The Consumer Price Index (CPI) is the official measure of inflation in consumer prices in the United Kingdom. It is also called the Harmonised Index of Consumer Prices (HICP). [1]

The Consumer Price Index (CPI) is the official measure of inflation in consumer prices in the United Kingdom. It is also called the Harmonised Index of Consumer Prices (HICP). [1]

The traditional measure of inflation in the UK for many years was the Retail Prices Index (RPI), which was first calculated in the early 20th century to evaluate the extent to which workers were affected by price changes during the First World War. The main index was described as the Interim Index of Retail Prices from 1947 to 1955. In January 1956, it was rebased and renamed the Index of Retail Prices. In January 1962, this was replaced by the General Index of Retail Prices, which was again rebased at that time. A further rebasing occurred in January 1987, subsequent to the issue of the first index-linked gilts.

An explicit inflation target was first set in October 1992 by Chancellor of the Exchequer Norman Lamont, following the UK's departure from the Exchange Rate Mechanism. Initially, the target was based on the RPIX, which is the RPI calculated excluding mortgage interest payments. This was felt to be a better measure of the effectiveness of macroeconomic policy. It was argued that if interest rates are used to curb inflation, then including mortgage payments in the inflation measure would be misleading. The Treasury set interest rates until 1997.

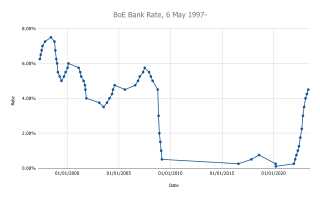

On election day in May 1997, the new Labour government handed control over interest rates to the politically independent Bank of England Monetary Policy Committee. This committee is given the responsibility of adjusting interest rates in order to meet an inflation target set by the Chancellor. [3] The initial target rate of inflation was an RPIX of 2.5%. The committee meets once per month to decide whether any changes to the interest rate are necessary. If, in any month, inflation deviates from the target by more than one percentage point, the Governor of the Bank of England is required to write an open letter to the Chancellor explaining the reasons for this and proposing a plan of action for bringing inflation back towards the target.

Since 1996, the United Kingdom has also tracked a Consumer Price Index figure, and in December 2003, the inflation target was changed to CPI of 2% from the previous target of RPIX of 2.5%. [1]

The Consumer Prices Index, including owner-occupiers' housing costs (CPIH), became the lead inflation index in UK official inflation statistics on 21 March 2017. [4]

The CPI calculates the average price increase as a percentage for a basket of 700 different goods and services. Around the middle of each month it collects information on prices of these commodities from 120,000 different retailing outlets. Note that unlike the RPI, the CPI takes the geometric mean of prices to aggregate items at the lowest levels, instead of the arithmetic mean. This means that the CPI will generally be lower than the RPI. The rationale is that this accounts for the fact that consumers will buy less of something if its price goes up, and more if its price goes down; it also ensures that if prices go up and then revert to the previous level, the CPI also reverts to its previous level (which is not the case with the calculation method used for the RPI). [5] The Government Actuary's Department estimates this difference in averaging method accounts for about 0.9% of the average 1.15% annual difference between CPI and RPI. [6]

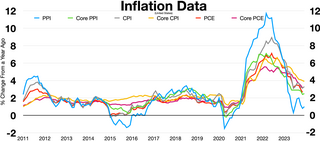

The change in the CPI over the 12 months to August 2008 was 4.7%, while the corresponding figure for RPIX (which excludes mortgage interest) was 5.2% and that for RPI (which includes mortgage interest) was 4.8%. [7] The CPI, the RPIX, and the RPI are published monthly by the Office for National Statistics (ONS). A history of CPI and RPIX going back to 1989 can be found at the ONS' website. [8]

There has been criticism of CPI as being a less effective measure of price rises than the Retail Prices Index, accusing it of being easier to manipulate and less broad based (for example excluding housing). John Redwood, the Conservative MP, has said that CPI targeting meant that interest rates were set lower at a time of rising (RPI) inflation. [9]

Nevertheless, following the UK general election of May 2010 the incoming Conservative Chancellor George Osborne announced that CPI was to be more widely adopted, including for setting benefits and pensions. [10]

In January 2013 the Office for National Statistics announced its conclusion that the RPI did not meet international standards and it is no longer formally ranked as a UK 'National Statistic'. [11] [12]

The basket of goods and services chosen is intended to reflect changes in society's buying habits. For example, on 23 March 2009, rosé wine and takeaway chicken were added to the basket, whereas volume bottled cider and boxes of wine were removed. [13]

In economics, inflation is a general increase of the prices. This is usually measured using the consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States.

Purchasing power parity (PPP) is a measure of the price of specific goods in different countries and is used to compare the absolute purchasing power of the countries' currencies. PPP is effectively the ratio of the price of a basket of goods at one location divided by the price of the basket of goods at a different location. The PPP inflation and exchange rate may differ from the market exchange rate because of tariffs, and other transaction costs.

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time. The CPI is calculated by using a representative basket of goods and services. The basket is updated periodically to reflect changes in consumer spending habits. The prices of the goods and services in the basket are collected monthly from a sample of retail and service establishments. The prices are then adjusted for changes in quality or features. Changes in the CPI can be used to track inflation over time and to compare inflation rates between different countries. The CPI is not a perfect measure of inflation or the cost of living, but it is a useful tool for tracking these economic indicators.

In economics, the GDP deflator is a measure of the money price of all new, domestically produced, final goods and services in an economy in a year relative to the real value of them. It can be used as a measure of the value of money. GDP stands for gross domestic product, the total monetary value of all final goods and services produced within the territory of a country over a particular period of time.

A market basket or commodity bundle is a fixed list of items, in given proportions. Its most common use is to track the progress of inflation in an economy or specific market. That is, to measure the changes in the value of money over time. A market basket is also used with the theory of purchasing price parity to measure the value of money in different places.

Cost of living is the cost of maintaining a certain standard of living. Changes in the cost of living over time can be operationalized in a cost-of-living index. Cost of living calculations are also used to compare the cost of maintaining a certain standard of living in different geographic areas. Differences in cost of living between locations can be measured in terms of purchasing power parity rates. An sharp rise in the cost of living can trigger a cost of living crisis where purchasing power is lost and the previous lifestyle is no longer affordable.

In economics, nominal value refers to value measured in terms of absolute money amounts, whereas real value is considered and measured against the actual goods or services for which it can be exchanged at a given time. For example, if one is offered a salary of $40,000, in that year, the real and nominal values are both $40,000. The following year, any inflation means that although the nominal value remains $40,000, because prices have risen, the salary will buy fewer goods and services, and thus its real value has decreased in accordance with inflation. On the other hand, ownership of an asset that holds its value, such as a diamond may increase in nominal price increase from year to year, but its real value, i.e. its value in relation to other goods and services for which it can be exchanged, or its purchasing power, is consistent over time, because inflation has affected both its nominal value and other goods' nominal value. In spite of changes in the price, it can be sold and an equivalent amount of emeralds can be purchased, because the emerald's prices will have increased with inflation as well.

The Monetary Policy Committee (MPC) is a committee of the Bank of England, which meets for three and a half days, eight times a year, to decide the official interest rate in the United Kingdom.

Substitution bias describes a possible bias in economic index numbers if they do not incorporate data on consumer expenditures switching from relatively more expensive products to cheaper ones as prices changed.

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and services.

In statistics, economics, and finance, an index is a statistical measure of change in a representative group of individual data points. These data may be derived from any number of sources, including company performance, prices, productivity, and employment. Economic indices track economic health from different perspectives. Examples include the consumer price index, which measures changes in retail prices paid by consumers, and the cost-of-living index (COLI), which measures the relative cost of living over time.

The Boskin Commission, formally called the "Advisory Commission to Study the Consumer Price Index", was appointed by the United States Senate in 1995 to study possible bias in the computation of the Consumer Price Index (CPI), which is used to measure inflation in the United States. Its final report, titled "Toward A More Accurate Measure Of The Cost Of Living" and issued on December 4, 1996, concluded that the CPI overstated inflation by about 1.1 percentage points per year in 1996 and about 1.3 percentage points prior to 1996.

The Harmonised Index of Consumer Prices (HICP) is an indicator of inflation and price stability for the European Central Bank (ECB). It is a consumer price index which is compiled according to a methodology that has been harmonised across EU countries. The euro area HICP is a weighted average of price indices of member states who have adopted the euro. The primary goal of the ECB is to maintain price stability, defined as keeping the year on year increase HICP below but close to 2% for the medium term. In order to do that, the ECB can control the short-term interest rate through Eonia, the European overnight index average, which affects market expectations. The HICP is also used to assess the convergence criteria on inflation which countries must fulfill in order to adopt the euro. In the United Kingdom, the HICP is called the CPI and is used to set the inflation target of the Bank of England.

The United States Consumer Price Index (CPI) is a set of various consumer price indices published monthly by the U.S. Bureau of Labor Statistics (BLS). The most commonly used are the CPI-U and the CPI-W, though many alternative versions exist. The CPI-U is the most popular measure of consumer inflation in the United States.

RPIX is a measure of inflation in the United Kingdom, equivalent to the all items Retail Price Index (RPI) excluding mortgage interest payments.

This page lists details of the consumer price index by country

The consumer price index (CPI) is the official measure of inflation in South Africa. One variant, the consumer price index excluding mortgage costs (CPIX), is officially targeted by the South African Reserve Bank and a primary measure that determines national interest rates.

Inflation rate in India was 5.5% as of May 2019, as per the Indian Ministry of Statistics and Programme Implementation. This represents a modest reduction from the previous annual figure of 9.6% for June 2011. Inflation rates in India are usually quoted as changes in the Wholesale Price Index (WPI), for all commodities.

The National Consumer Price Index measures the price inflation of key consumer goods for Swiss private households. The average of the population is used as a reference to obtain a "truthful" value. The CPI measures the price trend based on a basket of commodities containing about 1050 goods and services. These are weighted according to their share of the household budget.

The United States Chained Consumer Price Index (C-CPI-U), also known as chain-weighted CPI or chain-linked CPI is a time series measure of price levels of consumer goods and services created by the Bureau of Labor Statistics as an alternative to the US Consumer Price Index. It is based on the idea that when prices of different goods change at different rates, consumers will adjust their purchasing patterns by purchasing more of products whose relative prices have declined and fewer of those whose relative price has increased. This reduces the cost of living reported, but has no change on the cost of living; it is simply a way of accounting for a microeconomic "substitution effect." The "fixed weight" CPI also takes such substitutions into account, but does so through a periodic adjustment of the "basket of goods" that it represents, rather than through a continuous adjustment in that basket. Application of the chained CPI to federal benefits has been controversially proposed to reduce the federal deficit.