Proof of work (PoW) is a form of cryptographic zero-knowledge proof in which one party proves to others that a certain amount of computational effort has been expended for some purpose. Verifiers can subsequently confirm this expenditure with minimal effort on their part. The concept was invented by Cynthia Dwork and Moni Naor in 1993 as a way to deter denial-of-service attacks and other service abuses such as spam on a network by requiring some work from a service requester, usually meaning processing time by a computer. The term "proof of work" was first coined and formalized in a 1999 paper by Markus Jakobsson and Ari Juels. Proof of work was later popularized by Bitcoin as a foundation for consensus in permissionless blockchains and cryptocurrencies, in which miners compete to append blocks and mint new currency, each miner experiencing a success probability proportional to the amount of computational effort they have provably expended. PoW and PoS are the two best known consensus mechanisms and in the context of cryptocurrencies also most commonly used.

A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. Exchanges may accept credit card payments, wire transfers or other forms of payment in exchange for digital currencies or cryptocurrencies. A cryptocurrency exchange can be a market maker that typically takes the bid–ask spreads as a transaction commission for is service or, as a matching platform, simply charges fees.

Double-spending is a potential flaw in a digital cash scheme in which the same single digital token can be spent more than once. Unlike physical cash, a digital token consists of a digital file that can be duplicated or falsified. As with counterfeit money, such double-spending leads to inflation by creating a new amount of copied currency that did not previously exist. This devalues the currency relative to other monetary units or goods and diminishes user trust as well as the circulation and retention of the currency. Fundamental cryptographic techniques to prevent double-spending, while preserving anonymity in a transaction, are blind signatures and, particularly in offline systems, secret splitting.

Bitcoin (₿) is a cryptocurrency invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto and started in 2009 when its implementation was released as open-source software.

A cryptocurrency is a digital asset designed to work as a medium of exchange wherein individual coin ownership records are stored in a ledger existing in a form of computerized database using strong cryptography to secure transaction records, to control the creation of additional coins, and to verify the transfer of coin ownership. It typically does not exist in physical form and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to centralized digital currency and central banking systems. When a cryptocurrency is minted or created prior to issuance or issued by a single issuer, it is generally considered centralized. When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.

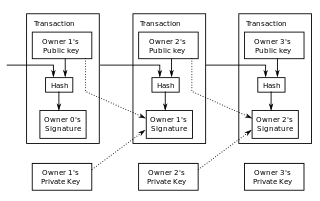

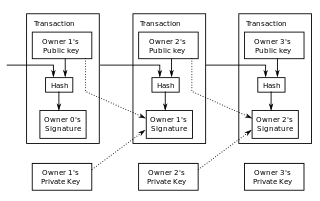

The bitcoin network is a peer-to-peer payment network that operates on a cryptographic protocol. Users send and receive bitcoins, the units of currency, by broadcasting digitally signed messages to the network using bitcoin cryptocurrency wallet software. Transactions are recorded into a distributed, replicated public database known as the blockchain, with consensus achieved by a proof-of-work system called mining. Satoshi Nakamoto, the designer of bitcoin, claimed that design and coding of bitcoin began in 2007. The project was released in 2009 as open source software.

Zerocoin is a privacy protocol proposed in 2013 by Johns Hopkins University professor Matthew D. Green and his graduate students, Ian Miers and Christina Garman. It was designed as an extension to the Bitcoin protocol that would improve Bitcoin transactions' anonymity by having coin-mixing capabilities natively built into the protocol. Zerocoin is not currently compatible with Bitcoin.

Bitcoin is a cryptocurrency, a digital asset designed to work as a medium of exchange that uses cryptography to control its creation and management, rather than relying on central authorities. It was invented and implemented by the presumed pseudonymous Satoshi Nakamoto, who integrated many existing ideas from the cypherpunk community. Over the course of bitcoin's history, it has undergone rapid growth to become a significant currency both on- and offline. From the mid 2010s, some businesses began accepting bitcoin in addition to traditional currencies.

Dogecoin is a cryptocurrency featuring a likeness of the Shiba Inu dog from the "Doge" Internet meme as its logo. Introduced as a "joke currency" on 6 December 2013, Dogecoin quickly developed its own online community and reached a capitalization of US$60 million in January 2014.

In the context of cryptocurrency mining, a mining pool is the pooling of resources by miners, who share their processing power over a network, to split the reward equally, according to the amount of work they contributed to the probability of finding a block. A "share" is awarded to members of the mining pool who present a valid partial proof-of-work. Mining in pools began when the difficulty for mining increased to the point where it could take centuries for slower miners to generate a block. The solution to this problem was for miners to pool their resources so they could generate blocks more quickly and therefore receive a portion of the block reward on a consistent basis, rather than randomly once every few years.

Monero is an open-source cryptocurrency created in April 2014 that focuses on fungibility, privacy and decentralization. Monero uses an obfuscated public ledger, meaning anybody can broadcast or send transactions, but no outside observer can tell the source, amount or destination. Monero uses a Proof of Work mechanism to issue new coins and incentivize miners to secure the network and validate transactions.

Kraken is a US-based cryptocurrency exchange, founded in 2011. The exchange provides cryptocurrency to fiat trading, and provides price information to Bloomberg Terminal. As of 2020, Kraken is available to residents of 48 U.S. states and 176 countries, and lists 40 cryptocurrencies available for trade. Kraken played a role in attempting to recover funds lost by investors during the 2014-15 Mt. Gox implosion. According to CoinMarketCap, Kraken is the 4th largest cryptocurrency exchange in the world.

Bitfinex is a cryptocurrency exchange owned and operated by iFinex Inc., which is headquartered in Hong Kong and registered in the British Virgin Islands. Their customers' money has been stolen or lost in several incidents, and they have been unable to secure normal banking relationships.

Ethereum Classic is an open source, blockchain-based distributed computing platform featuring smart contract (scripting) functionality. It supports a modified version of Nakamoto consensus via transaction-based state transitions executed on a public Ethereum Virtual Machine (EVM).

Zcoin is a cryptocurrency aimed at using cryptography to provide better privacy for its users compared to other cryptocurrencies such as Bitcoin.

The bitcoin scalability problem is the limited rate at which the bitcoin network can process transactions. It is related to the fact that records in the bitcoin blockchain are limited in size and frequency.

Bitcoin Cash is a cryptocurrency that is a fork of Bitcoin. Bitcoin Cash is a spin-off or altcoin that was created in 2017.

Bitmain Technologies Ltd., or Bitmain, is a privately owned company headquartered in Beijing, China that designs application-specific integrated circuit (ASIC) chips for bitcoin mining.

Predictions of a collapse of a speculative bubble in cryptocurrencies have been made by numerous experts in economics and financial markets.

Cryptocurrency and security describes attempts to obtain digital currencies by illegal means, for instance through phishing, scamming, a supply chain attack or hacking, or the measures to prevent unauthorized cryptocurrency transactions, and storage technologies. In extreme cases even a computer which is not connected to any network can be hacked.