Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

The 2003 mutual fund scandal was the result of the discovery of illegal late trading and market timing practices on the part of certain hedge fund and mutual fund companies.

Financial services are economic services tied to finance provided by financial institutions. Financial services encompass a broad range of service sector activities, especially as concerns financial management and consumer finance.

Prudential Financial, Inc. is an American Fortune Global 500 and Fortune 500 company whose subsidiaries provide insurance, retirement planning, investment management, and other products and services to both retail and institutional customers throughout the United States and in over 40 other countries. In 2019, Prudential was the largest insurance provider in the United States with $815.1 billion in total assets.

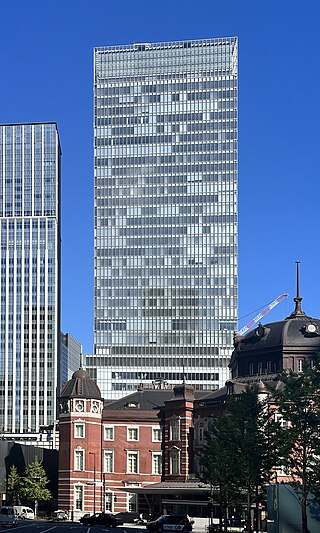

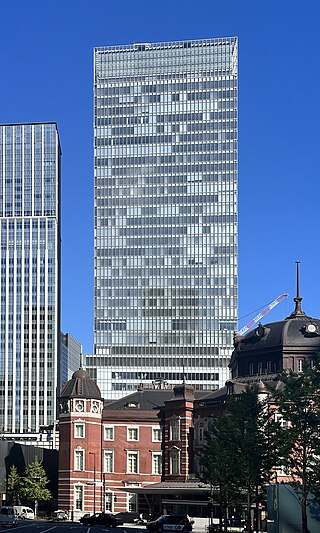

Daiwa Securities Group Inc. is a Japanese investment bank that is the second largest securities brokerage after Nomura Securities.

Dean Witter Reynolds was an American stock brokerage and securities firm catering to a variety of clients. Prior to the company's acquisition, it was among the largest firms in the securities industry with over 9,000 account executives and was among the largest members of the New York Stock Exchange. The company served over 3.2 million clients primarily in the U.S. Dean Witter provided debt and equity underwriting and brokerage as mutual funds and other saving and investment products for individual investors. The company's asset management arm, Dean Witter InterCapital, with total assets of $90.0 billion prior to the acquisition, was one of the largest asset management operations in the U.S.

The Securities Investor Protection Corporation is a federally mandated, non-profit, member-funded, United States government corporation created under the Securities Investor Protection Act (SIPA) of 1970 that mandates membership of most US-registered broker-dealers. Although created by federal legislation and overseen by the Securities and Exchange Commission, the SIPC is neither a government agency nor a regulator of broker-dealers. The purpose of the SIPC is to expedite the recovery and return of missing customer cash and assets during the liquidation of a failed investment firm.

Raymond James Financial, Inc. is an American multinational independent investment bank and financial services company providing financial services to individuals, corporations, and municipalities through its subsidiary companies that engage primarily in investment and financial planning, in addition to investment banking and asset management. Headquartered in St. Petersburg, Florida, Raymond James is one of the largest banking institutions in the United States.

Jefferies Group LLC is an American multinational independent investment bank and financial services company that is headquartered in New York City. The firm provides clients with capital markets and financial advisory services, institutional brokerage, securities research, and asset management. This includes mergers and acquisitions, restructuring, and other financial advisory services. The Capital Markets segment also includes its securities trading and investment banking activities.

Bache & Company was a securities firm that provided stock brokerage and investment banking services. The firm, which was founded in 1879, was based in New York, New York.

A.G. Edwards, Inc. was an American financial services holding company; its principal wholly owned subsidiary was A.G. Edwards & Sons, Inc., which operated as a full-service securities broker-dealer in the United States and Europe. The firm was acquired by Wachovia to be folded into Wachovia Securities; Wachovia was subsequently acquired by Wells Fargo, and the securities division was folded into Wells Fargo Advisors. The firm provided securities and commodities brokerage, investment banking, trust services, asset management, financial and retirement planning, private client services, investment management, and other related financial services to individual, governmental, and institutional clients.

Halsey, Stuart was a Chicago-based investment bank founded in 1911.

This article outlines the history of Wells Fargo & Company from its merger with Norwest Corporation and beyond. The new company chose to retain the name of "Wells Fargo" and so this article is about the history after the merger.

Paul V. Scura was the former executive vice president and head of the investment bank of Prudential Securities, a subsidiary of Prudential Financial, from 1986 to 2000. He was responsible for the firm's efforts in the areas of mergers and acquisitions, restructuring and reorganization, private finance, high-yield finance and all international and US investment banking. Scura also sat on the business review committee and was a member of the firm's operating council. He was a voting member of the investment committee of four separate private equity funds and Prudential Securities merchant banking fund, Prudential-Bache Interfunding. In February 1998, he joint ventured with the former EMI/Capitol Music chairman Charles Koppelman for musicians to cash in on music royalties.

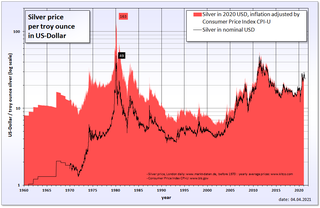

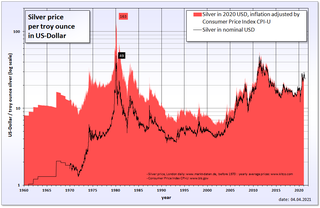

Silver Thursday was an event that occurred in the United States silver commodity markets on Thursday, March 27, 1980, following the attempt by brothers Nelson Bunker Hunt, William Herbert Hunt and Lamar Hunt to corner the silver market. A subsequent steep fall in silver prices led to panic on commodity and futures exchanges.

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world.

Wachovia Securities was the trade name of Wachovia's retail brokerage and institutional capital markets and investment banking subsidiaries. Following Wachovia's merger with Wells Fargo and Company on December 31, 2008, the retail brokerage became Wells Fargo Advisors on May 1, 2009 and the institutional capital markets and investment banking group became Wells Fargo Securities on July 6, 2009.

Merrill, previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment banking arm, both firms engage in prime brokerage and broker-dealer activities. The firm is headquartered in New York City, and once occupied the entire 34 stories of 250 Vesey Street, part of the Brookfield Place complex in Manhattan. Merrill employs over 14,000 financial advisors and manages $2.8 trillion in client assets. The company also operates Merrill Edge, a division for investment and related services, including call center counsultancy.

JM Financial (JMFL) is an Indian financial services group headquartered in Mumbai and has branches across India. It also has overseas branches in Ebene, Singapore, New Jersey and Dubai although almost all the group's business are domestic operations in India.