A fossil fuel is a fuel formed by natural processes, such as anaerobic decomposition of buried dead organisms, containing organic molecules originating in ancient photosynthesis that release energy in combustion. Such organisms and their resulting fossil fuels typically have an age of millions of years, and sometimes more than 650 million years. Fossil fuels contain high percentages of carbon and include petroleum, coal, and natural gas. Commonly used derivatives of fossil fuels include kerosene and propane. Fossil fuels range from volatile materials with low carbon-to-hydrogen ratios, to liquids, to nonvolatile materials composed of almost pure carbon, like anthracite coal. Methane can be found in hydrocarbon fields alone, associated with oil, or in the form of methane clathrates.

A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Carbon taxes are intended to make visible the "hidden" social costs of carbon emissions, which are otherwise felt only in indirect ways like more severe weather events. In this way, they are designed to reduce carbon dioxide (CO

2) emissions by increasing prices. This both decreases demand for such goods and services and incentivizes efforts to make them less carbon-intensive. In its simplest form, a carbon tax covers only CO2 emissions; however, they can also cover other greenhouse gases, such as methane or nitrous oxide, by calculating their global warming potential relative to CO2.

The use of energy is considered sustainable if it meets the needs of the present without compromising the needs of future generations. Definitions of sustainable energy typically include environmental aspects such as greenhouse gas emissions, and social and economic aspects such as energy poverty.

The energy policy of the United States is determined by federal, state, and local entities in the United States, which address issues of energy production, distribution, and consumption, such as building codes and gas mileage standards. Energy policy may include legislation, international treaties, subsidies and incentives to investment, guidelines for energy conservation, taxation and other public policy techniques.

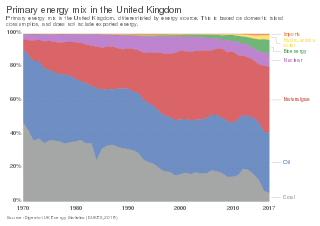

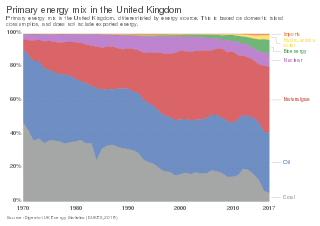

The current energy policy of the United Kingdom is the responsibility of the Department for Business, Energy and Industrial Strategy (BEIS), after the Department of Energy and Climate Change was merged with the Department for Business, Innovation and Skills in 2016. Energy markets are also regulated by the Office of Gas and Electricity Markets (Ofgem).

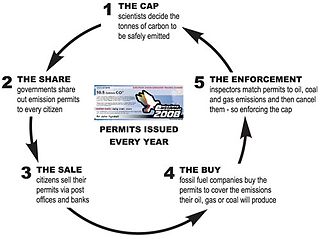

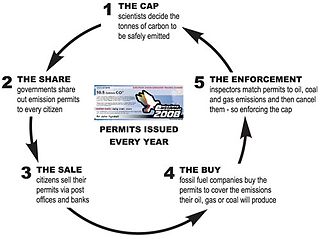

Cap and Share was originally developed by Feasta and is a regulatory and economic framework for controlling the use of fossil fuels in relation to climate stabilisation. Accepting that climate change is a global problem and that there is a need to cap and reduce greenhouse gas emissions globally, the philosophy of Cap and Share maintains that the earth’s atmosphere is a fundamental common resource. Consequently, it is argued, each individual should get an equal share of the benefits from the limited amount of fossil fuels that will have to be burned and their emissions released into the atmosphere in the period until the atmospheric concentration of greenhouse gases has been stabilised at a safe level.

A low-carbon economy (LCE), low-fossil-fuel economy (LFFE), or decarbonised economy is an economy based on low-carbon power sources that therefore has a minimal output of greenhouse gas (GHG) emissions into the atmosphere, specifically carbon dioxide. GHG emissions due to anthropogenic (human) activity are the dominant cause of observed climate change since the mid-20th century. Continued emission of greenhouse gases may cause long-lasting changes around the world, increasing the likelihood of severe, pervasive, and irreversible effects for people and ecosystems.

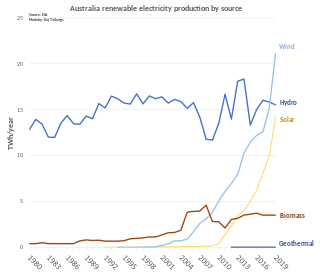

The energy policy of Australia is subject to the regulatory and fiscal influence of all three levels of government in Australia, although only the State and Federal levels determine policy for primary industries such as coal.

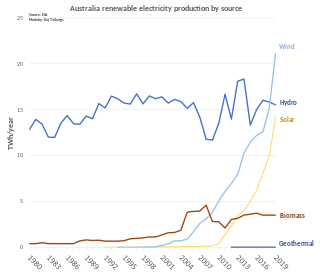

Renewable energy in Australia includes wind power, hydroelectricity, solar PV, heat pumps, geothermal, wave and solar thermal energy.

Renewable energy commercialization involves the deployment of three generations of renewable energy technologies dating back more than 100 years. First-generation technologies, which are already mature and economically competitive, include biomass, hydroelectricity, geothermal power and heat. Second-generation technologies are market-ready and are being deployed at the present time; they include solar heating, photovoltaics, wind power, solar thermal power stations, and modern forms of bioenergy. Third-generation technologies require continued R&D efforts in order to make large contributions on a global scale and include advanced biomass gasification, hot-dry-rock geothermal power, and ocean energy. As of 2012, renewable energy accounts for about half of new nameplate electrical capacity installed and costs are continuing to fall.

The United States produced 6.6 billion metric tons of carbon dioxide equivalent greenhouse gas (GHG) emissions in 2019, the second largest in the world after greenhouse gas emissions by China and among the countries with the highest greenhouse gas emissions per person. In 2019 China is estimated to have emitted 27% of world GhG, followed by the USA with 11%, then India with 6.6%. In total the USA has emitted 400 billion metric tons, more than any other country. This is over 15 tonnes per person and, amongst the top ten emitters, is the second highest country by greenhouse gas emissions per person after Canada. Because coal-fired power stations are gradually shutting down, in the 2010s emissions from electricity generation fell to second place behind transportation which is now the largest single source. In the year 2018, 28% of the GHG emissions of the United States were from transportation, 27% from electricity, 22% from industry, 12% from commercial and residential buildings and 10% from agriculture.

Biofuels are renewable fuels that are produced by living organisms (biomass). Biofuels can be solid, gaseous or liquid, which comes in two forms: ethanol and biodiesel and often replace fossil fuels. Many countries now use biofuels as energy sources, including Sweden. Sweden has one of the highest usages of biofuel in all of Europe, at 32%, primarily due to the wide-spread commitment to E85, bioheating and bioelectricity.

Fossil fuel phase-out is the gradual reduction of the use of fossil fuels to zero. It is part of the ongoing renewable energy transition. Current efforts in fossil fuel phase-out involve replacing fossil fuels with sustainable energy sources in sectors such as transport, and heating. Alternatives to fossil fuels include electrification, hydrogen and aviation biofuel.

Energy subsidies are measures that keep prices for customers below market levels, or for suppliers above market levels, or reduce costs for customers and suppliers. Energy subsidies may be direct cash transfers to suppliers, customers, or related bodies, as well as indirect support mechanisms, such as tax exemptions and rebates, price controls, trade restrictions, and limits on market access.

Energy in Finland describes energy and electricity production, consumption and import in Finland. Energy policy of Finland describes the politics of Finland related to energy. Electricity sector in Finland is the main article of electricity in Finland.

Greenhouse gas emissions by Australia totalled 533.36 million tonnes CO

2-equivalent based on Greenhouse Gas national inventory report data for 2019; representing per capita CO2e emissions of 21.03 tons. Australia uses principally coal power for electricity but this is rapidly decreasing with a growing share of renewables making up the energy supply mix, and most existing coal-fired power station scheduled to cease operation between 2022-2048. Emissions by the country have started to fall and are expected to continue to fall in coming years as more renewable projects come online.

A low-carbon fuel standard (LCFS) is a rule enacted to reduce carbon intensity in transportation fuels as compared to conventional petroleum fuels, such as gasoline and diesel. The most common low-carbon fuels are alternative fuels and cleaner fossil fuels, such as natural gas. The main purpose of a low-carbon fuel standard is to decrease carbon dioxide emissions associated with vehicles powered by various types of internal combustion engines while also considering the entire life cycle, in order to reduce the carbon footprint of transportation.

A carbon pricing scheme in Australia was introduced by the Gillard Labor minority government in 2011 as the Clean Energy Act 2011 which came into effect on 1 July 2012. Emissions from companies subject to the scheme dropped 7% upon its introduction. As a result of being in place for such a short time, and because the then Opposition leader Tony Abbott indicated he intended to repeal "the carbon tax", regulated organisations responded rather weakly, with very few investments in emissions reductions being made. The scheme was repealed on 17 July 2014, backdated to 1 July 2014. In its place the Abbott Government set up the Emission Reduction Fund in December 2014. Emissions thereafter resumed their growth evident before the tax.

The carbon bubble is a hypothesized bubble in the valuation of companies dependent on fossil-fuel-based energy production, because the true costs of carbon dioxide in intensifying global warming are not yet taken into account in a company's stock market valuation. Currently the price of fossil fuels companies' shares is calculated under the assumption that all fossil fuel reserves will be consumed. An estimate made by Kepler Chevreux puts the loss in value of the fossil fuel companies due to the impact of the growing renewables industry at US$28 trillion over the next two decades-long. A more recent analysis made by Citi puts that figure at $100 trillion.

Coal, cars and cows discharge almost half of Turkey's five hundred million tonnes annual greenhouse gas emissions, which are mostly carbon dioxide with some methane.