Bank One Corporation was an American bank founded in 1968 and at its peak the sixth-largest bank in the United States. It traded on the New York Stock Exchange under the stock symbol ONE. The company merged with JPMorgan Chase & Co. on July 1, 2004, with its CEO Jamie Dimon taking the lead at the combined company. The company had its headquarters in the Bank One Plaza in the Chicago Loop in Chicago, Illinois, now the headquarters of Chase's retail banking division.

Citizens Financial Group, Inc. is an American bank holding company, headquartered in Providence, Rhode Island. The company owns the bank Citizens Bank, N.A., which operates in the U.S. states of Connecticut, Delaware, Florida, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, and Virginia, as well as Washington, DC.

ICICI Bank Limited is an Indian multinational bank and financial services company headquartered in Mumbai with a registered office in Vadodara. It offers a wide range of banking and financial services for corporate and retail customers through various delivery channels and specialized subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management.

Capital One Financial Corporation is an American bank holding company founded on July 21, 1994 and specializing in credit cards, auto loans, banking, and savings accounts, headquartered in Tysons, Virginia with operations primarily in the United States. It is the 12th largest bank in the United States by total assets as of December 31, 2022, the third largest issuer of Visa and Mastercard credit cards, and one of the largest car finance companies in the United States.

Oversea-Chinese Banking Corporation Limited, abbreviated as OCBC, is a Singaporean multinational banking and financial services corporation headquartered at the OCBC Centre.

Fiserv, Inc. is an American multinational company headquartered in Milwaukee, Wisconsin. Fiserv provides financial technology and services to clients across the financial services sector, including banks, thrifts, credit unions, securities broker dealers, mortgage, insurance, leasing and finance companies, and retailers.

A custodian bank, or simply custodian, is a specialized financial institution responsible for providing securities services. It provides post-trade services and solutions for asset owners, asset managers, banks and broker-dealers. It is not engaged in "traditional" commercial or consumer/retail banking like lending.

Old National Bank is an American regional bank with nearly 200 retail branches operated by Old National Bancorp and based in Chicago and Evansville, Indiana. With assets at $48.5 billion and 250 banking centers, Old National Bancorp is the largest financial services bank holding company headquartered in Indiana and one of the top 30 banking companies in the U.S. Its primary banking footprint is in Illinois, Indiana, Kentucky, Michigan, Minnesota, and Wisconsin.

Kotak Mahindra Bank Limited is an Indian banking and financial services company headquartered in Mumbai. It offers banking products and financial services for corporate and retail customers in the areas of personal finance, investment banking, life insurance, and wealth management. As of December 2023, the bank has 1,869 branches and 3,239 ATMs, including branches in GIFT City and DIFC (Dubai).

MainSource Bank was a community bank located in Greensburg, Indiana. The company was the operating subsidiary of the MainSource Financial Group. It operated banks in Indiana, Illinois, Kentucky, and Ohio. On May 25, 2018, all MainSource locations closed as part of the acquisition by First Financial Bancorp. Most locations reopened May 29, 2018 as First Financial Bank locations, but some locations remained closed if there was a redundant location nearby.

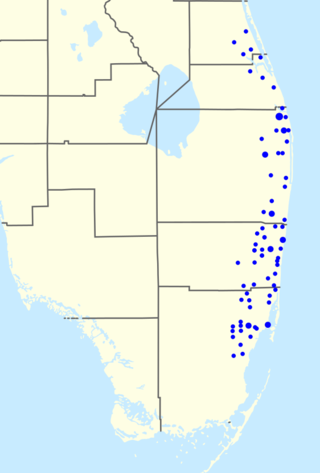

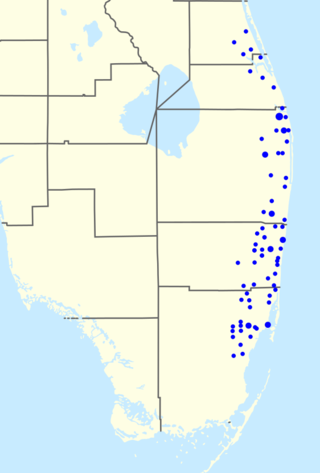

BankAtlantic was a US bank that operated in the state of Florida until it was acquired in 2012 by BB&T Corporation. It provided consumer and business banking services to communities throughout Florida.

AmBank Group comprises AMMB Holdings Berhad is one of the largest banking groups in Malaysia whose core businesses are retail banking, wholesale banking, Islamic banking, and life and general insurance.

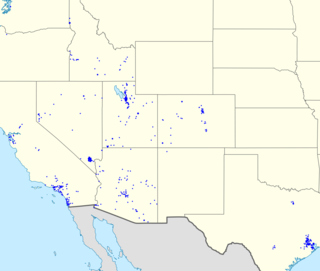

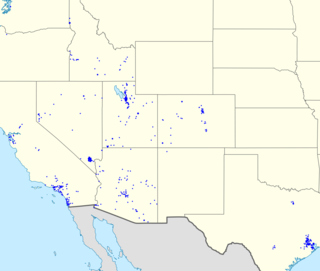

Zions Bancorporation is a national bank headquartered in Salt Lake City, Utah. It operates as a national bank rather than as a bank holding company and does business under the following seven brands: Zions Bank, Amegy Bank of Texas, California Bank and Trust, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and the Commerce Bank of Washington. It has 416 branches and over 1 million customers. It was founded by the Church of Jesus Christ of Latter-day Saints in 1873, although the church divested its interest in the bank in 1960.

People's United Financial, Inc., was an American bank holding company that owned People's United Bank. The bank operated 403 branches in Connecticut, southeastern New York State, Massachusetts, Vermont, Maine, and New Hampshire. It was the second-largest full-service bank in New England, one of the largest in the northeast, and the 46th-largest in the United States.

İşbank, officially Türkiye İş Bankası, is a commercial bank in Turkey. Global Turkish bank and the largest Turkish bank It has more than 110 subsidiaries It was the largest private bank in the country by the size of total assets, total loans, total deposits and equity, as well as by the number of branches and employees as of 31 December 2021. It was the first bank founded by the Turkish Republic. İşbank is a bank that provides consumer loans, vehicle loans, housing loans and commercial loans. “İşbank has the 181st place in The Banker Top 1000 World Banks Ranking 2021”. It was ranked and 673 on the Forbes Global 2000 list for 2021. It had a net profit for 2021 of TRY 13.5 billion, and TRY 90.2 billion in Tier I Capital, as defined by Basel's Bank for International Settlements.

Axis Bank Limited, formerly known as UTI Bank (1993–2007), is an Indian multinational banking and financial services company headquartered in Mumbai, Maharashtra. It is India's third largest private sector bank by assets and fourth largest by market capitalisation. It sells financial services to large and mid-size companies, SMEs and retail businesses.

First Financial Bancorp is a regional bank headquartered in Cincinnati, Ohio, with its operations centers in the northern Cincinnati suburb of Springdale, and Greensburg, Indiana. Founded in 1863, First Financial has the sixth oldest national bank charter and has 110 locations in Ohio, Kentucky, and throughout Indiana. First Financial acquired Irwin Financial Corp and its subsidiaries through a government assisted transaction on September 18, 2009.

PacWest Bancorp is an American bank holding company based in Beverly Hills, California, with one wholly owned banking subsidiary, Pacific Western Bank. It is a subsidiary of Banc of California.

Fintech, a portmanteau of "financial technology", refers to the application of innovative technologies to products and services in the financial industry. This broad term encompasses a wide array of technological advancements in financial services, including mobile banking, online lending platforms, digital payment systems, robo-advisors, and blockchain-based applications such as cryptocurrencies. Fintech companies include both startups and established technology and financial firms that aim to improve, complement, or replace traditional financial services.

The Savings Bank is a state-chartered mutual bank, headquartered in Wakefield, Massachusetts and founded in 1869. It is one of the oldest banks in the United States. The Savings Bank has over $780 million in assets, and 9 branches, serving residents of Wakefield, Lynnfield, Andover, Methuen, North Reading, and surrounding cities and towns. It is a wholly owned subsidiary of Wakefield Bancorp, MHC,