Paramaribo is the capital and largest city of Suriname, located on the banks of the Suriname River in the Paramaribo District. Paramaribo has a population of roughly 241,000 people, almost half of Suriname's population. The historic inner city of Paramaribo has been a UNESCO World Heritage Site since 2002.

ABN AMRO Bank N.V. is the third-largest Dutch bank, with headquarters in Amsterdam. It was initially formed in 1991 by merger of the two prior Dutch banks that form its name, Algemene Bank Nederland (ABN) and Amsterdamsche en Rotterdamsche Bank.

Hollandsche Bank-Unie (HBU) was a second-tier domestic bank in the Netherlands that Deutsche Bank absorbed in 2010. It had a notable international history.

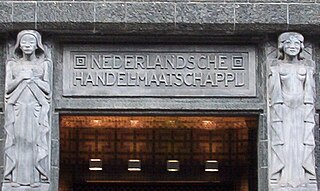

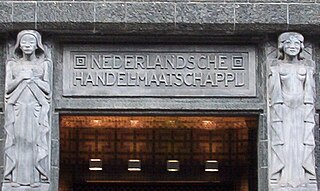

The Netherlands Trading Society was a Dutch trading and financial company, established in 1824, in The Hague by King William I to promote and develop trade, shipping and agriculture. For the next 140 years the NHM developed a large international branch network and increasingly engaged in banking operations. In 1964, it merged with Twentsche Bank to form Algemene Bank Nederland, itself a predecessor of ABN AMRO.

BNP Paribas Fortis is an international bank based in Belgium and a subsidiary of French banking group BNP Paribas. The bank was created in May 2009 after BNP Paribas acquired 75% of the Belgian Fortis Bank from the Federal Participation and Investment Company. It was formerly, together with Fortis Bank Nederland, the banking arm of the financial institution Fortis. After the ultimately unsuccessful ABN-AMRO takeover, the subprime crisis and subsequent global financial crisis (GFC) led to the sale of the Dutch and Luxembourg parts of the banking branch to the Dutch and Luxembourg governments. Fortis Bank itself was first partly bought by the Belgian government, then fully purchased by the government and sold to BNP Paribas.

Surinam Airways, also known by its initials SLM, is the flag carrier of Suriname, based in Paramaribo. It operates regional and long-haul scheduled passenger services. Its hub is at Johan Adolf Pengel International Airport (Zanderij). Surinam Airways is wholly owned by the Government of Suriname.

Aegon Ltd. is a Dutch public company for life insurance, pensions and asset management. It is headquartered in The Hague, Netherlands and has 26,000 employees as of July 21, 2020. Aegon is listed on the Euronext Amsterdam and is a constituent of the AEX index. It also operated a direct bank under the brand name "Knab" in the Netherlands. In October 2022, it was announced that AEGON's Dutch operations would be acquired by ASR Nederland. To the extent they had the AEGON trade name, it will become ASR; Knab and TKP will keep their names. Subsequently, AEGON reincorporated in Bermuda.

The guilder was the currency of Suriname until 2004, when it was replaced by the Surinamese dollar. It was divided into 100 cents. Until the 1940s, the plural in Dutch was cents, with centen appearing on some early paper money, but after the 1940s the Dutch plural became cent.

Boy Scouts van Suriname is the national Scouting organization of Suriname. Scouting in Suriname officially started in 1924 and became a member of the World Organization of the Scout Movement (WOSM) in 1968. The coeducational association has 2,601 members.

The Central Bank of Suriname (CBvS) is Suriname’s highest monetary authority and the country’s governing body in monetary and economic affairs.

Algemene Bank Nederland was a Dutch bank that was created in 1964 through the merger of the Netherlands Trading Society with the Twentsche Bank. In 1991, ABN merged with Amsterdamsche en Rotterdamsche Bank to form ABN AMRO.

DSB Bank was a Dutch bank and insurer that failed in 2009. Its loans were managed under Quion from June 2013 until June 2016 when Finqus began operating as the former DSB Bank. In 2018 Finqus BV took over DSB Bank and operated as a subsidiary of DSB Group. Finqus BV turned over its loan portfolio to NIBC Bank on 21 July 2021.

Arnout Henricus Elisabeth Maria "Nout" Wellink is a Dutch economist and former central banker.

In Indonesia, state-owned enterprises play an important role in the national economy. Their roles includes contributor for national economy growth, providing goods or services which are not covered by private company, employment provider, providing support guidance to small and medium businesses, and source of government revenue. The Ministry of State Owned Enterprises represents the government's function as a shareholder of most of those companies, while some are represented by the Ministry of Finance.

Sara Johanna de Beer was a printer and editor of a number of newspapers and magazines in the Dutch colony of Surinam.

The Nederlandsch-Indische Escompto Maatschappij was a significant Dutch bank, founded in 1857 in Batavia, Dutch East Indies. In the first half of the 20th century, it was the smallest of the “big three” commercial banks, behind the Netherlands Trading Society and the Nederlandsch-Indische Handelsbank, that dominated the Dutch East Indies’ financial system alongside the note-issuing Bank of Java.

Maurits Cornelis van Hall (1836–1900) was a Dutch lawyer, banker and politician. He was involved in founding many companies.

The Suriname Stock Exchange (SSX) is the stock exchange of Suriname. It is being organized by an association called the Vereniging voor de Effectenhandel in Suriname (VvES), and it was founded on 1 January 1994.

The Chamber of Commerce and Factories, native name Kamer van Koophandel en Fabrieken (KKF), is a Surinamese institution that offers advice to companies before, during and after the start, and registers them in the company register. The company register is being published at the website of Suriname Directory.