Class D supermartingales

A càdlàg supermartingale is of Class D if and the collection

The Doob–Meyer decomposition theorem is a theorem in stochastic calculus stating the conditions under which a submartingale may be decomposed in a unique way as the sum of a martingale and an increasing predictable process. It is named for Joseph L. Doob and Paul-André Meyer.

In 1953, Doob published the Doob decomposition theorem which gives a unique decomposition for certain discrete time martingales. [1] He conjectured a continuous time version of the theorem and in two publications in 1962 and 1963 Paul-André Meyer proved such a theorem, which became known as the Doob-Meyer decomposition. [2] [3] In honor of Doob, Meyer used the term "class D" to refer to the class of supermartingales for which his unique decomposition theorem applied. [4]

A càdlàg supermartingale is of Class D if and the collection

Let be a cadlag supermartingale of class D. Then there exists a unique, non-decreasing, predictable process with such that is a uniformly integrable martingale. [5]

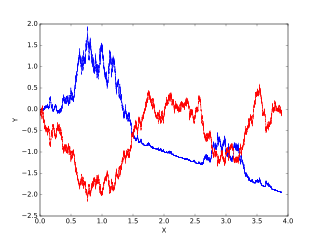

In probability theory and related fields, a stochastic or random process is a mathematical object usually defined as a family of random variables in a probability space, where the index of the family often has the interpretation of time. Stochastic processes are widely used as mathematical models of systems and phenomena that appear to vary in a random manner. Examples include the growth of a bacterial population, an electrical current fluctuating due to thermal noise, or the movement of a gas molecule. Stochastic processes have applications in many disciplines such as biology, chemistry, ecology, neuroscience, physics, image processing, signal processing, control theory, information theory, computer science, and telecommunications. Furthermore, seemingly random changes in financial markets have motivated the extensive use of stochastic processes in finance.

In probability theory, a martingale is a sequence of random variables for which, at a particular time, the conditional expectation of the next value in the sequence is equal to the present value, regardless of all prior values.

In probability theory, Girsanov's theorem or the Cameron-Martin-Girsanov theorem explains how stochastic processes change under changes in measure. The theorem is especially important in the theory of financial mathematics as it explains how to convert from the physical measure, which describes the probability that an underlying instrument will take a particular value or values, to the risk-neutral measure which is a very useful tool for evaluating the value of derivatives on the underlying.

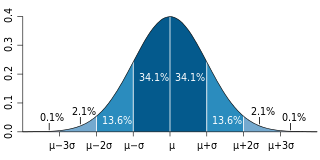

In probability theory, the Azuma–Hoeffding inequality gives a concentration result for the values of martingales that have bounded differences.

In probability theory, in particular in the study of stochastic processes, a stopping time is a specific type of “random time”: a random variable whose value is interpreted as the time at which a given stochastic process exhibits a certain behavior of interest. A stopping time is often defined by a stopping rule, a mechanism for deciding whether to continue or stop a process on the basis of the present position and past events, and which will almost always lead to a decision to stop at some finite time.

Itô calculus, named after Kiyosi Itô, extends the methods of calculus to stochastic processes such as Brownian motion. It has important applications in mathematical finance and stochastic differential equations.

Joseph Leo Doob was an American mathematician, specializing in analysis and probability theory.

In mathematics, quadratic variation is used in the analysis of stochastic processes such as Brownian motion and other martingales. Quadratic variation is just one kind of variation of a process.

Paul-André Meyer was a French mathematician, who played a major role in the development of the general theory of stochastic processes. He worked at the Institut de Recherche Mathématique (IRMA) in Strasbourg and is known as the founder of the 'Strasbourg school' in stochastic analysis.

In probability theory, the martingale representation theorem states that a random variable that is measurable with respect to the filtration generated by a Brownian motion can be written in terms of an Itô integral with respect to this Brownian motion.

In probability theory, a Hunt process is a type of Markov process, named for mathematician Gilbert A. Hunt who first defined them in 1957. Hunt processes were important in the study of probabilistic potential theory until they were superseded by right processes in the 1970s.

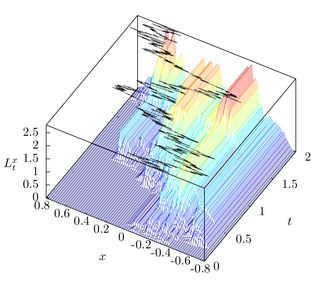

In the mathematical theory of stochastic processes, local time is a stochastic process associated with semimartingale processes such as Brownian motion, that characterizes the amount of time a particle has spent at a given level. Local time appears in various stochastic integration formulas, such as Tanaka's formula, if the integrand is not sufficiently smooth. It is also studied in statistical mechanics in the context of random fields.

In mathematics, Doob's martingale inequality, also known as Kolmogorov’s submartingale inequality is a result in the study of stochastic processes. It gives a bound on the probability that a submartingale exceeds any given value over a given interval of time. As the name suggests, the result is usually given in the case that the process is a martingale, but the result is also valid for submartingales.

In probability theory, a real valued stochastic process X is called a semimartingale if it can be decomposed as the sum of a local martingale and a càdlàg adapted finite-variation process. Semimartingales are "good integrators", forming the largest class of processes with respect to which the Itô integral and the Stratonovich integral can be defined.

In mathematics – specifically, in the theory of stochastic processes – Doob's martingale convergence theorems are a collection of results on the limits of supermartingales, named after the American mathematician Joseph L. Doob. Informally, the martingale convergence theorem typically refers to the result that any supermartingale satisfying a certain boundedness condition must converge. One may think of supermartingales as the random variable analogues of non-increasing sequences; from this perspective, the martingale convergence theorem is a random variable analogue of the monotone convergence theorem, which states that any bounded monotone sequence converges. There are symmetric results for submartingales, which are analogous to non-decreasing sequences.

In stochastic calculus, the Doléans-Dade exponential or stochastic exponential of a semimartingale X is the unique strong solution of the stochastic differential equation where denotes the process of left limits, i.e., .

In probability theory, the optional stopping theorem says that, under certain conditions, the expected value of a martingale at a stopping time is equal to its initial expected value. Since martingales can be used to model the wealth of a gambler participating in a fair game, the optional stopping theorem says that, on average, nothing can be gained by stopping play based on the information obtainable so far. Certain conditions are necessary for this result to hold true. In particular, the theorem applies to doubling strategies.

In the theory of stochastic processes in discrete time, a part of the mathematical theory of probability, the Doob decomposition theorem gives a unique decomposition of every adapted and integrable stochastic process as the sum of a martingale and a predictable process starting at zero. The theorem was proved by and is named for Joseph L. Doob.

James Laurie Snell was an American mathematician and educator.

In probability theory, Kramkov's optional decomposition theorem is a mathematical theorem on the decomposition of a positive supermartingale with respect to a family of equivalent martingale measures into the form