Related Research Articles

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Many central banks also have supervisory or regulatory powers to ensure the stability of commercial banks in their jurisdiction, to prevent bank runs, and in some cases also to enforce policies on financial consumer protection and against bank fraud, money laundering, or terrorism financing. Central banks play a crucial role in macroeconomic forecasting, which is essential for guiding monetary policy decisions, especially during times of economic turbulence.

The economy of Nauru is tiny, based on a population in 2019 of only 11,550 people. The economy has historically been based on phosphate mining. With primary phosphate reserves exhausted by the end of the 2010s, Nauru has sought to diversify its sources of income. In 2020, Nauru's main sources of income were the sale of fishing rights in Nauru's territorial waters, and revenue from the Regional Processing Centre.

The economy of Nicaragua is focused primarily on the agricultural sector. Nicaragua itself is the least developed country in Central America, and the second least developed in the Americas by nominal GDP, behind only Haiti. In recent years, under the administrations of Daniel Ortega, the Nicaraguan economy has expanded somewhat, following the Great Recession, when the country's economy actually contracted by 1.5%, due to decreased export demand in the American and Central American markets, lower commodity prices for key agricultural exports, and low remittance growth. The economy saw 4.5% growth in 2010 thanks to a recovery in export demand and growth in its tourism industry. Nicaragua's economy continues to post growth, with preliminary indicators showing the Nicaraguan economy growing an additional 5% in 2011. Consumer Price inflation have also curtailed since 2008, when Nicaragua's inflation rate hovered at 19.82%. In 2009 and 2010, the country posted lower inflation rates, 3.68% and 5.45%, respectively. Remittances are a major source of income, equivalent to 15% of the country's GDP, which originate primarily from Costa Rica, the United States, and European Union member states. Approximately one million Nicaraguans contribute to the remittance sector of the economy.

The economy of Guyana is one of the fastest growing economies in the world, with a gross domestic product (GDP) growth of 19.9% in 2021. In 2024, Guyana had a per capita gross domestic product of Int$80,137 and an average GDP growth of 4.2% over the previous decade. Guyana's economy was transformed in 2015 with the discovery of an offshore oil field in the country's waters about 190 km from Georgetown, making the first commercial-grade crude oil draw in December 2019, sending it abroad for refining.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

Currency substitution is the use of a foreign currency in parallel to or instead of a domestic currency.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

The 1997 Asian financial crisis was a period of financial crisis that gripped much of East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided.

Financial services are economic services tied to finance provided by financial institutions. Financial services encompass a broad range of service sector activities, especially as concerns financial management and consumer finance.

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

The economy of Africa consists of the trade, industry, agriculture, and human resources of the continent. As of 2019, approximately 1.3 billion people were living in 53 countries in Africa. Africa is a resource-rich continent. Recent growth has been due to growth in sales, commodities, services, and manufacturing. West Africa, East Africa, Central Africa and Southern Africa in particular, are expected to reach a combined GDP of $29 trillion by 2050.

The Bank of Korea is the central bank of South Korea and issuer of South Korean won. It was established on 12 June 1950 in Seoul, South Korea.

International economics is concerned with the effects upon economic activity from international differences in productive resources and consumer preferences and the international institutions that affect them. It seeks to explain the patterns and consequences of transactions and interactions between the inhabitants of different countries, including trade, investment and transaction.

The 'Economy of the Caribbean' is varied, but depends heavily on natural resources, agriculture and travel and tourism.

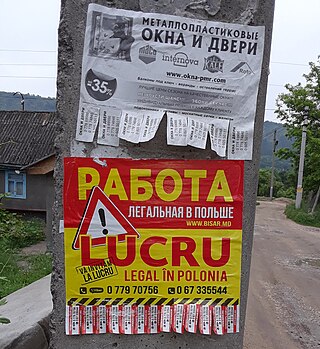

A remittance is a non-commercial transfer of money by a foreign worker, a member of a diaspora community, or a citizen with familial ties abroad, for household income in their home country or homeland. Money sent home by migrants competes with international aid as one of the largest financial inflows to developing countries. Workers' remittances are a significant part of international capital flows, especially with regard to labor-exporting countries.

The Bank of Guyana (BoG) is the central bank of Guyana. It was established in 1965 in advance of the country's independence in 1966. Dr. Gobind Ganga has been the governor of BoG since December 2014.

The Central Bank of the Islamic Republic of Iran, also known as Bank Markazi, was established under the Iranian Banking and Monetary Act in 1960, it serves as the banker to the Iranian government and has the exclusive right of issuing banknote and coinage. CBI is tasked with maintaining the value of Iranian rial and supervision of banks and credit institutions. It acts as custodian of the National Jewels, as well as foreign exchange and gold reserves of Iran. It is also a founding member of the Asian Clearing Union, controls gold and capital flows overseas, represents Iran in the International Monetary Fund (IMF) and internationally concludes payment agreements between Iran and other countries.

The Bank of Mozambique is the central bank of Mozambique. The bank does not function as a commercial bank, and has the responsibility of governing the monetary policies of the country. The president of the Republic appoints the governor. The bank is situated in the capital, Maputo, and has two branches, one in Beira and one in Nampula. The Bank of Mozambique is active in developing financial inclusion policy and is a member of the Alliance for Financial Inclusion.

The history of banking in China includes the business of dealing with money and credit transactions in China.

Republic Bank (Guyana) Limited was formed in 1836 as the British Guiana Bank, which was the first commercial bank in British Guiana, now Guyana. As of 2024 it has 12 branches and 52 Automated Teller Machines (ATMs).

References

- ↑ guyaneseonline (2014-05-22). "The 1836 British Guiana Bank now Republic Bank Ltd". Guyanese Online. Archived from the original on November 29, 2020. Retrieved 2020-11-22.

{{cite web}}: CS1 maint: unfit URL (link) - 1 2 3 4 5 GTIMES (2017-11-19). "The history and evolution of the banking industry in Guyana". Guyana Times. Retrieved 2020-11-21.

- ↑ "Guyana - Resources and power". Encyclopedia Britannica. Retrieved 2020-11-21.

- ↑ Hossein, Caroline (2014). "The Exclusion of Afro-Guyanese Hucksters in Micro-Banking". European Review of Latin American and Caribbean Studies. 96 (96): 75–98. doi: 10.18352/erlacs.9468 – via ResearchGate.

- ↑ "The Cooperative Movement". Guyana Chronicle. Retrieved 2020-11-22.

- ↑ Thompson, Clive, Y.; Jourdain, NATOYA STEPHEN (November 2009). "Revisiting the Underground Economy in Guyana 2001-2008" (PDF). cert-net.com. IMF. p. 5. Retrieved 2020-11-26.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ↑ GTIMES (2017-06-23). "Concessional financing for agriculture needed – rice magnate". Guyana Times. Retrieved 2020-11-21.

- ↑ "Guyana - Parallel Economy". countrystudies.us. Retrieved 2020-12-02.

- ↑ "Finance and Development". Finance and Development | F&D. Retrieved 2020-11-26.

- 1 2 Staritz, Cornelia; Atoyan, Ruben; Gold, Judith (2007-04-01). "Guyana: Why Has Growth Stopped? An Empirical Study on the Stagnation of Economic Growth". Rochester, NY. SSRN 980815.

{{cite journal}}: Cite journal requires|journal=(help) - ↑ Thomas, Clive Y.; Rampersaud, Rajendra (1991). "The Cambio-System of an Independent Exchange Rate Float: The Case of Guyana". Social and Economic Studies. 40 (4): 115–146. ISSN 0037-7651. JSTOR 27865035.

- ↑ "LIST OF CAMBIOS" (PDF). Bank of Guyana.

- ↑ "GBTI opens ATM at Mon Repos". Guyana Chronicle. Retrieved 2020-11-22.

- ↑ Roberts, Debra. "THE DEVELOPMENT IMPACT OF REMITTANCES ON CARIBBEAN ECONOMIES: THE CASE OF GUYANA" (PDF). The University of the West Indies. Retrieved 2020-11-26.

- ↑ "Guyana working with partners to address de-risking in banking sector". Stabroek News. 2016-11-30. Retrieved 2020-11-21.

- ↑ GTIMES (2018-11-28). "Scotiabank pulls out of Guyana". Guyana Times. Retrieved 2020-11-21.

- ↑ "Bank of Baroda Reverses Decision to Sell its Guyana Operations". Kaieteur News. 2019-08-16. Retrieved 2020-11-21.

- ↑ "Citibank officials on exploratory visit to Guyana". Stabroek News. 2020-01-23. Retrieved 2020-11-21.

- ↑ "Guyana lacks laws to govern electronic payment services". Kaieteur News. 2018-04-16. Retrieved 2020-11-22.

- ↑ "Guyana Payments System Project". World Bank. Retrieved 2020-11-22.

- ↑ Administrator. "Overview of the Legal and Regulatory Framework". www.bankofguyana.org.gy. Archived from the original on 2021-03-02. Retrieved 2020-11-23.

- 1 2 "Bank of Guyana". 2020. Retrieved 2020-11-22.