Related Research Articles

In finance, a high-yield bond is a bond that is rated below investment grade by credit rating agencies. These bonds have a higher risk of default or other adverse credit events but offer higher yields than investment-grade bonds in order to compensate for the increased risk.

A credit rating agency is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may rate the creditworthiness of issuers of debt obligations, of debt instruments, and in some cases, of the servicers of the underlying debt, but not of individual consumers.

Moody's Corporation, often referred to as Moody's, is an American business and financial services company. It is the holding company for Moody's Ratings, an American credit rating agency, and Moody's, an American provider of financial analysis software and services.

Chubb Limited is an American-Swiss company incorporated in Zürich, and listed on the New York Stock Exchange (NYSE) where it is a component of the S&P 500. Chubb is a global provider of insurance products covering property and casualty, accident and health, reinsurance, and life insurance and is the largest publicly traded property and casualty insurance company in the world. Chubb operates in 55 countries and territories and in the Lloyd's insurance market in London. Clients of Chubb consist of multinational corporations and local businesses, individuals, and insurers seeking reinsurance coverage. Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance, and life insurance.

A credit rating is an evaluation of the credit risk of a prospective debtor, predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting. The credit rating represents an evaluation from a credit rating agency of the qualitative and quantitative information for the prospective debtor, including information provided by the prospective debtor and other non-public information obtained by the credit rating agency's analysts.

The Ambac Financial Group, Inc., generally known as Ambac, is an American holding company. Its subsidiaries provide financial guarantee products such as bond insurance to clients in both the public and private sectors globally. Ambac Assurance is a guarantor of public finance and structured finance obligations. Its common stock and common stock purchase warrants are listed on the NYSE under the symbols AMBC and AMBCW respectively. Ambac is regulated by the insurance commission of Wisconsin. It has its headquarters in Lower Manhattan, New York City.

Moody's Ratings, previously known as Moody's Investors Service, often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Ratings provides international financial research on bonds issued by commercial and government entities. Moody's, along with Standard & Poor's and Fitch Group, is considered one of the Big Three credit rating agencies. It is also included in the Fortune 500 list of 2021.

USF&G was an American insurance company that existed from 1896 until 1998. It was originally called the United States Fidelity and Guaranty Company. The insurer formed a holding company for its insurance businesses and changed its name to USF&G in July 1981.

Catastrophe bonds are a subset of insurance-linked securities (ILS) that transfer a specified set of risks from a sponsor to investors. They were created and first used in the mid-1990s in the aftermath of Hurricane Andrew and the Northridge earthquake.

MBIA Inc. is an American financial services company. It was founded in 1973 as the Municipal Bond Insurance Association. It is headquartered in Purchase, New York, and as of January 1, 2015 had approximately 180 employees. MBIA is the largest bond insurer.

Reinsurance sidecars, conventionally referred to as "sidecars", are financial structures that are created to allow investors to take on the risk and return of a group of insurance policies written by an insurer or reinsurer and earn the risk and return that arises from that business. A re/insurer will only pay ("cede") the premiums associated with a book of business to such an entity if the investors place sufficient funds in the vehicle to ensure that it can meet claims if they arise. Typically, the liability of investors is limited to these funds. These structures have become quite prominent in the aftermath of Hurricane Katrina as a vehicle for re/insurers to add risk-bearing capacity, and for investors to participate in the potential profits resulting from sharp price increases in re/insurance over the four quarters following Katrina. An earlier and smaller generation of sidecars were created after 9/11 for the same purpose.

Bond insurance, also known as "financial guaranty insurance", is a type of insurance whereby an insurance company guarantees scheduled payments of interest and principal on a bond or other security in the event of a payment default by the issuer of the bond or security. It is a form of "credit enhancement" that generally results in the rating of the insured security being the higher of (i) the claims-paying rating of the insurer or (ii) the rating the bond would have without insurance.

Executive Life Insurance Company (ELIC) was once the largest life insurance company in California. Its financial problems and subsequent insolvency in April 1991 shocked its policyholders and the financial world.

Berkshire Hathaway Assurance is a bond insurance company created by Berkshire Hathaway, Inc. in December 2007.

This article is a subordinate article to the subprime mortgage crisis. It covers some of the miscellaneous effects of the crisis in more detail, to preserve the flow of the main page.

Reliance Insurance Company, now officially known as Reliance Insurance Company [in Liquidation], was founded in Philadelphia in 1817 and has undergone numerous corporate makeovers in the intervening years. Since October 3, 2001, the company has been in liquidation. As of 2020, Reliance was still in liquidation.

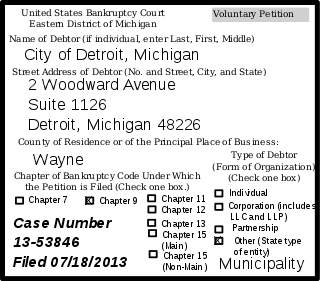

The city of Detroit, Michigan, filed for Chapter 9 bankruptcy on July 18, 2013. It is the largest municipal bankruptcy filing in U.S. history by debt, estimated at $18–20 billion, exceeding Jefferson County, Alabama's $4-billion filing in 2011. Detroit is also the largest city by population in U.S. history to file for Chapter 9 bankruptcy, more than twice as large as Stockton, California, which filed in 2012. While Detroit's population had declined from a peak of 1.8 million in 1950, its July 2013 population was reported by The New York Times as a city of 700,000.

Financial Security Assurance (FSA) was an American financial guaranty insurance company. FSA was bought in 2000 for EUR€2.7 billion by the Franco-Belgian bank Dexia. In 2007, before the 2008 financial crisis, FSA was ranked number four among global monoline credit insurers. In 2009, it was acquired by Assured Guaranty Corporation.

Build America Mutual Assurance Company is a mutual, monoline bond insurer of essential public-purpose U.S. municipal bonds. Since its inception in July 2012, the company has insured more than $65 billion in par amount for more than 3,300 member-issuers. In 2018, it insured $8.36 billion par across 653 new-issue insured transactions. BAM also publishes a credit profile for every transaction it insures and updates them. More than 6,000 are now available. The company is the preferred provider of financial guaranty insurance on debt for member municipalities of the National League of Cities. NLC endorsed BAM upon its launch.

Public–private partnerships are cooperative arrangements between two or more public and private sectors, typically of a long-term nature. In the United States, they mostly took the form of toll roads concessions, community post offices and urban renewal projects. In recent years, there has been interest in expanding P3s to multiple infrastructure projects, such as schools, universities, government buildings, waste and water. Reasons for expanding public-private partnership in the United States were initially cost-cutting and concerns about Public debt. In the early 2000s, P3s were implemented sporadically by different States and municipalities with little federal guidance. During Obama's second term, multiple policies were adopted to facilitate P3 projects, and Congress passed bills in that direction with overwhelming bipartisan support. My Brother's Keeper Challenge is an example of a public–private partnership. Some Private-public partnerships were carried out without incident, while others have attracted much controversy.

References

- ↑ http://www.thedeal.com/dealscape/2008/05/fgic_still_searching_for_a_lifeline.php [ dead link ]

- ↑ Bond Insurer Ponders Its Options. The New York Times , April 15, 2008

- ↑ A Split-Up of Insurers of Bonds Is Considered. The New York Times, "A Split-Up of Insurers of Bonds Is Considered"

- ↑ "Financial Guaranty Insurance Company – About FGIC". fgic.com. Retrieved April 9, 2016.

- ↑ McLaughlin, David (June 11, 2012). "Financial Guaranty Insurance to Be Taken Over by New York". Bloomberg.

- ↑ "Red Wings arena to be demolished". ESPN.com. Associated Press. October 16, 2014. Retrieved October 16, 2014.