First Pennsylvania Bank was a bank based in Philadelphia, Pennsylvania. Founded in 1782, it was for centuries the oldest bank in the United States until it was acquired by CoreStates Financial Corporation in 1989. [1]

In the 1970s, First Pennsylvania officials attempted to turn their firm, then a "sedate regional bank", into a major national concern. [2] Aggressive and risky lending and investments turned the bank into Philadelphia's largest, but in 1980, led to huge losses and panicked depositors. The federal government gave the bank a $500 million bailout, [1] the first major federal bailout of a national bank. [2]

Robert Morris Jr. was an English-born American merchant, investor and politician who was one of the Founding Fathers of the United States. He served as a member of the Pennsylvania legislature, the Second Continental Congress, and the United States Senate, and was one of only two people who signed the Declaration of Independence, the Articles of Confederation, and the United States Constitution. From 1781 to 1784, he served as the Superintendent of Finance of the United States, becoming known as the "Financier of the Revolution." Along with Alexander Hamilton and Albert Gallatin, he is widely regarded as one of the founders of the financial system of the United States.

Nicholas Biddle was an American financier who served as the third and last president of the Second Bank of the United States. Throughout his life Biddle worked as an editor, diplomat, author, and politician who served in both houses of the Pennsylvania state legislature. He is best known as the chief opponent of Andrew Jackson in the Bank War.

The PNC Financial Services Group, Inc. is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 states and the District of Columbia, with 2,629 branches and 9,523 ATMs. PNC Bank is on the list of largest banks in the United States by assets and is one of the largest banks by number of branches, deposits, and number of ATMs.

CoreStates Financial Corporation, previously known as Philadelphia National Bank (PNB), was an American bank holding company in the Philadelphia, Pennsylvania, metropolitan area.

Marine Midland Bank was an American bank formerly headquartered in Buffalo, New York, with several hundred branches throughout the state of New York. In 1998, branches extended to Pennsylvania. It was acquired by HSBC in 1980 and changed its name to HSBC Bank USA in 1999. As a result of several transactions since the turn of the millennium, much of what was once Marine Midland is now part of KeyBank with the exception of Downstate New York and Pennsylvania, that is now part of Citizens Bank. Branches in Seattle are part of Cathay Bank.

Congress Hall, located in Philadelphia at the intersection of Chestnut and 6th Streets, served as the seat of the United States Congress from December 6, 1790, to May 14, 1800. During Congress Hall's duration as the capitol of the United States, the country admitted three new states, Vermont, Kentucky, and Tennessee; ratified the Bill of Rights of the United States Constitution; and oversaw the presidential inaugurations of both George Washington and John Adams.

Independence National Historical Park is a federally protected historic district in Philadelphia, Pennsylvania that preserves several sites associated with the American Revolution and the nation's founding history. Administered by the National Park Service, the 55-acre (22 ha) park comprises many of Philadelphia's most-visited historic sites within the Old City and Society Hill neighborhoods. The park has been nicknamed "America's most historic square mile" because of its abundance of historic landmarks.

KeyBank is an American regional bank headquartered in Cleveland, Ohio, and the 25th largest bank in the United States. Organized under the publicly traded KeyCorp, KeyBank was formed from the 1994 merger of the Cleveland-based Society Corporation, which operated Society National Bank, and the Albany-headquartered KeyCorp. The company today operates over 1,000 branches and 40,000 ATMs, mostly concentrated in the Midwest and Northeast United States, though also operates in the Pacific Northwest as well as in Alaska, Colorado, Texas and Utah.

Clearfield Trust Co. v. United States, 318 U.S. 363 (1943), was a case in which the Supreme Court of the United States held that federal negotiable instruments were governed by federal law, and thus the federal court had the authority to fashion a common law rule.

First Bank is the name used by various financial institutions worldwide. The term, either as whole or as part of a combination of names, may refer to:

First Niagara Bank was a Federal Deposit Insurance Corporation-insured regional banking corporation headquartered in Buffalo, New York. Its parent company, First Niagara Financial Group, Inc. was the 44th-largest bank in the United States with assets of over $37.1 billion as of June 30, 2013.

The Centennial National Bank is a historic building in Philadelphia, Pennsylvania. Designed by noted Philadelphia architect Frank Furness and significant in his artistic development, it was built in 1876 as the headquarters of the eponymous bank that would be the fiscal agent of the Centennial Exposition. The building housed a branch of the First Pennsylvania Bank from 1956 until Drexel University purchased it c. 1976. Drexel renovated it between 2000-2002 and now uses it as an alumni center. The Centennial National Bank, described as "one of the best pieces of architecture in West Philadelphia," was placed on the National Register of Historic Places in 1971.

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing financial institutions and banks. The bill was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and was signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008. It created the $700 billion Troubled Asset Relief Program (TARP), which utilized congressionally appropriated taxpayer funds to purchase toxic assets from failing banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

The subprime mortgage crisis reached a critical stage during the first week of September 2008, characterized by severely contracted liquidity in the global credit markets and insolvency threats to investment banks and other institutions.

The National City acquisition by PNC was the deal by PNC Financial Services to acquire National City Corp. on October 24, 2008 following National City's untenable loan losses during the subprime mortgage crisis. The deal received much controversy due to PNC using TARP funds to buy National City only hours after accepting the funds while National City itself was denied funds, as well as civic pride for the city of Cleveland, Ohio, where National City was based.

This article details the history of banking in the United States. Banking in the United States is regulated by both the federal and state governments.

Philadelphia is the center of economic activity in both Pennsylvania and the four-state Delaware Valley metropolitan region of the United States. Philadelphia's close geographical and transportation connections to other large metropolitan economies along the Eastern Seaboard of the United States have been cited as offering a significant competitive advantage for business creation and entrepreneurship. Five Fortune 500 companies are headquartered in the city. As of 2021, the Philadelphia metropolitan area was estimated to produce a gross metropolitan product (GMP) of US$479 billion, an increase from the $445 billion calculated by the Bureau of Economic Analysis for 2017, representing the ninth largest U.S. metropolitan economy. Philadelphia was rated by the GaWC as a 'Beta' city in its 2016 ranking of world cities.

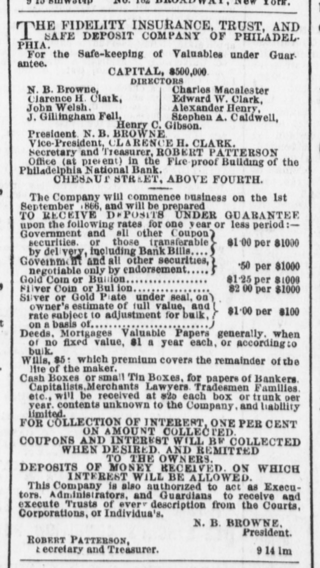

Fidelity Trust Company was a bank in Philadelphia, Pennsylvania. Founded in 1866 as Fidelity Insurance, Trust, & Safe Deposit Company, the bank was later renamed Fidelity Trust Company, Fidelity-Philadelphia Trust Company, The Fidelity Bank, and Fidelity Bank, National Association. It was absorbed in 1988 in the biggest U.S. bank merger up to that point, and is today part of Wells Fargo.

Somerset Trust Holding Company, doing business as Somerset Trust Company, is an American bank and financial services company headquartered in Somerset, Pennsylvania. As of December 31, 2016, the bank's assets are totaled at $1.1 billion. Somerset Trust Company's branch network serves the Pennsylvania counties of Somerset, Westmoreland, Cambria, Bedford, and Fayette County, with a branch in Garrett County, Maryland. Somerset Trust Company elected to deny the government TARP money in 2008.

Gibraltar Savings Association was a Houston, Texas based savings and loan. Its failure in 1988 and resolution was one of the most expensive in the savings and loan crisis at an estimated cost of $2.875 billion.