Related Research Articles

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Formed in 1944, started on 27 December 1945, at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system. It now plays a central role in the management of balance of payments difficulties and international financial crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money. As of 2016, the fund had XDR 477 billion. The IMF is regarded as the global lender of last resort.

The Bank for International Settlements (BIS) is an international financial institution owned by central banks that "fosters international monetary and financial cooperation and serves as a bank for central banks". The BIS carries out its work through its meetings, programmes and through the Basel Process – hosting international groups pursuing global financial stability and facilitating their interaction. It also provides banking services, but only to central banks and other international organizations. It is based in Basel, Switzerland, with representative offices in Hong Kong and Mexico City.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

Hans Eichel is a German politician (SPD) and the co-founder of the G20, or "Group of Twenty", an international forum for the governments and central bank governors of twenty developed and developing nations to discuss policy issues pertaining to the promotion of international financial stability.

The G20 or Group of Twenty is an intergovernmental forum comprising 20 countries and the European Union (EU). It works to address major issues related to the global economy, such as international financial stability, climate change mitigation, and sustainable development.

A financial centre (BE), financial center (AE), or financial hub, is a location with a concentration of participants in banking, asset management, insurance or financial markets with venues and supporting services for these activities to take place. Participants can include financial intermediaries, institutional investors, and issuers. Trading activity can take place on venues such as exchanges and involve clearing houses, although many transactions take place over-the-counter (OTC), that is directly between participants. Financial centres usually host companies that offer a wide range of financial services, for example relating to mergers and acquisitions, public offerings, or corporate actions; or which participate in other areas of finance, such as private equity, hedge funds, and reinsurance. Ancillary financial services include rating agencies, as well as provision of related professional services, particularly legal advice and accounting services.

Jihad Azour, , is a Lebanese economist and politician, he served as Lebanon's minister of finance under Fouad Saniora's government from 2005 to 2008.

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank.

Avinash D. Persaud born 22 June 1966 in Barbados, West Indies) is Emeritus Professor of Gresham College in the UK. He was Chairman of Intelligence Capital Ltd., a company specializing in analyzing, managing and creating financial liquidity in investment projects and portfolios. He was also the non-Executive Chairman of the London-based Elara Capital, an investment bank. Persaud was a Non-resident Senior Fellow of the Peterson Institute of International Economics, Executive Fellow of London Business School and Senior Fellow with the Caribbean Policy Research Institute and Head of its Barbados office.

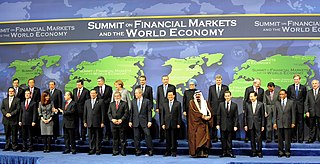

The 2008 G20 Washington Summit on Financial Markets and the World Economy took place on November 14–15, 2008, in Washington, D.C., United States. It achieved general agreement amongst the G20 on how to cooperate in key areas so as to strengthen economic growth, deal with the 2008 financial crisis, and lay the foundation for reform to avoid similar crises in the future. The Summit resulted from an initiative by the French and European Union President, Nicolas Sarkozy, Australian Prime Minister Kevin Rudd, and the British Prime Minister, Gordon Brown. In connection with the G7 finance ministers on October 11, 2008, United States President George W. Bush stated that the next meeting of the G20 would be important in finding solutions to the economic crisis. Since many economists and politicians called for a new Bretton Woods system to overhaul the world's financial structure, the meeting has sometimes been described by the media as Bretton Woods II.

Malcolm D. Knight is a Canadian economist, policymaker and banker. He is currently Visiting Professor of Finance at the London School of Economics and Political Science and a Distinguished Fellow at the Center for International Governance Innovation. From 2008 to 2012, Knight was Vice Chairman of Deutsche Bank Group where he was responsible for developing and coordinating the bank's global approach to issues in financial regulation, supervision, and financial stability. He served as general manager of the Bank for International Settlements from 2003 to 2008 and as Senior Deputy Governor of the Bank of Canada (1999-2003), after holding senior positions at the International Monetary Fund (1975-1999).

The Eurogroup is the recognised collective term for the informal meetings of the finance ministers of the eurozone—those member states of the European Union (EU) which have adopted the euro as their official currency. The group has 19 members. It exercises political control over the currency and related aspects of the EU's monetary union such as the Stability and Growth Pact. The current President of the Eurogroup is Paschal Donohoe, the Minister for Finance of Ireland.

The 2009 G20 London Summit was the second meeting of the G20 heads of government/heads of state, which was held in London on 2 April 2009 at the ExCeL Exhibition Centre to discuss financial markets and the world economy. It followed the first G20 Leaders Summit on Financial Markets and the World Economy, which was held in Washington, D.C. on 14–15 November 2008. Heads of government or heads of state from the G20 attended, with some regional and international organisations also represented. Due to the extended membership, it has been referred to as the London Summit.

The Financial Stability Board (FSB) is an international body that monitors and makes recommendations about the global financial system. It was established after the G20 London summit in April 2009 as a successor to the Financial Stability Forum (FSF). The Board includes all G20 major economies, FSF members, and the European Commission. Hosted and funded by the Bank for International Settlements, the board is based in Basel, Switzerland, and is established as a not-for-profit association under Swiss law.

The Santiago Principles or formally the Sovereign Wealth Funds: Generally Accepted Principles and Practices (GAPP) are designed as a common global set of 24 voluntary guidelines that assign best practices for the operations of Sovereign Wealth Funds (SWFs). They are a consequence of the concern of investors and regulators to establish management principles addressing the inadequate transparency, independence, and governance in the industry. They are guidelines to be followed by sovereign wealth fund management to maintain a stable global financial system, proper controls around risk, regulation and a sound governance structure.

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

A bank tax, or a bank levy, is a tax on banks which was discussed in the context of the financial crisis of 2007–08. The bank tax is levied on the capital at risk of financial institutions, excluding federally insured deposits, with the aim of discouraging banks from taking unnecessary risks. The bank tax is levied on a limited number of sophisticated taxpayers and is not especially difficult to understand. It can be used as a counterbalance to the various ways in which banks are currently subsidized by the tax system, such as the ability to subtract bad loan reserves, delay tax on interest received abroad, and buy other banks and use their losses to offset future income. In other words, the bank tax is a small reimbursement of taxpayer funds used to bail out major banks after the 2008 financial crisis, and it is carefully structured to target only certain institutions that are considered "too big to fail."

The 2011 G20 Cannes Summit was the sixth meeting of the G20 heads of government/heads of state in a series of on-going discussions about financial markets and the world economy.

BRICS is an acronym for five leading emerging economies: Brazil, Russia, India, China, and South Africa. The first four were initially grouped as "BRIC" in 2001 by Goldman Sachs economist Jim O'Neill, who coined the term to describe fast-growing economies that would collectively dominate the global economy by 2050; South Africa was added in 2010.

The Alliance for Financial Inclusion, or AFI, is a policy leadership alliance owned and led by member central banks and financial regulatory institutions with the common objective of advancing financial inclusion at the country, regional and international levels. Its members include roughly 100 institutions, being central banks, financial regulatory institutions, and financial inclusion policymakers from nearly 90 developing and emerging economies.

References

- 1 2 "Archived copy" (PDF). Archived from the original (PDF) on 2009-04-11. Retrieved 2016-04-30.

{{cite web}}: CS1 maint: archived copy as title (link) - ↑ Genesis of the FSF Archived June 14, 2008, at the Wayback Machine , FSF website.

- ↑ fsforum.org Archived 2009-05-12 at the Wayback Machine , main website.

- ↑ FSF:Who we are Archived June 14, 2008, at the Wayback Machine .

- 1 2 Financial Stability Forum meets in Rome, 29 March 2008, Press release, Website of Bank for International Settlements