Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

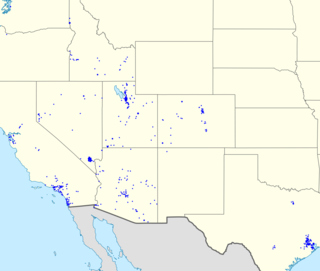

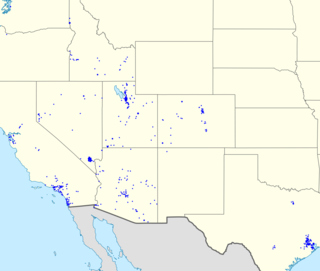

U.S. Bancorp is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. As of 2019, it had 3,106 branches and 4,842 automated teller machines, primarily in the Western and Midwestern United States. In 2023 it ranked 149th on the Fortune 500, and it is considered a systemically important bank by the Financial Stability Board. The company also owns Elavon, a processor of credit card transactions for merchants, and Elan Financial Services, a credit card issuer that issues credit card products on behalf of small credit unions and banks across the U.S.

Citizens Financial Group, Inc. is an American bank holding company, headquartered in Providence, Rhode Island. The company owns the bank Citizens Bank, N.A., which operates in the U.S. states of Connecticut, Delaware, Florida, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, and Virginia, as well as Washington, DC.

M&T Bank Corporation is an American bank holding company headquartered in Buffalo, New York. It operates 1,000+ branches in 12 states across the Eastern United States, from Maine to Northern Virginia. Until May 1998, the bank's holding company was named First Empire State Corporation.

The PNC Financial Services Group, Inc. is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 states and the District of Columbia, with 2,629 branches and 9,523 ATMs. PNC Bank is on the list of largest banks in the United States by assets and is one of the largest banks by number of branches, deposits, and number of ATMs.

National City Corporation was a regional bank holding company based in Cleveland, Ohio, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary National City Mortgage is credited for doing the first mortgage in America. The company operated through an extensive banking network primarily in Ohio, Illinois, Indiana, Kentucky, Michigan, Missouri, Pennsylvania, Florida, and Wisconsin, and also served customers in selected markets nationally. Its core businesses included commercial and retail banking, mortgage financing and servicing, consumer finance, and asset management. The bank reached out to customers primarily through mass advertising and offered comprehensive banking services online. In its last years, the company was commonly known in the media by the abbreviated NatCity, with its investment banking arm even bearing the official name NatCity Investments.

TD Banknorth, formerly Banknorth, was a wholly owned subsidiary of the Toronto-Dominion Bank which conducted banking and insurance activities, primarily serving the northeastern area of the United States, headquartered in Portland, Maine. The bank became TD Bank, N.A. on May 31, 2008.

Old National Bank is an American regional bank with nearly 200 retail branches operated by Old National Bancorp and based in Chicago and Evansville, Indiana. With assets at $23.0 billion and 162 banking centers, Old National Bancorp is the largest financial services bank holding company headquartered in Indiana and one of the top 100 banking companies in the U.S. Its primary banking footprint is in Illinois, Indiana, Kentucky, Michigan, Minnesota, and Wisconsin.

Elmer Edwin Rasmuson was an American banker, philanthropist and politician in the territory and state of Alaska. He led the family business, National Bank of Alaska, for many decades as president and later chairman. He also served as Mayor of Anchorage from 1964 to 1967 and was the Republican nominee for United States Senator from Alaska in the 1968 election, losing the general election to Mike Gravel.

This article outlines the history of Wells Fargo & Company from its merger with Norwest Corporation and beyond. The new company chose to retain the name of "Wells Fargo" and so this article is about the history after the merger.

First Interstate Bancorp was a bank holding company based in the United States that was taken over in 1996 by Wells Fargo. Headquartered in Los Angeles, it was the nation's eighth largest banking company.

First Niagara Bank was a Federal Deposit Insurance Corporation-insured regional banking corporation headquartered in Buffalo, New York. Its parent company, First Niagara Financial Group, Inc. was the 44th-largest bank in the United States with assets of over $37.1 billion as of June 30, 2013.

Firstar Corporation was a Milwaukee, Wisconsin-based regional bank holding company that existed from 1853 to 2001. In 2001, Firstar acquired U.S. Bancorp and assumed its name, moving its headquarters to Minneapolis.

Zions Bancorporation is a national bank headquartered in Salt Lake City, Utah. It operates as a national bank rather than as a bank holding company and does business under the following seven brands: Zions Bank, Amegy Bank of Texas, California Bank and Trust, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and the Commerce Bank of Washington. It has 416 branches and over 1 million customers. It was founded by the Church of Jesus Christ of Latter-day Saints in 1873, although the church divested its interest in the bank in 1960.

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important financial institution according to the Financial Stability Board, and is considered one of the "Big Four Banks" in the United States, alongside JPMorgan Chase, Bank of America, and Citigroup.

Rockland Trust is a commercial bank based in Rockland, Massachusetts that serves Southeastern Massachusetts, Coastal Massachusetts, Cape Cod, and Boston's MetroWest. Established in 1907 as Rockland Trust Company. A wholly owned subsidiary of Independent Bank Corp., by October 2016, Rockland Trust had $7.5 billion in assets and employed around 1,000 people. By April 2022, Rockland Trust had $20 billion in assets and employed around 1,100 people.

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world.

First Financial Bancorp is a regional bank headquartered in Cincinnati, Ohio, with its operations centers in the northern Cincinnati suburb of Springdale, and Greensburg, Indiana. Founded in 1863, First Financial has the sixth oldest national bank charter and has 110 locations in Ohio, Kentucky, and throughout Indiana. First Financial acquired Irwin Financial Corp and its subsidiaries through a government assisted transaction on September 18, 2009.

First Bank System was a Minneapolis, Minnesota-based regional bank holding company that operated from 1864 to 1997. What was once First Bank forms the core of today's U.S. Bancorp; First Bank merged with the old U.S. Bancorp in 1997 and took the U.S. Bancorp name.

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has operated under the Wells Fargo name.