Vinod Khosla is an Indian-American billionaire businessman and venture capitalist. He is a co-founder of Sun Microsystems and the founder of Khosla Ventures. Khosla made his wealth from early venture capital investments in areas such as networking, software, and alternative energy technologies. He is considered one of the most successful and influential venture capitalists. Khosla was named the top venture capitalist on the Forbes Midas List in 2001 and has been listed multiple times since that time. As of August 2024, Forbes estimated his net worth at US$7.2 billion.

Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovative technology or business model and often come from high technology industries such as information technology (IT) or biotechnology.

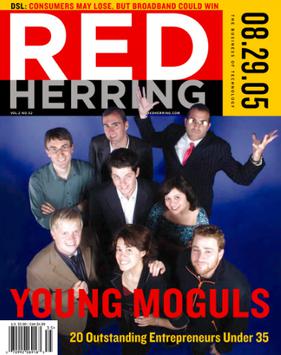

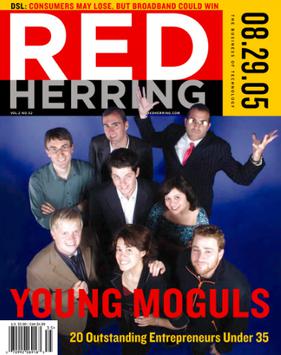

Red Herring is a media company that at different times has published a magazine about tech innovation, an online daily technology news service, and technology newsletters, and has hosted events for technology leaders.

Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB), is an American venture capital firm which specializes in investing in incubation, early stage and growth companies. Since its founding in 1972, the firm has backed entrepreneurs in over 900 ventures, including America Online, Amazon.com, Tandem Computers, Compaq, Electronic Arts, JD.com, Square, Genentech, Google, Netscape, Sun Microsystems, Nest, Palo Alto Networks, Synack, Snap, AppDynamics, and Twitter. By 2019 it had raised around $9 billion in 19 venture capital funds and four growth funds.

Sequoia Capital Operations, LLC is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. As of 2022, the firm had approximately US$85 billion in assets under management.

Jerry Colonna is an American venture capitalist and professional coach who played a prominent part in the early development of Silicon Valley. Colonna has been named to Upside magazine's list of the 100 Most Influential People of the New Economy, Forbes ASAP's list of the best VCs in the country, and Worth's list of the 25 most generous young Americans. He is a co-founder and CEO of the executive coaching and leadership development company, Reboot. He is the host of the Reboot Podcast. He also serves as chairman on the Board of Trustees at Naropa University.

Silicon Wadi is a region in Israel that serves as one of the global centres for advanced technology. It spans the Israeli coastal plain, and is cited as among the reasons why the country has become known as the world's "start-up nation". The highest concentrations of high-tech industry in the region can be found around Tel Aviv, including small clusters around the cities of Raʽanana, Petah Tikva, Herzliya, Netanya, Rehovot, and Ness Ziona. Additional clusters of high-tech industry can be found in Haifa and Caesarea. More recent high-tech establishments have been raised in cities such as Jerusalem and Beersheba, in towns such as Yokneam Illit, and in Airport City. Israel has the third highest number of startups by region and the highest rate of startups per capita in the world.

AlpInvest Partners is a global private equity asset manager with over $85 billion of committed capital since inception as of December 31, 2022. The firm invests on behalf of more than 450 institutional investors from North America, Asia, Europe, South America and Africa.

GLG is a financial and global information services consulting company headquartered in New York City. The company provides financial information and advises investors and consultants with business clients seeking expert advice. It is the world's largest expert network, with over 1,000,000 freelance consultants. GLG's experts include asset managers, investors, consultants, physicians, scientists, engineers, lawyers, senior current and former c-level executives, and former government members. GLG's clients include strategy consulting corporations, hedge funds, private equity firms, professional service firms, and non-profit organizations.

Matrix is a US-based venture capital investment firm. The firm invests in seed and early-stage companies in the United States and India, particularly in the software, communications, semiconductors, data storage, Internet or wireless sectors.

View, Inc. is an American glass-manufacturing company specializing in the production of smart glass.

Corporate venture capital (CVC) is the investment of corporate funds directly in external startup companies. CVC is defined by the Business Dictionary as the "practice where a large firm takes an equity stake in a small but innovative or specialist firm, to which it may also provide management and marketing expertise; the objective is to gain a specific competitive advantage." Examples of CVCs include GV and Intel Capital.

Institutional Venture Partners (IVP) is a US-based venture capital investment firm focusing on fast-growing technology companies. IVP was founded in 1980, making it one of the first venture capital firms in Silicon Valley.

Lucidworks is a San Francisco, California-based software company that specializes in commerce, customer service, and workplace applications.

Danny Rimer OBE is a partner at Index Ventures, a global venture capital firm founded in Geneva in 1992. Rimer opened the firm's London office in 2002 and its San Francisco office in 2012. He has become a leading voice on venture capital in Silicon Valley and Europe, and has been actively involved in various philanthropic and cultural activities.

Union Square Ventures (USV) is an American venture capital firm based in New York City. The firm has backed more than 130 startups, including Twitter, Etsy, Stripe, Coinbase, Zynga, Tumblr, Stack Overflow, Meetup, Kickstarter, MongoDB, Flurry, and Carta.

OurCrowd is an online global venture investing platform that empowers institutions and individual accredited investors to invest and engage in emerging technology companies at an early stage while still privately held. Based in Jerusalem, the company launched in February 2013, and has since opened overseas branches in the United States, the United Kingdom, Canada, Australia, Spain, Singapore, Brazil, and the UAE.

Panaya is a global technology company based in Hod Hasharon, Israel. The company is a subsidiary of Infosys, and has offices in North America, Europe and Japan. It is a SaaS based company certified by SAP, Oracle and Salesforce.com, offering an all-in-one platform for Smart Testing solutions and Change Intelligence, tailored for Enterprise Resource Planning (ERP), Customer Relationship Management (CRM) and cloud-business applications.

Xfund is an American venture capital firm with offices in Palo Alto, California and Cambridge, Massachusetts. It provides early-stage venture capital to entrepreneurs across multiple disciplines. Xfund was founded as the Experiment Fund in 2012 as a partnership between the venture capital companies New Enterprise Associates, Accel Partners, Breyer Capital, and Polaris Partners. Anchored at Harvard University’s School of Engineering and Applied Sciences (SEAS), it was established to make seed-stage investments in startups developed at Harvard and MIT, although the fund has been open to all founders regardless of university affiliation from the start. In 2014 the fund formally renamed itself Xfund, and raised $100 million in a second fund, Xfund 2. A third fund in 2020 raised $120 million. The first investor in most of its portfolio companies, Xfund's partners have invested companies such as 23andMe, Kensho, Gusto, Plaid, Robinhood, Patreon, Andela, and Philo.

Livspace, is a home interior and renovation company headquartered in Singapore. It provides interior design and renovation services in Singapore and India. The company was founded in 2014 by Anuj Srivastava and Ramakant Sharma and has raised funding of $450 million.