The Federal Reserve System is the central banking system of the United States. It was created on December 23,1913,with the enactment of the Federal Reserve Act,after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years,events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The chairman of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve,and is the active executive officer of the Board of Governors of the Federal Reserve System. The chairman presides at meetings of the Board.

Janet Louise Yellen is an American economist who served as the 78th United States secretary of the treasury from 2021 to 2025. She also served as chair of the Federal Reserve from 2014 to 2018. She is the first woman to hold either post,and has also led the White House Council of Economic Advisers. Yellen is the Eugene E. and Catherine M. Trefethen Professor of Business Administration and Economics at the University of California,Berkeley.

The Community Reinvestment Act is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities,including low- and moderate-income neighborhoods. Congress passed the Act in 1977 to reduce discriminatory credit practices against low-income neighborhoods,a practice known as redlining.

Roger W. Ferguson Jr. is an American economist,attorney and corporate executive who served as the 17th vice chairman of the Federal Reserve from 1999 to 2006. Prior to his term as vice chairman,Ferguson served as a member of the Federal Reserve Board of Governors,taking office in 1997. He was the first African-American vice chairman. After leaving the Fed,he served as president and CEO of the Teachers Insurance and Annuity Association of America (TIAA) from 2008 to 2021. Ferguson has also been appointed to the board of directors of several companies including Alphabet.

Stanley Fischer is an Israeli-American economist who served as the 20th vice chair of the Federal Reserve from 2014 to 2017. Fischer previously served as the 8th governor of the Bank of Israel from 2005 to 2013. Born in Northern Rhodesia,he holds dual citizenship in Israel and the United States. He previously served as First Deputy Managing Director of the International Monetary Fund and as Chief Economist of the World Bank. On January 10,2014,President Barack Obama nominated Fischer to the position of Vice Chair of the Federal Reserve. He is a senior advisor at BlackRock. On September 6,2017,Stanley Fischer announced that he was resigning as Vice-Chair for personal reasons effective October 13,2017.

Stephen Friedman is an American economist. He is a former chairman of the U.S. President's Intelligence Advisory Board and former chair of the Federal Reserve Bank of New York. He was nominated on October 27,2005,to replace Brent Scowcroft in the position.

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank.

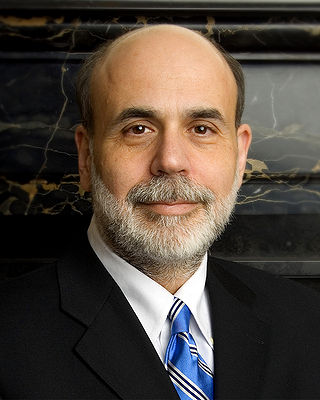

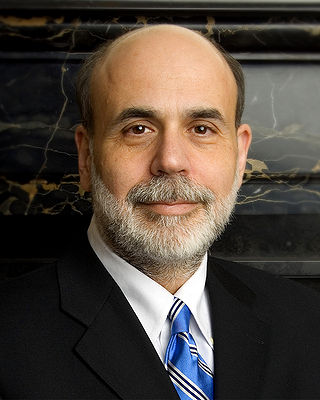

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve,he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman,Bernanke oversaw the Federal Reserve's response to the 2007–2008 financial crisis,for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman,Bernanke was a tenured professor at Princeton University and chaired the Department of Economics there from 1996 to September 2002,when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences,jointly with Douglas Diamond and Philip H. Dybvig,"for research on banks and financial crises",more specifically for his analysis of the Great Depression.

The Federal Financial Institutions Examination Council (FFIEC) is a formal U.S. government interagency body composed of five banking regulators that is "empowered to prescribe uniform principles,standards,and report forms to promote uniformity in the supervision of financial institutions". It also oversees real estate appraisal in the United States. Its regulations are contained in title 12 of the Code of Federal Regulations.

Kevin Maxwell Warsh is an American financier and bank executive who served as a member of the Federal Reserve Board of Governors from 2006 to 2011.

Thomas Michael Hoenig is a Distinguished Senior Fellow at the Mercatus Center. He became a director of the Federal Deposit Insurance Corporation on April 16,2012,and served as vice chairman from November 30,2012 to April 30,2018. From 1991 to 2011,he served as the eighth chief executive of the Tenth District Federal Reserve Bank,in Kansas City,United States. In 2010,he was serving as a voting member of the Federal Open Market Committee,as one of five of the twelve Federal Reserve Bank presidents that sit on the Committee on a yearly rotating basis. He is known as an "anti-inflation hawk".

The College National Fed Challenge is an annual team competition for undergraduate college students inspired by the working of the Federal Open Market Committee. The competition is intended to encourage students to learn more about the U.S. macro economy,the Federal Reserve System,and the implementation of monetary policy. The College Fed Challenge also aims at promoting interest in economics and finance as subjects for advanced study and as the basis for a career.

Lael Brainard is an American economist who served as the 14th director of the National Economic Council from 2023 to 2025. She previously served as the 22nd vice chair of the Federal Reserve between May 2022 and February 2023. Prior to her term as vice chair,Brainard served as a member of the Federal Reserve Board of Governors,taking office in 2014. Before her appointment to the Federal Reserve,she served as the under secretary of the treasury for international affairs from 2010 to 2013.

Bank regulation in the United States is highly fragmented compared with other G10 countries,where most countries have only one bank regulator. In the U.S.,banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure,it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities,commodities,and insurance regulatory agencies at the federal and state level,unlike Japan and the United Kingdom. Bank examiners are generally employed to supervise banks and to ensure compliance with regulations.

The U.S. central banking system,the Federal Reserve,in partnership with central banks around the world,took several steps to address the subprime mortgage crisis. Federal Reserve Chairman Ben Bernanke stated in early 2008:"Broadly,the Federal Reserve’s response has followed two tracks:efforts to support market liquidity and functioning and the pursuit of our macroeconomic objectives through monetary policy." A 2011 study by the Government Accountability Office found that "on numerous occasions in 2008 and 2009,the Federal Reserve Board invoked emergency authority under the Federal Reserve Act of 1913 to authorize new broad-based programs and financial assistance to individual institutions to stabilize financial markets. Loans outstanding for the emergency programs peaked at more than $1 trillion in late 2008."

Sarah Bloom Raskin is an American attorney and financial markets policymaker who served as the 13th United States Deputy Secretary of the Treasury from 2014 to 2017. Raskin previously served as a member of the Federal Reserve Board of Governors from 2010 to 2014. She also was Maryland Commissioner of Financial Regulation. She was a Rubenstein Fellow at Duke University. She is currently the Colin W. Brown Distinguished Professor of the Practice of Law at Duke Law School. She is also a Senior Fellow at the Duke Center on Risk. She also serves as a Partner at Kaya Partners,Ltd.,a climate advisory firm.

In monetary policy of the United States,the term Fedspeak is what Alan Blinder called "a turgid dialect of English" used by Federal Reserve Board chairs in making wordy,vague,and ambiguous statements. The strategy,which was used most prominently by Alan Greenspan,was used to prevent financial markets from overreacting to the chairman's remarks. The coinage is an intentional parallel to Newspeak.

Raphael W. Bostic is an American economist,academic,and public servant who has served as the 15th president and CEO of the Federal Reserve Bank of Atlanta since 2017. During his academic career,Bostic served as chair of the Department of Governance,Management,and the Policy Process at the Price School of Public Policy at the University of Southern California.