Washington Mutual, Inc. was an American savings bank holding company based in Seattle. It was the parent company of WaMu Bank, which was the largest savings and loan association in the United States until its collapse in 2008.

Washington Federal, Inc.,, is an American bank based in Seattle, Washington. It operates 235 branches throughout Washington, Oregon, Idaho, Nevada, Utah, Arizona, New Mexico, and Texas.

East West Bank, the primary subsidiary of East West Bancorp, Inc., is the largest publicly traded bank headquartered in Southern California, United States. It was founded in 1973 in Los Angeles to serve the Chinese American community in Southern California. In 2023, East West expanded its footprint in Asia with the opening of a representative office in Singapore. Forbes magazine has recognized East West Bank as one of "America's Best Banks" since 2010. East West earned the number one spot in S&P Global Market Intelligence's 2022 Ranking of U.S. Public Banks by Financial Performance.

U.S. Bancorp is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. As of 2019, it had 3,106 branches and 4,842 automated teller machines, primarily in the Western and Midwestern United States. In 2023 it ranked 149th on the Fortune 500, and it is considered a systemically important bank by the Financial Stability Board. The company also owns Elavon, a processor of credit card transactions for merchants, and Elan Financial Services, a credit card issuer that issues credit card products on behalf of small credit unions and banks across the U.S.

Comerica Incorporated is an American financial services company, headquartered in Dallas, Texas. It is the parent of Comerica Bank, a regional commercial bank with 413 branches in the U.S. states of Texas, Michigan, California, Florida and Arizona. Comerica is among the largest U.S. financial holding companies, with offices in a number of U.S. cities.

The Bank of Hawaii Corporation is a regional commercial bank headquartered in Honolulu, Hawaii. It is Hawaii's second oldest bank and its largest locally owned bank in that the majority of the voting stockholders reside within the state. Bank of Hawaii has the most accounts, customers, branches, and ATMs of any financial institution in the state. The bank consists of four business segments: retail banking, commercial banking, investment services, and treasury. The bank is currently headed by chairman, president and chief executive officer, Peter S. Ho.

Old National Bank is an American regional bank with nearly 200 retail branches operated by Old National Bancorp and based in Chicago and Evansville, Indiana. With assets at $23.0 billion and 162 banking centers, Old National Bancorp is the largest financial services bank holding company headquartered in Indiana and one of the top 100 banking companies in the U.S. Its primary banking footprint is in Illinois, Indiana, Kentucky, Michigan, Minnesota, and Wisconsin.

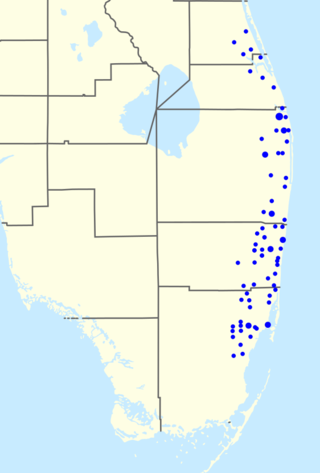

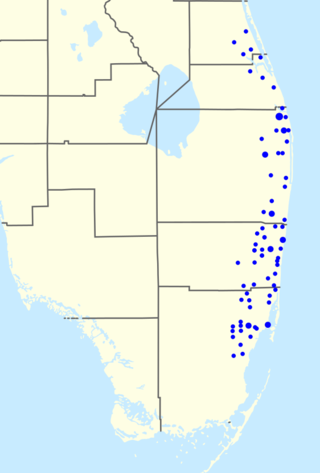

BankAtlantic was a US bank that operated in the state of Florida until it was acquired in 2012 by BB&T Corporation. It provided consumer and business banking services to communities throughout Florida.

New York Community Bancorp, Inc. (NYCB), headquartered in Hicksville, New York, is a bank holding company for Flagstar Bank. In 2023, the bank operated 395 branches in New York, Michigan, New Jersey, Ohio, Florida, Arizona and Wisconsin. Branches used to be operated under the names Queens County Savings Bank, Roslyn Savings Bank, Richmond County Savings Bank, Roosevelt Savings Bank, and Atlantic Bank in New York; Garden State Community Bank in New Jersey; Ohio Savings Bank in Ohio; and AmTrust Bank in Arizona and Florida. However, they rebranded all of these under the Flagstar name on February 21, 2024. NYCB is on the list of largest banks in the United States and is one of the largest lenders in the New York City metro area.

First Hawaiian, Inc. is a bank holding company headquartered in Honolulu, Hawaiʻi. Its principal subsidiary, First Hawaiian Bank, founded in 1858, is Hawaiʻi’s oldest and largest financial institution headquartered in Honolulu, Hawaiʻi, at the First Hawaiian Center. The bank has 57 branches throughout Hawaiʻi, three in Guam and two in Saipan. It offers banking services to consumer and commercial customers, including deposit products, lending services and wealth management, insurance, private banking and trust services. First Hawaiian was listed on the NASDAQ on August 4, 2016, and made its debut at number 12 in the January 2017 publication of Forbes' America's 100 Largest Banks with $20 billion in total assets. In 2019, BNP Paribas sold its stake in First Hawaiian Bank.

Northeast Bank is a Maine-based full-service financial institution. Their National Lending group purchases and originates commercial loans on a nationwide basis while the Community Banking group offers personal and business banking services within Maine via nine branches. Additionally, ableBanking, a division of Northeast Bank, offers online savings products to consumers nationwide. Information regarding Northeast Bank can be found at www.northeastbank.com.

Hanmi Bank is a community bank headquartered in Los Angeles, California, with 35 branches and eight loan production offices in California, Texas, Illinois, New York, New Jersey and Virginia.

Cadence Bank is a commercial bank with dual headquarters in Tupelo, Mississippi and Houston, Texas with operations in Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Missouri, Oklahoma, Tennessee, Texas, and Illinois. In 1876, Raymond Trice and Company received a charter to create a bank in its hardware store in Verona, Mississippi. In 1886, the banking operation was moved to Tupelo, Mississippi and the company was renamed to Bank of Lee County, Mississippi. Soon after, it was renamed to the Bank of Tupelo. The bank was renamed to Bank of Mississippi in 1966. In 1997, the bank changed its name to BancorpSouth. In October 2021, the bank changed its name to Cadence Bank. It has the naming rights to Cadence Bank Amphitheatre in Atlanta and Cadence Bank Arena in Tupelo.

Beneficial State Bank is an Oakland, California-based community development bank. The bank was founded in 2007 by billionaire philanthropist and former presidential candidate Tom Steyer and his wife Kat Taylor, to provide loans and banking services to individuals in low wealth communities, including entrepreneurs and existing businesses.

PacWest Bancorp is an American bank holding company based in Beverly Hills, California, with one wholly owned banking subsidiary, Pacific Western Bank. It is a subsidiary of Banc of California.

SoFi Technologies, Inc. is an American online personal finance company and online bank. Based in San Francisco, SoFi provides financial products including student loan refinancing, mortgages, personal loans, credit card, investing, and banking through both mobile app and desktop interfaces.

Pacific Premier Bancorp, Inc. is a registered holding company under the Bank Holding Company Act of 1956 headquartered in Irvine, California, US. Its principal business focuses on Pacific Premier Bank, which offers a range of financial services to individuals, businesses, and professionals. The bank operates numerous branches in California, Arizona, Nevada, and Washington. Pacific Premier Bank offers commercial escrow services and facilitates 1031 Exchange transactions through its Commerce Escrow division.

Open Bank is an American community bank based in California that focuses on the Korean American community. The bank offers commercial banking services.

Green Bank was a nationally chartered commercial bank headquartered in Houston, Texas. It was founded in 1999 and acquired by Veritex Community Bank in 2018. The bank had branches in Texas and Kentucky. The bank offered traditional banking services such as checking accounts and savings accounts. In addition, it offered various consumer loans, such as residential real estate loans, home equity loans, installment loans, unsecured and secured personal lines of credit, overdraft protection, and letters of credit. The company also provided a range of online banking services, including access to account balances, online transfers, online bill payment, and electronic delivery of customer statements; and extended drive-through hours, and ATMs, as well as banking through telephone, mail, and personal appointment.

Metro City Bank is a Korean-American bank based in Doraville, Georgia and offers personal and commercial banking services. It is the largest Korean-American bank to not be based out of Los Angeles, California. It currently operates a total of 19 branches in Texas, New York, New Jersey, Virginia, Georgia, Alabama, and Florida.