Related Research Articles

The presence of the logo on commercial products indicates that the manufacturer or importer affirms the goods' conformity with European health, safety, and environmental protection standards. It is not a quality indicator or a certification mark. The CE marking is required for goods sold in the European Economic Area (EEA); goods sold elsewhere may also carry the mark.

Type approval or certificate of conformity is granted to a product that meets a minimum set of regulatory, technical and safety requirements. Generally, type approval is required before a product is allowed to be sold in a particular country, so the requirements for a given product will vary around the world. Processes and certifications known as type approval in English are often called homologation, or some cognate expression, in other European languages.

Supply chain security activities aim to enhance the security of the supply chain or value chain, the transport and logistics systems for the world's cargo and to "facilitate legitimate trade". Their objective is to combine traditional practices of supply-chain management with the security requirements driven by threats such as terrorism, piracy, and theft. A healthy and robust supply chain absent from security threats requires safeguarding against disturbances at all levels such as facilities, information flow, transportation of goods, and so on. A secure supply chain is critical for organizational performance.

Intrastat is the system for collecting information and producing statistics on the trade in goods between countries of the European Union (EU). It began operation on 1 January 1993, when it replaced customs declarations as the source of trade statistics within the EU. The requirements of Intrastat are similar in all member states of the EU, although there are important exceptions.

A value-added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES website. It confirms that the number is currently allocated and can provide the name or other identifying details of the entity to whom the identifier has been allocated. However, many national governments will not give out VAT identification numbers due to data protection laws.

Government procurement or public procurement is undertaken by the public authorities of the European Union (EU) and its member states in order to award contracts for public works and for the purchase of goods and services in accordance with principles derived from the Treaties of the European Union. Such procurement represents 13.6% of EU GDP as of March 2023, and has been the subject of increasing European regulation since the 1970s because of its importance to the European single market.

ENTSO-E, the European Network of Transmission System Operators, represents 40 electricity transmission system operators (TSOs) from 36 countries across Europe, thus extending beyond EU borders. ENTSO-E was established and given legal mandates by the EU's Third Package for the Internal energy market in 2009, which aims at further liberalising the gas and electricity markets in the EU. Ukrainian Ukrenergo became the 40th member of the association on 1 January 2024.

The European Union Customs Union (EUCU), formally known as the Community Customs Union, is a customs union which consists of all the member states of the European Union (EU), Monaco, and the British Overseas Territory of Akrotiri and Dhekelia. Some detached territories of EU states do not participate in the customs union, usually as a result of their geographic separation. In addition to the EUCU, the EU is in customs unions with Andorra, San Marino and Turkey, through separate bilateral agreements.

The End of Life Vehicles Directive is a Directive of the European Union addressing the end of life for automotive products. Every year, motor vehicles which have reached the end of their useful lives create between 8 and 9 million tonnes of waste in the European Union. In 1997, the European Commission adopted a Proposal for a Directive to tackle this problem.

The Schengen Area is an area encompassing 29 European countries that have officially abolished border controls at their mutual borders. Being an element within the wider area of freedom, security and justice policy of the European Union (EU), it mostly functions as a single jurisdiction under a common visa policy for international travel purposes. The area is named after the 1985 Schengen Agreement and the 1990 Schengen Convention, both signed in Schengen, Luxembourg.

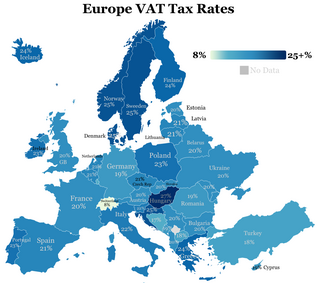

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

Regulation No. 305/2011 of the European Parliament and of the Council of the European Union is a regulation of 9 March 2011 which lays down harmonised conditions for the marketing of construction products and replaces Construction Products Directive (89/106/EEC). This EU regulation is designed to simplify and clarify the existing framework for the placing on the market of construction products. It replaced the earlier (1989) Construction Products Directive (89/106/EEC).

Market surveillance for products ensures that products on the market conform to applicable laws and regulations. This helps to foster trust among consumers buying products or financial services and protects consumers and professionals from harm from non-compliant products. It also helps companies that comply to stay in business and avoid losing market share to rogue traders.

The term digital single market refers to the policy objective of eliminating national or other jurisdictional barriers to online transactions, building on the common market concept designed to remove trade barriers in other commercial fields.

A customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory. Most countries require travellers to complete a customs declaration form when bringing notified goods across international borders. Posting items via international mail also requires the sending party to complete a customs declaration form.

The Single Administrative Document (SAD), also known as Form C88 in the UK, is the main customs form used in international trade to or from the European Union Customs Union. Traders and agents can use the SAD to assist with declaring import, export, transit and community status declarations in manual processing situations. It is used for EU trade with non-EU countries and for the movement of non-EU goods within the EU, and replaced the various national forms in use among member states before its introduction in 1988.

Regulation (EU) 2017/745 is a regulation of the European Union on the clinical investigation and sale of medical devices for human use. It repeals Directive 93/42/EEC (MDD), which concerns medical devices, and Directive 90/385/EEC, which concerns active implantable medical devices, on 26 May 2021.

The Brexit withdrawal agreement, officially titled Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community, is a treaty between the European Union (EU), Euratom, and the United Kingdom (UK), signed on 24 January 2020, setting the terms of the withdrawal of the UK from the EU and Euratom. The text of the treaty was published on 17 October 2019, and is a renegotiated version of an agreement published in November 2018. The earlier version of the withdrawal agreement was rejected by the House of Commons on three occasions, leading to the resignation of Theresa May as Prime Minister and the appointment of Boris Johnson as the new prime minister on 24 July 2019.

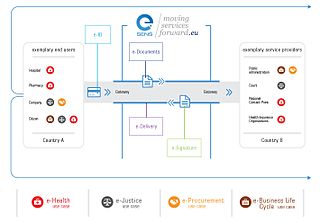

Import One-Stop Shop is an electronic one-stop shop (OSS) portal in the European Union (EU) which serves as a point of contact for the import of goods from third countries into the European Union. The scheme aims to simplify the declaration and payment of value-added tax when importing goods into the European Union.

References

- ↑ European Commission, Economic Operators Registration and Identification number (EORI), accessed 23 August 2019

- ↑ European Commission, European Customs Information Portal, accessed 27 February 2018

- ↑ EORI number validation, accessed April 25, 2018

- ↑ European Commission, EORI Guidelines, published 23 August 2010, accessed 27 February 2018

- ↑ Commission Delegated Regulation (EU) 2015/2446 of 28 July 2015 supplementing Regulation (EU) No 952/2013 of the European Parliament and of the Council as regards detailed rules concerning certain provisions of the Union Customs Code (OJ L 343, 29/12/2015)

- ↑ European Commission, MASP Rev. 2017 v1.4 Consolidated Project Fiches published 30 November 2017, accessed 19 August 2018

- ↑ UK Government, Get an EORI number: If you move goods to or from Northern Ireland, accessed 12 November 2021