A commercial bank is a financial institution that accepts deposits from the public and gives loans for the purposes of consumption and investment to make a profit.

Washington Mutual, Inc. was an American savings bank holding company based in Seattle. It was the parent company of WaMu Bank, which was the largest savings and loan association in the United States until its collapse in 2008.

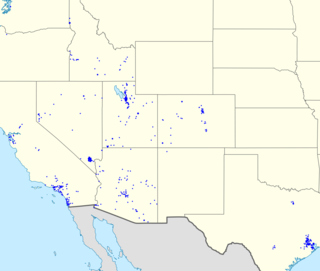

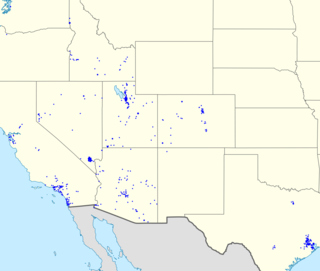

Washington Federal, Inc.,, is an American bank based in Seattle, Washington. It operates 235 branches throughout Washington, Oregon, Idaho, Nevada, Utah, Arizona, New Mexico, and Texas.

Bank One Corporation was an American bank founded in 1968 and at its peak the sixth-largest bank in the United States. It traded on the New York Stock Exchange under the stock symbol ONE. The company merged with JPMorgan Chase & Co. on July 1, 2004, with its CEO Jamie Dimon taking the lead at the combined company. The company had its headquarters in the Bank One Plaza in the Chicago Loop in Chicago, Illinois, now the headquarters of Chase's retail banking division.

Financial services are economic services tied to finance provided by financial institutions. Financial services encompass a broad range of service sector activities, especially as concerns financial management and consumer finance.

The main elements of Japan's financial system are much the same as those of other major industrialized nations: a commercial banking system, which accepts deposits, extends loans to businesses, and deals in foreign exchange; specialized government-owned financial institutions, which fund various sectors of the domestic economy; securities companies, which provide brokerage services, underwrite corporate and government securities, and deal in securities markets; capital markets, which offer the means to finance public and private debt and to sell residual corporate ownership; and money markets, which offer banks a source of liquidity and provide the Bank of Japan with a tool to implement monetary policy.

Old National Bank is an American regional bank with nearly 200 retail branches operated by Old National Bancorp and based in Chicago and Evansville, Indiana. With assets at $23.0 billion and 162 banking centers, Old National Bancorp is the largest financial services bank holding company headquartered in Indiana and one of the top 100 banking companies in the U.S. Its primary banking footprint is in Illinois, Indiana, Kentucky, Michigan, Minnesota, and Wisconsin.

Retail banking, also known as consumer banking or personal banking, is the provision of services by a bank to the general public, rather than to companies, corporations or other banks, which are often described as wholesale banking.

China Banking Corporation, commonly known as Chinabank, is a Filipino bank established in 1920. It was the first privately owned local commercial bank in the Philippines initially catering to the banking needs of Chinese Filipino businesspeople. It offers various banking services and products related to deposit, investment, trust, cash management, remittance, and financing products and services. It also offers insurance brokerage, stock brokerage, capital markets, and bancassurance services through its subsidiaries and affiliate.

Dollar Bank is a full-service regional savings bank serving both individuals and business customers, operating more than 90 offices throughout Pennsylvania, Ohio, Maryland, and Virginia. The bank's corporate headquarters is located in downtown Pittsburgh alongside its Pennsylvania regional headquarters. The Ohio headquarters is located in downtown Cleveland, and Virginia headquarters is located in Hampton Roads.

Zions Bancorporation is a national bank headquartered in Salt Lake City, Utah. It operates as a national bank rather than as a bank holding company and does business under the following seven brands: Zions Bank, Amegy Bank of Texas, California Bank and Trust, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and the Commerce Bank of Washington. It has 416 branches and over 1 million customers. It was founded by the Church of Jesus Christ of Latter-day Saints in 1873, although the church divested its interest in the bank in 1960.

China's banking sector had CN¥319.7 trillion in assets at the end of 2020. The "Big Four" state-owned commercial banks are the Bank of China, the China Construction Bank, the Industrial and Commercial Bank of China, and the Agricultural Bank of China, all of which are among the largest banks in the world As of 2018. Other notable big and also the largest banks in the world are China Merchants Bank and Ping An Bank.

West Coast Bancorp was a publicly traded financial services holding company headquartered in Lake Oswego, Oregon. Its principal holding was West Coast Bank, a full-service, commercial bank with 63 branches in 40 cities in western and central Oregon and western Washington. As of December 31, 2006, the company had deposits totaling $2 billion and net loans of $1.9 billion. In September 2012, Columbia Banking System of Tacoma bought West Coast.

Bank regulation in the United States is highly fragmented compared with other G10 countries, where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure, it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike Japan and the United Kingdom. Bank examiners are generally employed to supervise banks and to ensure compliance with regulations.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Northeast Bank is a Maine-based full-service financial institution. Their National Lending group purchases and originates commercial loans on a nationwide basis while the Community Banking group offers personal and business banking services within Maine via nine branches. Additionally, ableBanking, a division of Northeast Bank, offers online savings products to consumers nationwide. Information regarding Northeast Bank can be found at www.northeastbank.com.

The New York State Banking Department was created by the New York Legislature on April 15, 1851, with a chief officer to be known as the Superintendent. The New York State Banking Department was the oldest bank regulatory agency in the United States.

First Security Bank is a privately held company based in Searcy, Arkansas. It currently operates 78 locations across the state of Arkansas and is a division of Arkansas’ fifth largest bank holding company, First Security Bancorp. First Security owns the recognizable First Security Center in Downtown Little Rock, located in the historic River Market District.

CBB Bank is an American bank that operates in the states of California, Texas and Hawaii providing commercial and personal banking services to the Korean-American community. It owned by the holding company CBB Bancorp, Inc.

The Savings Bank is a state-chartered mutual bank, headquartered in Wakefield, Massachusetts and founded in 1869. It is one of the oldest banks in the United States. The Savings Bank has over $780 million in assets, and 9 branches, serving residents of Wakefield, Lynnfield, Andover, Methuen, North Reading, and surrounding cities and towns. It is a wholly owned subsidiary of Wakefield Bancorp, MHC,