Related Research Articles

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors.

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations. Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. In 2022, Fannie Mae was ranked number 33 on the Fortune 500 rankings of the largest United States corporations by total revenue.

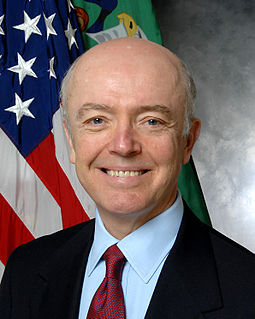

James A. Johnson was an American businessman, Democratic Party political figure, and chairman and chief executive officer of Fannie Mae. He was the campaign chairman for Walter Mondale's unsuccessful 1984 presidential bid and chaired the vice presidential selection committee for the presidential campaign of John Kerry. He briefly led the vice-presidential selection process for the 2008 Democratic presidential nominee, Senator Barack Obama.

Jeffrey Robert Immelt is an American business executive currently working as a venture partner at New Enterprise Associates. He previously served as the CEO of General Electric from 2001 to 2017, and the CEO of GE's Medical Systems division from 1997 to 2000.

Franklin Delano Raines also known as Frank Raines is an American business executive. He is the former chairman and chief executive officer of the Federal National Mortgage Association, commonly known as Fannie Mae, who served as White House budget director under President Bill Clinton. His role leading Fannie Mae has come under scrutiny. He has been called one of the "25 People to Blame for the Financial Crisis" according to Time magazine.

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia. The FHLMC was created in 1970 to expand the secondary market for mortgages in the US. Along with the Federal National Mortgage Association, Freddie Mac buys mortgages, pools them, and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purchases. The name "Freddie Mac" is a variant of the FHLMC initialism of the company's full name that was adopted officially for ease of identification.

Roger Harrison Mudd was an American broadcast journalist who was a correspondent and anchor for CBS News and NBC News. He also worked as the primary anchor for The History Channel. Previously, Mudd was weekend and weekday substitute anchor for the CBS Evening News, the co-anchor of the weekday NBC Nightly News, and the host of the NBC-TV Meet the Press and American Almanac TV programs. Mudd was the recipient of the Peabody Award, the Joan Shorenstein Award for Distinguished Washington Reporting, and five Emmy Awards.

Herbert Monroe Allison, Jr. was an American businessman who oversaw the Troubled Asset Relief Program (TARP) as Assistant Secretary of the Treasury for Financial Stability from 2009 to 2010. His previous positions included president and CEO of Fannie Mae, a post to which he was appointed in September 2008, after Fannie was placed into conservatorship. Prior to that, Allison was chairman, president and chief executive officer of TIAA from 2002 until his retirement in 2008.

Arlington Asset Investment Corp. is a mortgage real estate investment trust headquartered in McLean, Virginia.

Fortress Investment Group is an American investment management firm based in New York City. Fortress was founded as a private equity firm in 1998 by Wes Edens, Rob Kauffman, and Randal Nardone. When Fortress launched on the NYSE in February 2007, it was the first large private equity firm in the US to be traded publicly. As of June 30, 2020, the firm manages approximately $45.5 billion alternative assets in private equity, liquid hedge funds and credit funds.

The subprime mortgage crisis impact timeline lists dates relevant to the creation of a United States housing bubble and the 2005 housing bubble burst and the subprime mortgage crisis which developed during 2007 and 2008. It includes United States enactment of government laws and regulations, as well as public and private actions which affected the housing industry and related banking and investment activity. It also notes details of important incidents in the United States, such as bankruptcies and takeovers, and information and statistics about relevant trends. For more information on reverberations of this crisis throughout the global financial system see Financial crisis of 2007–2008.

The Federal Housing Finance Agency (FHFA) is an independent federal agency in the United States created as the successor regulatory agency of the Federal Housing Finance Board (FHFB), the Office of Federal Housing Enterprise Oversight (OFHEO), and the U.S. Department of Housing and Urban Development government-sponsored enterprise mission team, absorbing the powers and regulatory authority of both entities, with expanded legal and regulatory authority, including the ability to place government sponsored enterprises (GSEs) into receivership or conservatorship.

In September 2008 the Federal Housing Finance Agency (FHFA) announced that it would take over the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation. Both government-sponsored enterprises, which finance home mortgages in the United States by issuing bonds, had become illiquid as the market for those bonds collapsed in the subprime mortgage crisis. The FHFA established conservatorships in which each enterprise's management works under the FHFA's direction to reduce losses and to develop a new operating structure that will allow a return to self-management.

James B. Lockhart III is an American U.S. Navy officer, business executive, and, since September 2009, Vice Chairman of WL Ross & Co. LLC, which manages $9 billion of private equity investments, a hedge fund and a Mortgage Recovery Fund. It is a subsidiary of Invesco, a Fortune 500 investment management firm. He coordinates WL Ross's investments in financial services firms and mortgages. Lockhart serves co-chairs the Bipartisan Policy Center's Commission on Retirement Security and Personal Savings.

The U.S. subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2007. It was characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages. Several major financial institutions collapsed in September 2008, with significant disruption in the flow of credit to businesses and consumers and the onset of a severe global recession.

Daniel Och is an American billionaire hedge fund manager, and philanthropist. He is the founder, chairman and former CEO of Och-Ziff Capital Management, a global hedge fund and alternative asset management firm. According to Forbes he has a net worth of US$3.6 billion, as of August 2021.

Michael Edward Novogratz is an American investor, formerly of the investment firm Fortress Investment Group. He is currently CEO of Galaxy Investment Partners which focuses on investments in cryptocurrency.

Ruth Porat is a British-American business executive serving as Chief Financial Officer of Alphabet and its subsidiary Google since 2015.

Timothy J. Mayopoulos is an American businessman and lawyer. He was formerly president and chief executive officer (CEO) of Fannie Mae. Mayopoulos was announced as president and member of the board of directors at Blend in 2019.

References

- ↑ US Bails out Fannie Mae & Freddie Mac NYTimes

- 1 2 3 4 5 6 7 8 9 10 11 "Daniel Mudd: Executive Profile & Biography". investing.businessweek.com. BusinessWeek . Retrieved December 9, 2008.

- 1 2 3 4 "Daniel H. Mudd Profile". people.forbes.com. Forbes.com LLC. Archived from the original on March 9, 2009. Retrieved December 9, 2008.

- 1 2 "Franklin Raines out at Fannie". CNNMoney.com. December 22, 2004. Retrieved December 9, 2008.

- ↑ "Daniel H. Mudd Rankings". people.forbes.com. Forbes.com LLC. Archived from the original on July 22, 2011. Retrieved December 9, 2008.

- ↑ Hilzenrath, David S., "Former Fannie Mae CEO Mudd takes leave from hedge fund firm", Washington Post, December 21, 2011. Retrieved December 21, 2011.

- ↑ Fred Schulte and Ben Protess (October 18, 2010). "The New Tax Man: Big Banks and Hedge Funds". Huffington Post Investigative Fund. Archived from the original on September 4, 2011. Retrieved September 20, 2011.

- ↑ "Government may soon back troubled mortgage giants". Archived from the original on February 15, 2012. Retrieved March 13, 2022.

- ↑ Goldstein, Richard (May 25, 2002), "Dr. Richard Mudd, 101, Dies; Grandfather Treated Booth (limited no-charge access)", The New York Times, retrieved May 23, 2009

- ↑ Chung, Juliet. "Fannie Mae's Former Chief, Mudd, Sells in Washington", The Wall Street Journal, September 11, 2009. Accessed July 14, 2014.

- ↑ CHUNG, JULIET (September 11, 2009). "Fannie Mae's Former Chief, Mudd, Sells in Washington". The Wall Street Journal. ISSN 0099-9660 . Retrieved August 12, 2020.