Related Research Articles

A free-trade area is the region encompassing a trade bloc whose member countries have signed a free trade agreement (FTA). Such agreements involve cooperation between at least two countries to reduce trade barriers, import quotas and tariffs, and to increase trade of goods and services with each other. If natural persons are also free to move between the countries, in addition to a free-trade agreement, it would also be considered an open border. It can be considered the second stage of economic integration.

The United Nations Conference on Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the United Nations General Assembly (UNGA) and reports to that body and the United Nations Economic and Social Council (ECOSOC). UNCTAD is composed of 195 member states and works with nongovernmental organizations worldwide; its permanent secretariat is in Geneva, Switzerland.

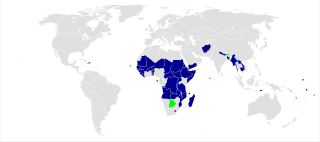

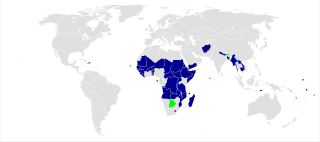

The least developed countries (LDCs) are developing countries listed by the United Nations that exhibit the lowest indicators of socioeconomic development. The concept of LDCs originated in the late 1960s and the first group of LDCs was listed by the UN in its resolution 2768 (XXVI) on 18 November 1971.

The Generalized System of Preferences, or GSP, is a preferential tariff system which provides tariff reduction on various products. The concept of GSP is very different from the concept of "most favored nation" (MFN). MFN status provides equal treatment in the case of tariff being imposed by a nation but in case of GSP differential tariff could be imposed by a nation on various countries depending upon factors such as whether it is a developed country or a developing country. Both the rules comes under the purview of WTO.

In international economic relations and international politics, most favoured nation (MFN) is a status or level of treatment accorded by one state to another in international trade. The term means the country which is the recipient of this treatment must nominally receive equal trade advantages as the "most favoured nation" by the country granting such treatment. In effect, a country that has been accorded MFN status may not be treated less advantageously than any other country with MFN status by the promising country.

Trade can be a key factor in economic development. The prudent use of trade can boost a country's development and create absolute gains for the trading partners involved. Trade has been touted as an important tool in the path to development by prominent economists. However trade may not be a panacea for development as important questions surrounding how free trade really is and the harm trade can cause domestic infant industries to come into play.

The South Asian Free Trade Area (SAFTA) is a 2004 agreement that created a free-trade area of 1.6 billion people in Afghanistan, Bangladesh, Bhutan, India, the Maldives, Nepal, Pakistan and Sri Lanka with the vision of increasing economic cooperation and integration.

Everything but Arms (EBA) is an initiative of the European Union under which all imports to the EU from the Least Developed Countries are duty-free and quota-free, with the exception of armaments. EBA entered into force on 5 March 2001. There were transitional arrangements for bananas, sugar and rice until January 2006, July 2009 and September 2009 respectively. The EBA is part of the EU Generalized System of Preferences (GSP). The up-to-date list of all countries benefiting from such preferential treatment is given in Annex IV of the consolidated text of Regulation (EU) 978/2012.

A free-trade agreement (FTA) or treaty is an agreement according to international law to form a free-trade area between the cooperating states. There are two types of trade agreements: bilateral and multilateral. Bilateral trade agreements occur when two countries agree to loosen trade restrictions between the two of them, generally to expand business opportunities. Multilateral trade agreements are agreements among three or more countries, and are the most difficult to negotiate and agree.

In international trade, market access is a company's ability to enter a foreign market by selling its goods and services in another country. Market access is not the same as free trade, because market access is normally subject to conditions or requirements, whereas under ideal free trade conditions goods and services can circulate across borders without any barriers to trade. Expanding market access is therefore often a more achievable goal of trade negotiations than achieving free trade.

Economic Partnership Agreements (EPAs) are a scheme to create a free trade area (FTA) between the European Union and other countries. They are a response to continuing criticism that the non-reciprocal and discriminating preferential trade agreements offered by the EU are incompatible with WTO rules. The EPAs date back to the signing of the Cotonou Agreement. The EPAs with the different regions are at different states of play. The EU has signed EPAs with the following countries: the Southern African Development Community (SADC), ECOWAS, six countries in Eastern and Southern Africa, Cameroon, four Pacific states, and the CARIFORUM states. Their defining characteristic is that they open up exports to the EU immediately, while exports to the partner regions is opened up only partially and over transitioning periods.

The South Pacific Regional Trade and Economic Co-operation Agreement (SPARTECA) is a nonreciprocal trade agreement in which Australia and New Zealand offer duty-free and unrestricted access for specified products originating from the developing island member countries of the Pacific Islands Forum. The agreement was signed in 1980 in Tarawa, Kiribati, and subject to Rules of Origin regulations, designed to address the unequal trade relationships between the two groups. The textiles, clothing and footwear (TCF) industry has been a major beneficiary of SPARTECA through the preferential access to Australian and New Zealand markets. The agreement entered into force on 1 January 1981.

A Certificate of Origin or Declaration of Origin is a document widely used in international trade transactions which attests that the product listed therein has met certain criteria to be considered as originating in a particular country. A certificate of origin / declaration of origin is generally prepared and completed by the exporter or the manufacturer, and may be subject to official certification by an authorized third party. It is often submitted to a customs authority of the importing country to justify the product's eligibility for entry and/or its entitlement to preferential treatment. Guidelines for issuance of Certificates of Origin by chambers of commerce globally are issued by the International Chamber of Commerce.

Rules of origin are the rules to attribute a country of origin to a product in order to determine its "economic nationality". The need to establish rules of origin stems from the fact that the implementation of trade policy measures, such as tariffs, quotas, trade remedies, in various cases, depends on the country of origin of the product at hand.

Caribbean Basin Economic Recovery Act of 1983 (CBERA) — P.L. 98-67, Title II, authorized unilateral preferential trade and tax benefits for eligible Caribbean countries, including duty-free treatment of eligible products.

The China–Pakistan Free Trade Agreement(CPFTA) is a free trade agreement (FTA) between the People's Republic of China and the Islamic Republic of Pakistan that seeks to increase trade and strengthen the partnership between the two countries.

The Bali Package is a trade agreement resulting from the Ninth Ministerial Conference of the World Trade Organization in Bali, Indonesia on 3–7 December 2013. It is aimed at lowering global trade barriers and is the first agreement reached through the WTO that is approved by all its members. The package forms part of the Doha Development Round, which started in 2001.

India–Malawi relations refers to the international relations that exist between India and Malawi.

Burundi–India relations are the international relations that exist between Burundi and India. Apart from bilateral relations, India also engages with Burundi through the African Union and the Regional Economic Communities (RECs).

India is party to free trade agreements (FTAs) and other trade agreements with many countries and trade blocs, and is negotiating with many others. According to the Ministry of Commerce and Industry, "India is a late, and cautious, starter in concluding comprehensive preferential tariff agreements covering substantially all trade with some of its trading partners."

References

- ↑ "India's Duty Free Tariff Preference (DFTP) Scheme for Least Developed Countries (LDCs)" (PDF). Lesotho Revenue Authority. November 2015. Retrieved 5 October 2021.

- ↑ "Utilising India's Duty Free Preference Scheme for LDCs: Analysis of the Trade Trends". researchgate.net. Centre for WTO Studies. Retrieved 5 October 2021.

- 1 2 3 4 Scelta, Gabriella. "Preferential Market Access: India's Duty Free Tariff Preference Scheme for LDCs". United Nations. Retrieved 5 October 2021.

- ↑ Tavares, Marcia. "Preferential market access for goods | LDC Portal". United Nations. Retrieved 5 October 2021.

- 1 2 "India's Duty Free Tariff Preference (DFTP) Scheme for Least Developed Countries (LDCs)" (PDF). Ministry of Commerce. 9 October 2017. Retrieved 5 October 2021.

- 1 2 3 "HANDBOOK ON INDIA'S DUTY-FREE TARIFF PREFERENCE SCHEME for least developed countriesfor least developed countries" (PDF). UNCTAD. Retrieved 5 October 2021.

- ↑ "India increases duty free tariff line to African exports up to 98 percent". International Centre for Trade and Sustainable Development. Retrieved 5 October 2021.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 "INDIA'S DUTY FREE TARIFF PREFERENCE SCHEME FOR LDCs" (PDF). International Trade Centre. 2015. Retrieved 5 October 2021.

- ↑ Tavares, Marcia. "Preferential market access for goods | LDC Portal". United Nations. Retrieved 5 October 2021.