An index fund is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that the fund can replicate the performance ("track") of a specified basket of underlying investments. While index providers often emphasize that they are for-profit organizations, index providers have the ability to act as "reluctant regulators" when determining which companies are suitable for an index. Those rules may include tracking prominent indexes like the S&P 500 or the Dow Jones Industrial Average or implementation rules, such as tax-management, tracking error minimization, large block trading or patient/flexible trading strategies that allow for greater tracking error but lower market impact costs. Index funds may also have rules that screen for social and sustainable criteria.

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges.

Putnam Investments (Putnam) is a investment management firm founded in 1937 by George Putnam, who established one of the first balanced mutual funds, The George Putnam Fund of Boston. As one of the oldest mutual fund complexes in the United States, Putnam has over $183 billion in assets under management, 79 individual mutual fund offerings, 96 institutional clients, and over seven million shareholders and retirement plan participants.

The Vanguard Group, Inc. is an American registered investment advisor based in Malvern, Pennsylvania, with about $7.7 trillion in global assets under management, as of April 2023. It is the largest provider of mutual funds and the second-largest provider of exchange-traded funds (ETFs) in the world after BlackRock's iShares. In addition to mutual funds and ETFs, Vanguard offers brokerage services, educational account services, financial planning, asset management, and trust services. Several mutual funds managed by Vanguard are ranked at the top of the list of US mutual funds by assets under management. Along with BlackRock and State Street, Vanguard is considered to be one of the Big Three index fund managers that play a dominant role in corporate America.

PIMCO is an American investment management firm focusing on active fixed income management worldwide. PIMCO manages investments in many asset classes such as fixed income, equities, commodities, asset allocation, ETFs, hedge funds, and private equity. PIMCO is one of the largest investment managers, actively managing more than $2 trillion in assets for central banks, sovereign wealth funds, pension funds, corporations, foundations and endowments, and individual investors around the world. PIMCO’s headquarters are in Newport Beach, California; the firm has over 3,100 employees working in 22 offices throughout the Americas, Europe, and Asia. PIMCO and Allianz Global Investors manage around €2.5 trillion of third-party assets.

Invesco Ltd. is an American independent investment management company that is headquartered in Atlanta, Georgia, with additional branch offices in 20 countries. Its common stock is a constituent of the S&P 500 and trades on the New York stock exchange. Invesco operates under the Invesco, Trimark, Invesco Perpetual, WL Ross & Co and Powershares brand names.

A "fund of funds" (FOF) is an investment strategy of holding a portfolio of other investment funds rather than investing directly in stocks, bonds or other securities. This type of investing is often referred to as multi-manager investment. A fund of funds may be "fettered", meaning that it invests only in funds managed by the same investment company, or "unfettered", meaning that it can invest in external funds run by other managers.

Bridgewater Associates, LP is an American investment management firm founded by Ray Dalio in 1975. The firm serves institutional clients including pension funds, endowments, foundations, foreign governments, and central banks.

State Street Global Advisors (SSGA) is the investment management division of State Street Corporation and the world's fourth largest asset manager, with nearly $4.14 trillion (USD) in assets under management as of 31 December 2021.

A chief information security officer (CISO) is a senior-level executive within an organization responsible for establishing and maintaining the enterprise vision, strategy, and program to ensure information assets and technologies are adequately protected. The CISO directs staff in identifying, developing, implementing, and maintaining processes across the enterprise to reduce information and information technology (IT) risks. They respond to incidents, establish appropriate standards and controls, manage security technologies, and direct the establishment and implementation of policies and procedures. The CISO is also usually responsible for information-related compliance. The CISO is also responsible for protecting proprietary information and assets of the company, including the data of clients and consumers. CISO works with other executives to make sure the company is growing in a responsible and ethical manner.

Core & Satellite Portfolio Management is an investment strategy that incorporates traditional fixed-income and equity-based securities known as the "core" portion of the portfolio, with a percentage of selected individual securities in the fixed-income and equity-based side of the portfolio known as the "satellite" portion.

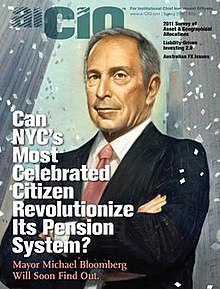

The chief investment officer (CIO) is a job title for the board level head of investments within an organization. The CIO's purpose is to understand, manage, and monitor their organization's portfolio of assets, devise strategies for growth, act as the liaison with investors, and recognize and avoid serious risks, including those never before encountered.

Risk parity is an approach to investment management which focuses on allocation of risk, usually defined as volatility, rather than allocation of capital. The risk parity approach asserts that when asset allocations are adjusted to the same risk level, the risk parity portfolio can achieve a higher Sharpe ratio and can be more resistant to market downturns than the traditional portfolio. Risk parity is vulnerable to significant shifts in correlation regimes, such as observed in Q1 2020, which led to the significant underperformance of risk-parity funds in the Covid-19 sell-off.

Genstar Capital is a private equity firm that executes leveraged buyout transactions in middle-market companies based in North America. Founded in 1988, Genstar currently has approximately $33 billion in assets under management.

Thomas Britton "Britt" Harris IV is the current chief investment officer of the University of Texas/Texas A&M Investment Management Company. The investment management company oversees the assets of The University of Texas and Texas A&M University. In 2013 Harris was announced as the recipient of the aiCIO's Lifetime Achievement Award. He founded and has led Titans of Investing since 2006.

Henry Alexander Swieca is the co-founder and former Chief Investment Officer of Highbridge Capital Management and the founder of Talpion Fund Management.

International Investment Group (IIG) is an American financial institution that specializes in short-term trade finance and commercial finance with a focus on emerging markets. Through its affiliate IIG Capital it provides financing to small and medium-sized merchants, traders and processors with a need for supply chain financing.

Investment outsourcing is the process whereby institutional investors and high-net-worth families engage a third party to manage all or a portion of their investment portfolio. This arrangement can include functions such as establishing the asset allocation, selecting investment managers, implementing portfolio decisions, providing on-going oversight, performing risk management and other areas of portfolio management.

WisdomTree, Inc. is a global exchange-traded fund (ETF) and exchange-traded product (ETP) sponsor and asset manager with headquarters in New York. WisdomTree launched its first ETFs in June 2006, and became one of the major ETF providers in the United States. WisdomTree sponsors different ETFs that span asset classes and countries worldwide. Categories include: U.S. and International Equity, Currency, Fixed Income and Alternatives.

The State of Wisconsin Investment Board (SWIB), created in 1951, is an independent state agency responsible for managing the assets of the Wisconsin Retirement System, the State Investment Fund (SIF), and other state trust funds. As of December 31, 2022, SWIB managed over $143 billion in assets.