The country is mostly flat, with the highest points on Antigua being in the Shekerley Mountains and on Barbuda the Highlands. The country has a tropical savanna climate, with pockets of tropical monsoon in Antigua's southwest. Its largest city is St. John's.

Credit Suisse Group AG is a global investment bank and financial services firm founded and based in Switzerland as a standalone firm but now a subsidiary of UBS. According to UBS, eventually Credit Suisse will be fully integrated into UBS but while the integration is not complete both banks are operating separately. Headquartered in Zürich, as a standalone firm it maintained offices in all major financial centers around the world and provided services in investment banking, private banking, asset management, and shared services. It was known for strict bank–client confidentiality and banking secrecy. The Financial Stability Board considered it to be a global systemically important bank. Credit Suisse was also a primary dealer and Forex counterparty of the Federal Reserve in the United States.

Julius Bär Group AG, known alternatively as Julius Baer Group Ltd., is a private banking corporation founded and based in Switzerland. Headquartered in Zürich, it is among the older Swiss banking institutions. In terms of assets under management, Julius Baer is number two among Swiss banks after UBS and the biggest pure play private bank. The bank's reputation has been marred by various controversies and legal challenges. These include a legal dispute with WikiLeaks in 2008, allegations of aiding U.S. citizens in tax evasion in 2011, and a censure by the Swiss Financial Market Supervisory Authority (FINMA) in 2020 for deficiencies in combating money laundering. The bank has also been implicated in money laundering scandals involving corrupt Venezuelan officials and has faced investigations for its role in the FIFA corruption case. These controversies have cast a shadow on its legacy and raised questions about its compliance and ethical practices.

1 Cabot Square is a 21-floor office building in Cabot Square, Canary Wharf, London, England. From its completion in 1991 until 2023, the building's primary tenant was Credit Suisse.

The Swiss Bankers Association is a professional organization of Swiss financial institutions.

Ariane de Rothschild is a Salvadorean-French banker, CEO of Edmond de Rothschild Group since March 2023. She is the first woman and the first person without Rothschild lineage to run a Rothschild-branded financial institution.

PostFinance Ltd is the financial services unit of Swiss Post which was founded in 1906. As of 2023, it is the fifth largest retail financial institution in Switzerland. Its main area of activity is in the national and international payments and a smaller but growing part in the areas of savings, pensions and real estate.

Baruch "Bruce" Rappaport was an international banker and financier. He was born in Haifa, Mandatory Palestine to Russian-Jewish emigre parents. He maintained a global business empire in the shipping and oil trading sectors through hundreds of shell companies registered in places like Panama, Liberia and Antigua and Barbuda. Rappaport was rumored to have contacts in transnational organized crime and to intelligence services such as the CIA and Mossad. He was a personal friend of former CIA director William J. Casey.

Raiffeisen Switzerland is a cooperative of cooperatives – the union of all independent Swiss Raiffeisen banks. It bears responsibility for the business policy and strategy within the Raiffeisen Group. The 219 independent Raiffeisen banks of Switzerland are organised as cooperatives. With 896 branch offices in total, they make up the densest branch network of any Swiss bank. After the acquisition of Credit Suisse by UBS, the Raiffeisen Group has become the second-largest banking group in Switzerland with client assets under management of 246.6 billion francs. Since June 2014, Raiffeisen has been classified as one of Switzerland's systemically important banks and must therefore meet special requirements in terms of capital. Raiffeisen Switzerland has 3.65 million clients in Switzerland, of whom approximately 1.9 million are cooperative members and thus co-owners of their regional Raiffeisen banks.

Adriano B. Lucatelli is a Swiss entrepreneur and investor in the financial services industry.

A contingent convertible bond (CoCo), also known as an enhanced capital note (ECN), is a fixed-income instrument that is convertible into equity if a pre-specified trigger event occurs. The concept of CoCo has been particularly discussed in the context of crisis management in the banking industry. It has been also emerging as an alternative way for keeping solvency in the insurance industry.

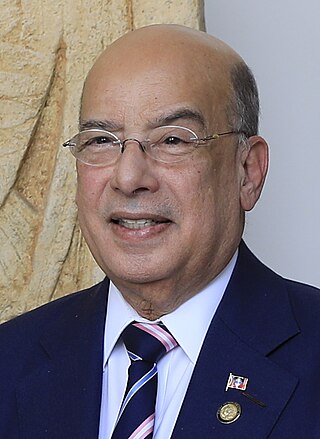

Sir Ronald Michael Sanders is an Antiguan Barbudan diplomat, academic, former broadcast-journalist, and the current Ambassador Extraordinary and Plenipotentiary to the United States and to the Organization of American States (OAS) since 2015. He holds the unique distinction of being the first person, since the OAS enlarged its membership in 1962, to serve as Chairman of the Permanent Council of the OAS for an unprecedented three terms. He completed his highly successful third term on December 31, 2023, having played a widely recognized role in guiding the work of the Permanent Council in the peaceful transition of government in Guatemala on 14 January 2024.

Swissquote Group Holding SA is a Swiss banking group specialising in providing online financial and trading services. Its headquarters are located in Gland, Switzerland. The Group's shares have been listed on the SIX Swiss Exchange under the ticker symbol "SQN" since 29 May 2000. The company had 1,134 employees in 2023. Swissquote Bank Ltd holds a banking licence issued by its supervisory authority, the Swiss Financial Market Supervisory Authority (FINMA).

Henley & Partners is a British investment migration consultancy based in London. The company offers services to individuals and consults governments on residence and citizenship programs. In some cases, the company even runs the programs on behalf of governments. The company has pioneered the industry of selling citizenship and passports.

Dukascopy Bank is a Swiss online bank which provides online and mobile trading, banking and financial services. Headquartered in Geneva, Switzerland, it also has offices in Riga and Tokyo, with over 300 employees.

Karen-Mae Hill, is the High Commissioner for Antigua and Barbuda to the United Kingdom and member of the Commonwealth's Board of Governors. Hill is also the Ambassador Extraordinary and Plenipotentiary of Antigua and Barbuda to the Republic of Estonia.

Dadvan Ismat Yousuf Yousuf is an Iraqi cryptocurrency investor and businessman whose early bitcoin investments made him the youngest self-made billionaire in Switzerland. Yousuf and his companies have been the subject of a number of investigations into financial impropriety.

On 19 March 2023, Swiss bank UBS Group AG agreed to buy Credit Suisse for CHF 3 billion in an all-stock deal brokered by the government of Switzerland and the Swiss Financial Market Supervisory Authority. The Swiss National Bank supported the deal by providing more than CHF 100 billion in liquidity to UBS following its takeover of Credit Suisse's operations, while the Swiss government provided a guarantee to UBS to cover losses of up to CHF 9 billion over the short term. Additionally, CHF 16 billion of Additional Tier 1 bonds were written down to zero.

ONE Swiss Bank SA is a Swiss publicly traded private bank and wealth management firm based in Geneva. One Swiss Bank specializes in private banking and tailored asset & wealth management. It provides its services to private and institutional clients across Switzerland and the world.

Dario Item is a Swiss and Antiguan and Barbudan diplomat and lawyer. He is the Ambassador Extraordinary and Plenipotentiary of Antigua and Barbuda to Spain, Principality of Monaco, and the Principality of Liechtenstein. He is Antigua and Barbuda's Permanent Representative to the UNWTO. He is best known for his game changing efforts to boost investments in Antigua and Barbuda amounting to over 100 million,and for his investigations, which led to major revelations on Credit Suisse AT1 bonds considered by the Financial Times as "one of the most consequential European banking scoops of the year".

References

- 1 2 O'Murchu, Cynthia; Smith, Robert; Ashworth, Louis; Walker, Owen (2023-05-24). "Meet the pizza-loving diplomat behind Antigua News's big Credit Suisse scoop". Financial Times. Retrieved 2025-01-08.

- ↑ Item, Dario (2023-05-15). "Credit Suisse AT1 Bonds write-down: Swiss Court orders FINMA to disclose documents to plaintiffs - Antigua and Barbuda News !" . Retrieved 2025-01-01.

- ↑ Smith, Robert; Walker, Owen; Morris, Stephen (2023-05-22). "Credit Suisse privately challenged Finma's AT1 writedown". Financial Times. Retrieved 2024-12-29.

- ↑ "Credit Suisse neared its cash limits days before rescue, filing shows". Reuters. Archived from the original on 2023-09-26. Retrieved 2024-12-29.

- ↑ "Credit Suisse Was «Scraping By» Days Before Rescue". finews.com. 2023-05-19. Retrieved 2024-12-29.

- ↑ Michael (2023-05-31). "Investigations by 'pizza lover' Antiguan diplomat led to major Credit Suisse revelation". Antigua Observer Newspaper. Retrieved 2025-01-09.

- ↑ Admin (2023-05-29). "Antigua and Barbuda ambassador Dario Item makes sensational international scoop in Credit Suisse AT1 case". Dominica News Online. Retrieved 2025-01-09.

- ↑ "Robert Smith | Financial Times | Twitter". 22 May 2023.

- ↑ Item, Dario (2023-10-03). "CREDIT SUISSE AT1s CASE: The Unspoken Things - Antigua and Barbuda News !" . Retrieved 2025-01-03.

- ↑ "Salvataggio Credit Suisse, le cose non dette". Corriere del Ticino (in Italian). 2023-10-05. Retrieved 2025-01-03.

- ↑ "Der 16-Milliarden-Schwindel – Inside Paradeplatz" (in German). 2023-10-04. Retrieved 2025-01-03.

- 1 2 Morcillo, Nuño Rodrigo Palacios, Nuria (2023-11-22). "El colapso de Credit Suisse llega por primera vez a los tribunales de Estados Unidos". Cinco Días (in Spanish). Retrieved 2025-01-03.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ↑ Item, Dario (2023-11-03). "CREDIT SUISSE AT1 BONDS: The Missed Opportunity - Antigua and Barbuda News !" . Retrieved 2025-01-03.

- ↑ Item, Dario (2023-11-04). "CSG AT1s CASE: Class Action In The U.S. Against Credit Suisse, Its Officers And PricewaterhouseCoopers - Antigua and Barbuda News !" . Retrieved 2025-01-03.

- ↑ "Die 16-Milliarden-Frage: Die gescheiterten CS-Manager versuchten alles, um ihre üppigen Boni ins Trockene zu bringen. Kunden und Investoren wurden hingegen eiskalt abserviert, wie neue Dokumente zeigen". Die Weltwoche (in German). 2023-11-08. Retrieved 2025-01-03.

- ↑ "Class action negli USA contro ex vertici di Credit Suisse". Corriere del Ticino (in Italian). 2023-11-05. Retrieved 2025-01-03.

- 1 2 "Wipe-out, Monster-Prozesse? So what: UBS lanciert frische AT-1 – Inside Paradeplatz" (in German). 2023-11-09. Retrieved 2025-01-03.

- ↑ Item, Dario (2024-04-03). "Credit Suisse AT1: FINMA asks court not to show files to plaintiffs - Antigua and Barbuda News !" . Retrieved 2025-01-03.

- ↑ Smith, Robert. "Robert Smith | Financial Times | Twitter".

- ↑ Smith, Robert; Walker, Owen (2024-04-04). "Swiss regulator seeks to block investors from accessing Credit Suisse AT1 files". Financial Times. Retrieved 2025-01-03.

- ↑ Palacios, Nuño Rodrigo (2024-04-04). "La CNMV suiza intenta bloquear el acceso de inversores a los documentos sobre el colapso de Credit Suisse". Cinco Días (in Spanish). Retrieved 2025-01-03.

- ↑ "Vicenda Credit Suisse, gli AT1 «non danno diritto a ricorrere»". Corriere del Ticino (in Italian). 2024-04-04. Retrieved 2025-01-03.

- ↑ "CS-Untergang: Brief der Finma an Gericht versetzt Investoren in Rage". finews.ch (in German). 2024-04-04. Retrieved 2025-01-03.

- ↑ "A Swiss Lawyer Is Leading The Charge In The Writedown Case Of CS". finews.com. 2024-04-05. Retrieved 2025-01-03.

- ↑ "Finma hat Angst vor Prozessflut von Credit-Suisse-Klägern". Tages-Anzeiger (in German). 2024-04-04. Retrieved 2025-01-03.

- ↑ Item, Dario (2024-09-05). "AT1 case: Credit Suisse relationship managers lied to clients, too - Antigua and Barbuda News !" . Retrieved 2025-01-03.

- 1 2 "AT1 Bonds: Report Reveals How Credit Suisse Client Was Misled". finews.com. 2024-09-06. Retrieved 2025-01-03.

- ↑ "Credit Suisse: lo scandalo AT1, il cliente frodato e la verità nascosta". Corriere del Ticino (in Italian). 2024-09-06. Retrieved 2025-01-03.

- ↑ "Ein Lügengespinst begleitete den Untergang der CS – Inside Paradeplatz" (in German). 2024-09-06. Retrieved 2025-01-03.

- ↑ "Credit Suisse mintió a sus clientes justo antes de caer asegurando que no había retiradas de dinero". www.economiadigital.es (in Spanish). 2024-09-10. Retrieved 2025-01-03.

- 1 2 "A Swiss Lawyer Is Leading The Charge In The Writedown Case Of CS". finews.com. 2024-04-05. Retrieved 2024-12-29.

- ↑ "ABGMA". Global Awards, Radio, Tv, Magazine, Promotion. Retrieved 2025-01-03.

- 1 2 "Antigua and Barbuda Global Music & Media Awards (ABGMA)" (PDF).

- 1 2 "Antigua Barbuda Global Music & Media Awards (ABGMA)" (PDF).

- ↑ "ABGMA Awards finalists announcement (see also ABGMA FB page)". 8 October 2024.

- ↑ Admin (2024-12-16). "Dominican journalist Shermain Bique-Charles: The driving force behind Antigua.News". Dominica News Online. Retrieved 2024-12-29.