Energy use in Oman was 381 TWh in 2020, almost double the consumption in 2010. [1]

Energy use in Oman was 381 TWh in 2020, almost double the consumption in 2010. [1]

Oman is a country in the Middle East. Its current GDP per capita has expanded continuously over the past 50 years. It grew 339% in the 1960s and reached a peak growth of 1,370% in 1976.[ citation needed ]. Oman both imports and exports energy.

When Oman declined as an entrepot for arms and slaves in the mid-19th century, much of its former prosperity vanished; the economy turned almost exclusively to agriculture, camel and goat herding, fishing, and traditional handicrafts. Today, petroleum (oil) exports fuel the economy. Revenues from petroleum products have enabled Oman's dramatic development and modernization over the past 300 years.

| Energy in Oman [2] [3] [4] [5] [6] [7] [8] [9] | ||||||

|---|---|---|---|---|---|---|

| Capita | Prim. energy | Production | Export | Ammunition | CO2-emission | |

| Million | TWh | TWh | TWh | TWh | Mt | |

| 2004 | 2.5310 | 138 | 676 | 549 | 9.72 | 25.261 |

| 2007 | 2.60 | 180 | 689 | 484 | 12.22 | 35.85 |

| 2008 | 2.79 | 191 | 738 | 497 | 13.63 | 34.92 |

| 2009 | 2.85 | 175 | 782 | 593 | 15.52 | 38.95 |

| 2010 | 2.78 | 233 | 839 | 617 | 16.51 | 40.27 |

| 2012 | 2.85 | 294 | 855 | 576 | 19.03 | 63.48 |

| 2012R | 3.31 | 306 | 881 | 589 | 21.61 | 67.63 |

| 2013 | 3.63 | 283 | 880 | 584 | 23.37 | 57.92 |

| Change 2004–10 | 9.9% | 69.1% | 24.2% | 12.4% | 69.9% | 59.4% |

| Mtoe = 11.63 TWh, Prim. energy includes energy losses 2012R = CO2 calculation criteria changed, numbers updated | ||||||

Oil was first discovered in 1964, near Fahud in the western desert. Petroleum Development Oman (PDO) began production in August 1967. The Omani Government owns 60% of PDO, and foreign interests own 40% (Royal Dutch Shell owns 34%; the remaining 6% is owned by Total and Partex). In 1976, Oman's oil production rose to 366,000 barrels (58,000 m³) per day but declined to about 285,000 barrels (45,000 m³) per day in the late 1980s due to the depletion of recoverable reserves. From 1981 to 1986, Oman compensated for declining oil prices by increasing production levels to 600,000 b/d; however, when oil prices collapsed in 1986, revenues dropped dramatically. Production was cut back temporarily in coordination with the Organization of Petroleum Exporting Countries (OPEC). Production levels again reached 600,000 b/d by mid-1987, which helped increase revenues. Oman's economic performance improved significantly in 1999 due largely to the mid-year upturn in oil prices. The government moved ahead with privatization of its utilities, and the development of the commercial law to encourage foreign investment. Oman liberalized its markets in an effort to join the World Trade Organization (WTO) and was accepted in 2000. By the mid-2000s, production had climbed to more than 900,000 b/d and where they remain. Oman is not a member of OPEC.

In November 2017, Oman Oilfield received steam generated from 1,021 MW Solar Plant. [10]

Oman LNG is an LNG plant in operation since September 2000. It is supplied with gas in central Oman from Saih Rowl, the gas field is operated by Petroleum Development Oman (PDO).

Since oil and gas account for 60% of Oman's energy exports, the nation has begun to diversify its energy use using renewable hydrogen produced by electrolysis of desalinated seawater. In 2022, the government formed Hydrogen Oman (HYDROM) as an autonomous body to lead and administer its hydrogen policy. 1,500 square km of land have been set aside for development thus far. [11]

The economy of Oman is mainly centered around its oil sector, with fishing and trading activities located around its coastal regions. When oil was discovered in 1964, the production and export increased significantly. The government has made plans to diversify away from oil under its privatization and Omanization policies. This has helped raise Oman's GDP per capita continuously in the past 50 years. It grew 339% in the 1960s, reaching a peak growth of 1,370% in the 1970s. Similar to the pricing of all other commodities, the price of oil is subject to significant fluctuations over time, especially those associated with the business cycle. A commodity's price will rise sharply when demand, like that for oil, outpaces supply; meanwhile, when supply outpaces demand, prices will fall.

Petroleum, also known as crude oil, or simply oil, is a naturally occurring yellowish-black liquid mixture of mainly hydrocarbons, and is found in geological formations. The name petroleum covers both naturally occurring unprocessed crude oil and petroleum products that consist of refined crude oil. A fossil fuel, petroleum is formed when large quantities of dead organisms, mostly zooplankton and algae, are buried underneath sedimentary rock and subjected to both prolonged heat and pressure.

The Organization of the Petroleum Exporting Countries is an organization enabling the co-operation of leading oil-producing countries in order to collectively influence the global oil market and maximize profit. It was founded on 14 September 1960 in Baghdad by the first five members. The 13 member countries account for an estimated 30 percent of global oil production.

Peak oil is the point in time when the maximum rate of global oil production is reached, after which production will begin an irreversible decline. It is related to the distinct concept of oil depletion; while global petroleum reserves are finite, the limiting factor is not whether the oil exists but whether it can be extracted economically at a given price. A secular decline in oil extraction could be caused both by depletion of accessible reserves and by reductions in demand that reduce the price relative to the cost of extraction, as might be induced to reduce carbon emissions or from demand destruction triggered by persistently high oil prices.

Petroleum Development Oman (PDO) is the leading exploration and production company in the Sultanate of Oman. The Company delivers the majority of the country's crude oil production and natural gas supply. The company is owned by the Government of Oman, Royal Dutch Shell (34%), TotalEnergies (4%) and Partex (2%). The first economic oil find was made in 1962, and the first oil consignment was exported in 1967.

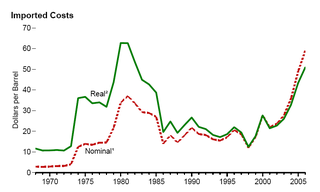

From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under US$25/barrel in 2008 dollars. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed these price increases to many factors, including Middle East tension, soaring demand from China, the falling value of the U.S. dollar, reports showing a decline in petroleum reserves, worries over peak oil, and financial speculation.

Yibal is the largest oilfield in Oman, located in the Ad Dhahirah Governorate, about 360km southwest of Muscat. It began production in 1968, and at its peak had a production of nearly 250,000 barrels per day (40,000 m3/d). In recent years, it has begun to decline, and in 2005 produces about 88,000 barrels per day (14,000 m3/d). The Yibal oil field is operated primarily by Petroleum Development Oman.

Energy in Kazakhstan describes energy and electricity production, consumption and import in Kazakhstan and the politics of Kazakhstan related to energy.

Peak oil is the point at which oil production, sometimes including unconventional oil sources, hits its maximum. Predicting the timing of peak oil involves estimation of future production from existing oil fields as well as future discoveries. The most influential production model is Hubbert peak theory, first proposed in the 1950s. The effect of peak oil on the world economy remains controversial.

The 1980s oil glut was a significant surplus of crude oil caused by falling demand following the 1970s energy crisis. The world price of oil had peaked in 1980 at over US$35 per barrel ; it fell in 1986 from $27 to below $10. The glut began in the early 1980s as a result of slowed economic activity in industrial countries due to the crises of the 1970s, especially in 1973 and 1979, and the energy conservation spurred by high fuel prices. The inflation-adjusted real 2004 dollar value of oil fell from an average of $78.2 in 1981 to an average of $26.8 per barrel in 1986.

EnergyinSaudi Arabia involves petroleum and natural gas production, consumption, and exports, and electricity production. Saudi Arabia is the world's leading oil producer and exporter. Saudi Arabia's economy is petroleum-based; oil accounts for 90% of the country's exports and nearly 75% of government revenue. The oil industry produces about 45% of Saudi Arabia's gross domestic product, against 40% from the private sector. Saudi Arabia has per capita GDP of $20,700. The economy is still very dependent on oil despite diversification, in particular in the petrochemical sector.

This article describes the energy and electricity production, consumption and import in Egypt.

The 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages as well as elevated prices. The two worst crises of this period were the 1973 oil crisis and the 1979 energy crisis, when, respectively, the Yom Kippur War and the Iranian Revolution triggered interruptions in Middle Eastern oil exports.

Iran is an energy superpower and the petroleum industry in Iran plays an important part in it. In 2004, Iran produced 5.1 percent of the world's total crude oil, which generated revenues of US$25 billion to US$30 billion and was the country's primary source of foreign currency. At 2006 levels of production, oil proceeds represented about 18.7% of gross domestic product (GDP). However, the importance of the hydrocarbon sector to Iran's economy has been far greater. The oil and gas industry has been the engine of economic growth, directly affecting public development projects, the government's annual budget, and most foreign exchange sources.

The energy sector of Iraq is mostly concentrated around oil and gas.

Solar thermal enhanced oil recovery is a form of thermal enhanced oil recovery (EOR), a technique applied by oil producers to extract more oil from maturing oil fields. Solar EOR uses solar thermal arrays to concentrate the sun's energy to heat water and generate steam. The steam is injected into an oil reservoir to reduce the viscosity, or thin, heavy crude thus facilitating its flow to the surface. Thermal recovery processes, also known as steam injection, have traditionally burned natural gas to produce steam. Solar EOR is proving to be a viable alternative to gas-fired steam production for the oil industry. Solar EOR can generate the same quality steam as natural gas, reaching temperatures up to 750 °F (400 °C) and 2,500 PSI.

Miraah is a solar thermal energy plant that is under construction in Oman for the production of steam for solar thermal enhanced oil recovery. In July 2015, Petroleum Development Oman and GlassPoint Solar announced that they signed a $600 million agreement to build the 1 GWth solar field. The project will be one of the world's largest solar field measured by peak thermal capacity.

The 2021–2023 global energy crisis began in the aftermath of the COVID-19 pandemic in 2021, with much of the globe facing shortages and increased prices in oil, gas and electricity markets. The crisis was caused by a variety of economic factors, including the rapid post-pandemic economic rebound that outpaced energy supply, and escalated into a widespread global energy crisis following the Russian invasion of Ukraine. The price of natural gas reached record highs, and as a result, so did electricity in some markets. Oil prices hit their highest level since 2008.