Related Research Articles

The economy of Denmark is a modern high-income and mixed economy.

A pension is a fund into which amounts are paid regularly during the individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

Flexicurity is a welfare state model with a pro-active labour market policy. The term was first coined by the social democratic Prime Minister of Denmark Poul Nyrup Rasmussen in the 1990s.

Active labour market policies (ALMPs) are government programmes that intervene in the labour market to help the unemployed find work, but also for the underemployed and employees looking for better jobs. In contrast, passive labour market policies involve expenditures on unemployment benefits and early retirement. Historically, labour market policies have developed in response to both market failures and socially/politically unacceptable outcomes within the labor market. Labour market issues include, for instance, the imbalance between labour supply and demand, inadequate income support, shortages of skilled workers, or discrimination against disadvantaged workers.

The Labour Party governed the United Kingdom of Great Britain and Northern Ireland from 1974 to 1979. During this period, Harold Wilson and James Callaghan were successively appointed as Prime Minister by Queen Elizabeth II. The end of the Callaghan ministry was presaged by the Winter of Discontent, a period of serious industrial discontent. This was followed by the election of Conservative leader Margaret Thatcher in 1979.

Social welfare has long been an important part of New Zealand society and a significant political issue. It is concerned with the provision by the state of benefits and services. Together with fiscal welfare and occupational welfare, it makes up the social policy of New Zealand. Social welfare is mostly funded through general taxation. Since the 1980s welfare has been provided on the basis of need; the exception is universal superannuation.

The Italian welfare state is based partly upon the corporatist-conservative model and partly upon the universal welfare model.

Taxation in Denmark consists of a comprehensive system of direct and indirect taxes. Ever since the income tax was introduced in Denmark via a fundamental tax reform in 1903, it has been a fundamental pillar in the Danish tax system. Today various personal and corporate income taxes yield around two thirds of the total Danish tax revenues, indirect taxes being responsible for the last third. The state personal income tax is a progressive tax while the municipal income tax is a proportional tax above a certain income level.

Social protection, as defined by the United Nations Research Institute for Social Development, is concerned with preventing, managing, and overcoming situations that adversely affect people's well-being. Social protection consists of policies and programs designed to reduce poverty and vulnerability by promoting efficient labour markets, diminishing people's exposure to risks, and enhancing their capacity to manage economic and social risks, such as unemployment, exclusion, sickness, disability, and old age. It is one of the targets of the United Nations Sustainable Development Goal 10 aimed at promoting greater equality.

Workfare in the United Kingdom is a system of welfare regulations put into effect by UK governments at various times. Individuals subject to workfare must undertake work in return for their welfare benefit payments or risk losing them. Workfare policies are politically controversial. Supporters claim that such policies help people move off welfare and into employment whereas critics argue that they are analogous to slavery or indentured servitude and counterproductive in decreasing unemployment.

The world's poor are significantly more likely to have or incur a disability within their lifetime compared to more financially privileged populations. The rate of disability within impoverished nations is notably higher than that found in more developed countries. Since the early 2010s there has been growing research in support of an association between disability and poverty and of a cycle by which poverty and disability are mutually reinforcing. Physical, cognitive, mental, emotional, sensory, or developmental impairments independently or in tandem with one another may increase one's likelihood of becoming impoverished, while living in poverty may increase one's potential of having or acquiring disability in some capacity.

Youth unemployment is the situation of young people who are looking for a job but cannot find a job, with the age range being defined by the United Nations as 15–24 years old. An unemployed person is defined as someone who does not have a job but is actively seeking one. To be qualified as unemployed for official and statistical measurement, the individual must be without employment, willing and able to work, of the officially designated "working age" and actively searching for a position. Youth unemployment rates tend to be higher than adult rates in every country in the world.

Four million people in Australia (18.5%) reported having a disability in 2009, according to the results of the Survey of Disability, Ageing and Carers. Males and females were similarly affected by disability.

Disability in the United Kingdom covers a wide range of conditions and experiences, deeply impacting the lives of millions of people. Defined by the Equality Act 2010 as a physical or mental impairment with a substantial and long-term adverse effect on a person's ability to carry out normal day-to-day activities, it encompasses various aspects of life, including demographics, legislation, healthcare, employment, and culture. Despite numerous advancements in policy and social attitudes, individuals with disabilities often encounter unique challenges and disparities.

Youth unemployment in Italy discusses the statistics, trends, causes and consequences of unemployment among young Italians. Italy displays one of the highest rates of youth unemployment among the 35 member countries of the Organization of Economic Co-Operation and Development (OECD). The Italian youth unemployment rate started raising dramatically since the 2008 financial crisis reaching its peak of 42.67% in 2014. In 2017, among the EU member states, the youth unemployment rate of Italy (35.1%) was exceeded by only Spain and Greece. The Italian youth unemployment rate was more than the double of the total EU average rate of 16.7% in 2017. While youth unemployment is extremely high compared to EU standards, the Italian total unemployment rate (11.1%) is closer to EU average (7.4%).

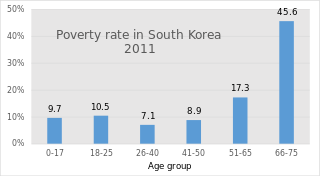

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

Pensions in Denmark consist of both private and public programs, all managed by the Agency for the Modernisation of Public Administration under the Ministry of Finance. Denmark created a multipillar system, consisting of an unfunded social pension scheme, occupational pensions, and voluntary personal pension plans. Denmark's system is a close resemblance to that encouraged by the World Bank in 1994, emphasizing the international importance of establishing multifaceted pension systems based on public old-age benefit plans to cover the basic needs of the elderly. The Danish system employed a flat-rate benefit funded by the government budget and available to all Danish residents. The employment-based contribution plans are negotiated between employers and employees at the individual firm or profession level, and cover individuals by labor market systems. These plans have emerged as a result of the centralized wage agreements and company policies guaranteeing minimum rates of interest. The last pillar of the Danish pension system is income derived from tax-subsidized personal pension plans, established with life insurance companies and banks. Personal pensions are inspired by tax considerations, desirable to people not covered by the occupational scheme.

Unemployment in Hungary measured by the Hungarian Central Statistical Office shows the rate of unemployed individuals out of the labor force. The European Union's own statistical office, Eurostat also makes reports and predictions about the Hungarian job market and the unemployment rate in the country. The KSH's most recent unemployment data shows the unemployment rate for men 15–74 to be 3.3% and 4.1% for women.

Denmark is a Scandinavian country in Europe consisting of the Jutland Peninsula and numerous islands. Typically, Denmark has had relatively low unemployment rates. Currently, Denmark has generous unemployment benefits in the form of private insurance funds. Unemployment benefits are typically payments made by the state or other authorized actors to unemployed persons.

References

- ↑ "Disability statistics - prevalence and demographics" (PDF). Eurostat.

- ↑ "Disability". The Danish Institute for Human Rights. Retrieved 7 January 2019.

- ↑ Jensen, V; Lundager, B; Christensen, AL; Fonager, K (April 2014). "Unemployment under the flex job scheme increases the risk of permanent social security benefits". Danish Medical Journal. 61 (4): A4804. PMID 24814586.

- ↑ Greve, Bent (April 2009), "The labour market situation of disabled people in European countries and implementation of employment policies: a summary of evidence from country reports and research studies" (PDF), Academic Network of European Disability experts (ANED) VT/2007/005: 27[ dead link ]

- 1 2 https://pure.sfi.dk/ws/files/292672/wp182002.pdf Hogeland & Pederson, 2002 "Active labour market policies for disabled people in Denmark" The open labour market working paper 18/2002.

- ↑ http://www.oecd.org/denmark/46460721.pdf [ bare URL PDF ]

- ↑ Kautto & Othman, 2010 "Disability and employment - lessons from reforms" Finnish Centre for Pensions Reports 2010/4:3

- ↑ OECD "Sickness, disability and work: Breaking the barriers" www.oecd.org 2010, p1

- ↑ "Home". handicap.dk.

- ↑ "Threat to Danish disability festival". BBC News. Retrieved 2020-09-22.