In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the underlying. Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets.

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In finance, speculation is the purchase of an asset with the hope that it will become more valuable shortly. It can also refer to short sales in which the speculator hopes for a decline in value.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. For most of its history, the exchange was in the then common form of a non-profit organization, owned by members of the exchange. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

The Chicago Board of Trade (CBOT), established on April 3, 1848, is one of the world's oldest futures and options exchanges. On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group. CBOT and three other exchanges now operate as designated contract markets (DCM) of the CME Group.

The Commodity Futures Modernization Act of 2000 (CFMA) is United States federal legislation that ensured financial products known as over-the-counter (OTC) derivatives remained unregulated. It was signed into law on December 21, 2000 by President Bill Clinton. It clarified the law so most OTC derivative transactions between "sophisticated parties" would not be regulated as "futures" under the Commodity Exchange Act of 1936 (CEA) or as "securities" under the federal securities laws. Instead, the major dealers of those products would continue to have their dealings in OTC derivatives supervised by their federal regulators under general "safety and soundness" standards. The Commodity Futures Trading Commission's (CFTC) desire to have "functional regulation" of the market was also rejected. Instead, the CFTC would continue to do "entity-based supervision of OTC derivatives dealers". The CFMA's treatment of OTC derivatives such as credit default swaps has become controversial, as those derivatives played a major role in the financial crisis of 2008 and the subsequent 2008–2012 global recession.

Leo Melamed is an American attorney, finance executive, and a pioneer of financial futures. He is the chairman emeritus of CME Group.

A currency future, also known as an FX future or a foreign exchange future, is a futures contract to exchange one currency for another at a specified date in the future at a price that is fixed on the purchase date; see Foreign exchange derivative. Typically, one of the currencies is the US dollar. The price of a future is then in terms of US dollars per unit of other currency. This can be different from the standard way of quoting in the spot foreign exchange markets. The trade unit of each contract is then a certain amount of other currency, for instance €125,000. Most contracts have physical delivery, so for those held at the end of the last trading day, actual payments are made in each currency. However, most contracts are closed out before that. Investors can close out the contract at any time prior to the contract's delivery date.

Options Clearing Corporation (OCC) is a United States clearing house based in Chicago. It specializes in equity derivatives clearing, providing central counterparty (CCP) clearing and settlement services to 16 exchanges. Started by Wayne Luthringshausen and carried on by Michael Cahill. Its instruments include options, financial and commodity futures, security futures, and securities lending transactions.

A commodity broker is a firm or an individual who executes orders to buy or sell commodity contracts on behalf of the clients and charges them a commission. A firm or individual who trades for his own account is called a trader. Commodity contracts include futures, options, and similar financial derivatives. Clients who trade commodity contracts are either hedgers using the derivatives markets to manage risk, or speculators who are willing to assume that risk from hedgers in hopes of a profit.

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

CME Group Inc., headquartered in Chicago, operates financial derivatives exchanges including the Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, and The Commodity Exchange. The company also owns 27% of S&P Dow Jones Indices. It is the world's largest operator of financial derivatives exchanges. Its exchanges are platforms for trading in agricultural products, currencies, energy, interest rates, metals, futures contracts, options, stock indexes, and cryptocurrencies futures.

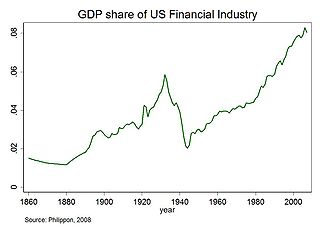

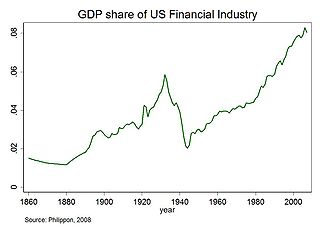

Financialization is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors.

Ashishkumar Chauhan is an Indian business executive, administrator and current Chancellor of University of Allahabad. In July 2022, Chauhan is managing director and chief executive officer of National Stock Exchange (NSE). He was the managing director and chief executive officer of the Bombay Stock Exchange (BSE). and his term will complete in November 2022. He also serves as the member of Governing council of one of the premier B school in India - IIM Raipur. Ashish is best known as the father of modern financial derivatives in India, and is considered one of the foremost experts in financial market policies, Information technology, organized retail, telecommunications and Indian social issues.

A Swap Execution Facility (SEF) is a platform for financial swap trading that provides pre-trade information and a mechanism for executing swap transactions among eligible participants.

ICE Clear Credit LLC, a Delaware limited liability company, is a Derivatives Clearing Organisation (DCO) previously known as ICE Trust US LLC which was launched in March 2009. ICE offers trade execution and processing for the credit derivatives markets through Creditex and clearing through ICE Trust™. ICE Clear Credit LLC operates as a central counterparty (CCP) and clearinghouse for credit default swap (CDS) transactions conducted by its participants. ICE Clear Credit LLC is a subsidiary of IntercontinentalExchange (ICE). ICE Clear Credit LLC is a wholly owned subsidiary of ICE US Holding Company LP which is "organized under the law of the Cayman Islands but has consented to the jurisdiction of United States courts and government agencies with respect to matters arising out of federal banking laws."

Securities market participants in the United States include corporations and governments issuing securities, persons and corporations buying and selling a security, the broker-dealers and exchanges which facilitate such trading, banks which safe keep assets, and regulators who monitor the markets' activities. Investors buy and sell through broker-dealers and have their assets retained by either their executing broker-dealer, a custodian bank or a prime broker. These transactions take place in the environment of equity and equity options exchanges, regulated by the U.S. Securities and Exchange Commission (SEC), or derivative exchanges, regulated by the Commodity Futures Trading Commission (CFTC). For transactions involving stocks and bonds, transfer agents assure that the ownership in each transaction is properly assigned to and held on behalf of each investor.