Related Research Articles

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome.

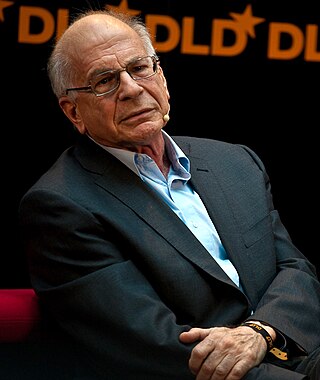

Prospect theory is a theory of behavioral economics, judgment and decision making that was developed by Daniel Kahneman and Amos Tversky in 1979. The theory was cited in the decision to award Kahneman the 2002 Nobel Memorial Prize in Economics.

The expected utility hypothesis is a foundational assumption in mathematical economics concerning decision making under uncertainty. It postulates that rational agents maximize utility, meaning the subjective desirability of their actions. Rational choice theory, a cornerstone of microeconomics, builds this postulate to model aggregate social behaviour.

In decision theory, subjective expected utility is the attractiveness of an economic opportunity as perceived by a decision-maker in the presence of risk. Characterizing the behavior of decision-makers as using subjective expected utility was promoted and axiomatized by L. J. Savage in 1954 following previous work by Ramsey and von Neumann. The theory of subjective expected utility combines two subjective concepts: first, a personal utility function, and second a personal probability distribution.

Antoine Augustin Cournot was a French philosopher and mathematician who contributed to the development of economics.

In decision theory, the Ellsberg paradox is a paradox in which people's decisions are inconsistent with subjective expected utility theory. John Maynard Keynes published a version of the paradox in 1921. Daniel Ellsberg popularized the paradox in his 1961 paper, "Risk, Ambiguity, and the Savage Axioms". It is generally taken to be evidence of ambiguity aversion, in which a person tends to prefer choices with quantifiable risks over those with unknown, incalculable risks.

The Allais paradox is a choice problem designed by Maurice Allais to show an inconsistency of actual observed choices with the predictions of expected utility theory. The Allais paradox demonstrates that individuals rarely make rational decisions consistently when required to do so immediately. The independence axiom of expected utility theory, which requires that the preferences of an individual should not change when altering two lotteries by equal proportions, was proven to be violated by the paradox.

In monotone comparative statics, the single-crossing condition or single-crossing property refers to a condition where the relationship between two or more functions is such that they will only cross once. For example, a mean-preserving spread will result in an altered probability distribution whose cumulative distribution function will intersect with the original's only once.

In decision theory and economics, ambiguity aversion is a preference for known risks over unknown risks. An ambiguity-averse individual would rather choose an alternative where the probability distribution of the outcomes is known over one where the probabilities are unknown. This behavior was first introduced through the Ellsberg paradox.

Lionel Wilfred McKenzie was an American economist. He was the Wilson Professor Emeritus of Economics at the University of Rochester. He was born in Montezuma, Georgia. He completed undergraduate studies at Duke University in 1939 and subsequently moved to Oxford that year as a Rhodes Scholar. McKenzie worked with the Cowles Commission while it was in Chicago and served as an assistant professor at Duke from 1948 to 1957. Having received his Ph.D. at Princeton University in 1956, McKenzie moved to Rochester where he was responsible for the establishment of the graduate program in economics.

Faruk R. Gül is a Turkish American economist, a professor of economics at Princeton University, and a Fellow of the Econometric Society.

Alvin Eliot Roth is an American academic. He is the Craig and Susan McCaw professor of economics at Stanford University and the Gund professor of economics and business administration emeritus at Harvard University. He was President of the American Economic Association in 2017.

In social choice theory, a dictatorship mechanism is a rule by which, among all possible alternatives, the results of voting mirror a single predetermined person's preferences, without consideration of the other voters. Dictatorship by itself is not considered a good mechanism in practice, but it is theoretically important: by Arrow's impossibility theorem, when there are at least three alternatives, dictatorship is the only ranked voting electoral system that satisfies unrestricted domain, Pareto efficiency, and independence of irrelevant alternatives. Similarly, by Gibbard's theorem, when there are at least three alternatives, dictatorship is the only strategyproof rule.

David Schmeidler was an Israeli mathematician and economic theorist. He was a Professor Emeritus at Tel Aviv University and the Ohio State University.

Arunava Sen is a professor of economics at the Indian Statistical Institute. He works on Game Theory, Social Choice Theory, Mechanism Design, Voting and Auctions.

Chew Soo Hong is a Singaporean economist who is Professor at the National University of Singapore and an adjunct professor at the Hong Kong University of Science and Technology. He is considered one of the pioneers in axiomatic non-expected utility models.

Stochastic transitivity models are stochastic versions of the transitivity property of binary relations studied in mathematics. Several models of stochastic transitivity exist and have been used to describe the probabilities involved in experiments of paired comparisons, specifically in scenarios where transitivity is expected, however, empirical observations of the binary relation is probabilistic. For example, players' skills in a sport might be expected to be transitive, i.e. "if player A is better than B and B is better than C, then player A must be better than C"; however, in any given match, a weaker player might still end up winning with a positive probability. Tightly matched players might have a higher chance of observing this inversion while players with large differences in their skills might only see these inversions happen seldom. Stochastic transitivity models formalize such relations between the probabilities and the underlying transitive relation.

Eva Elisabet Rutström is a Swedish born experimental economist, and an accomplished field researcher in individual decision making and interactive group behaviors. Over the last 40 years she has worked as an instructor and researcher at universities in Canada, the United States, and Sweden. She currently serves as the program director of field experiments at Georgia State University’s Robinson College of Business.

In economic theory, the Wilson doctrine stipulates that game theory should not rely excessively on common knowledge assumptions. Most prominently, it is interpreted as a request for institutional designs to be "detail-free". That is, mechanism designers should offer solutions that do not depend on market details because they may be unknown to practitioners or are subject to intractable change. The name is due to Nobel laureate Robert Wilson, who argued:

Game theory has a great advantage in explicitly analyzing the consequences of trading rules that presumably are really common knowledge; it is deficient to the extent it assumes other features to be common knowledge, such as one agent's probability assessment about another’s preferences or information. I foresee the progress of game theory as depending on successive reductions in the base of common knowledge required to conduct useful analyses of practical problems. Only by repeated weakening of common knowledge assumptions will the theory approximate reality.

Fractional social choice is a branch of social choice theory in which the collective decision is not a single alternative, but rather a weighted sum of two or more alternatives. For example, if society has to choose between three candidates: A B or C, then in standard social choice, exactly one of these candidates is chosen, while in fractional social choice, it is possible to choose "2/3 of A and 1/3 of B".

References

- ↑ "Economic Theory Fellows – SAET" . Retrieved 2019-06-25.

- ↑ "Distinguished professor at WBS" (PDF). WBS Website. Archived (PDF) from the original on 2017-12-15.

- ↑ Karni, Edi; Safra, Zvi (1987). ""Preference Reversal" and the Observability of Preferences by Experimental Methods". Econometrica. 55 (3): 675. doi:10.2307/1913606. ISSN 0012-9682. JSTOR 1913606.

- ↑ Karni, Edi (1979). "On Multivariate Risk Aversion". Econometrica. 47 (6): 1391–1401. doi:10.2307/1914007. ISSN 0012-9682. JSTOR 1914007.

- ↑ Hong, Chew Soo; Karni, Edi; Safra, Zvi (1987). "Risk aversion in the theory of expected utility with rank dependent probabilities". Journal of Economic Theory. 42 (2): 370–381. doi: 10.1016/0022-0531(87)90093-7 . ISSN 0022-0531.

- ↑ "Subjective Expected Utility With Incomplete Preferences". Econometrica. 81 (1): 255–284. 2013. doi: 10.3982/ecta9621 . ISSN 0012-9682.

- ↑ Karni, Edi. (1985). Decision making under uncertainty : the case of state-dependent preferences. Cambridge, Mass.: Harvard University Press. ISBN 0674195256. OCLC 11812479.

- ↑ Karni, Edi (2012-02-02). "Bayesian decision theory with action-dependent probabilities and risk attitudes". Economic Theory. 53 (2): 335–356. CiteSeerX 10.1.1.360.2882 . doi:10.1007/s00199-012-0692-4. ISSN 0938-2259. S2CID 28407506.

- ↑ Karni, Edi Vierø, Marie-Louise (2014). Awareness of Unawareness: A Theory of Decision Making in the Face of Ignorance. Kingston, Ont.: Queen's Economics Dep., Queen's Univ. OCLC 951025796.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ↑ Darby, Michael R.; Karni, Edi (1973). "Free Competition and the Optimal Amount of Fraud". The Journal of Law and Economics. 16 (1): 67–88. doi:10.1086/466756. ISSN 0022-2186. S2CID 53667439.