Related Research Articles

In economics and finance, arbitrage is the practice of taking advantage of a difference in prices in two or more markets – striking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which the unit is traded. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price.

A capital market is a financial market in which long-term debt or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties.

In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor. The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure.

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

The bond market is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA).

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

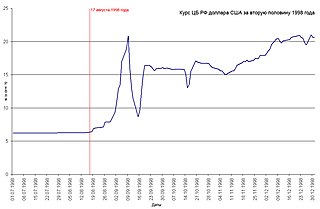

The Russian financial crisis began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the ruble and defaulting on its debt. The crisis had severe impacts on the economies of many neighboring countries.

The Moscow Interbank Currency Exchange or MICEX was a stock exchange that operated in Russia from 1992 to 2011. MICEX was the leading Russian stock exchange and one of the largest universal stock exchanges in Eastern Europe. It merged with the Russian Trading System in 2011, creating Moscow Exchange.

The Russian Trading System was a stock market that operated in Moscow from 1995 to 2011. It was established in September 1995 to consolidate various regional trading floors into one exchange. In December 2011 it merged with Moscow Interbank Currency Exchange (MICEX), creating Moscow Exchange. Originally RTS was modeled on NASDAQ's trading and settlement software; in 1998 the exchange went on line with its own in-house system. Initially created as a non-profit organisation, it was transformed into a joint-stock company.

A sovereign default is the failure or refusal of the government of a sovereign state to pay back its debt in full when due. Cessation of due payments may either be accompanied by that government's formal declaration that it will not pay its debts (repudiation), or it may be unannounced. A credit rating agency will take into account in its gradings capital, interest, extraneous and procedural defaults, and failures to abide by the terms of bonds or other debt instruments.

The Great Recession in Russia was a crisis during 2008–2009 in the Russian financial markets as well as an economic recession that was compounded by political fears after the war with Georgia and by the plummeting price of Urals heavy crude oil, which lost more than 70% of its value since its record peak of US$147 on 4 July 2008 before rebounding moderately in 2009. According to the World Bank, Russia's strong short-term macroeconomic fundamentals made it better prepared than many emerging economies to deal with the crisis, but Russia's underlying structural weaknesses and high dependence on the price of a single commodity made the crisis' impact more pronounced than would otherwise be the case.

Fixed-Income Relative-Value Investing (FI-RV) is a hedge fund investment strategy made popular by the failed hedge fund Long-Term Capital Management. FI-RV Investors most commonly exploit interest-rate anomalies in the large, liquid markets of North America, Europe and the Pacific Rim. The financial instruments traded include government bonds, interest rate swaps and futures contracts.

After the dissolution of the Soviet Union in 1991 and the end of its centrally-planned economy, the Russian Federation succeeded it under president Boris Yeltsin. The Russian government used policies of shock therapy to liberalize the economy as part of the transition to a market economy, causing a sustained economic recession. GDP per capita levels returned to their 1991 levels by the mid-2000s. The economy of Russia is much more stable today than in the early 1990s, but inflation still remains an issue. Historically and currently, the Russian economy has differed sharply from major developed economies because of its weak legal system, underdevelopment of modern economic activities, technological backwardness, and lower living standards.

The Moscow Exchange is the largest exchange in Russia, operating trading markets in equities, bonds, derivatives, the foreign exchange market, money markets, and precious metals. The Moscow Exchange also operates Russia's central securities depository, the National Settlement Depository (NSD), and the country's largest clearing service provider, the National Clearing Centre. The exchange was formed in 2011 in a merger of the Moscow Interbank Currency Exchange and the Russian Trading System.

Hyperinflation in early Soviet Russia connotes a seven-year period of uncontrollable spiraling inflation in the early Soviet Union, running from the earliest days of the Bolshevik Revolution in November 1917 to the reestablishment of the gold standard with the introduction of the chervonets as part of the New Economic Policy. The inflationary crisis effectively ended in March 1924 with the introduction of the so-called "gold ruble" as the country's standard currency.

Self-fulfilling crisis refers to a situation that a financial crisis is not directly caused by the unhealthy economic fundamental conditions or improper government policies, but a consequence of pessimistic expectations of investors. In other words, investors' fear of the crisis makes the crisis inevitable, which justified their initial expectations.

The financial crisis in Russia in 2017 was the result of the sharp devaluation of the Russian rouble beginning in the second half of 2014. A decline in confidence in the Russian economy caused investors to sell off their Russian assets, which led to a decline in the value of the Russian rouble and sparked fears of a financial crisis. The lack of confidence in the Russian economy stemmed from at least two major sources. The first is the fall in the price of oil in 2014. Crude oil, a major export of Russia, declined in price by nearly 50% between its yearly high in June 2014 and 16 December 2014. The second is the result of international economic sanctions imposed on Russia following Russia's annexation of Crimea, the war in Donbas and the broader Russo-Ukrainian War.

The National Settlement Depository (NSD), headquartered in Moscow, is a Russian non-bank financial institution and central securities depository (CSD). It provides depository, settlement, and related services to financial market entities. Its services cover both securities listed in Russia's 2011 Federal Law "On the Central Securities Depository", and other Russian and foreign equity and debt securities. NSD is the CSD of the Russian Federation, and was assigned CSD status by the Russian Federal Financial Markets Service in 2012. It is the largest securities depository in Russia by market value of equity and debt securities held in custody, which in June 2022 were 70 trillion roubles. It is a member of the Moscow Exchange Group. In March 2022, in the wake of the 2022 Russian invasion of Ukraine, NSD's accounts were blocked and frozen at international CSDs Euroclear and Clearstream. In addition, the European Union added NSD to its sanctions list, blocking NSD's accounts in euros, and in Euroclear and Clearstream; as a result, NSD could not service forex-denominated bonds issued by Russia and Russian companies. NSD suspended transactions in euros.

OFZ are coupon-bearing federal loan bonds issued by the Russian government. The Ministry of Finance auctions off OFZs to finance the federal budget, or less commonly, to bail out troubled banks. Given their role, they form an essential part of the Russian financial system.

Russia defaulted on part of its foreign currency denominated debt on 27 June 2022, because of funds being stuck in Euroclear. This was its first such default since 1918, back then it was just ruble-denominated bonds, not foreign currency debt. Before that, on 2 June, Russia defaulted on the 30-day interest, incorrectly not counting interest for the grace period, but a failure to pay $1.9 million was not sufficient to trigger a cross-default across other instruments, because the minimum threshold is an amount of at least $75 million, according to documents for other Russian eurobonds. The default occurred due to technicalities as the payment in dollars was impossible due to the sanctions by US and EU authorities, but did not mark an actual lack of capability to pay its debts.

References

- 1 2 3 "Россия избавилась от комплекса ГКО". Коммерсантъ. 25 November 2014. p. 1. Retrieved 29 September 2018.

- ↑ Lossan, Alexei (2 December 2014). "Russia to issue short-term state bonds, despite memories of 1998 crisis". RBTH. Retrieved 21 December 2017.

in 1998, when the country suffered the most severe financial crisis in its modern history