HM Customs and Excise was a department of the British Government formed in 1909 by the merger of HM Customs and HM Excise; its primary responsibility was the collection of customs duties, excise duties, and other indirect taxes.

The Inland Revenue was, until April 2005, a department of the British Government responsible for the collection of direct taxation, including income tax, national insurance contributions, capital gains tax, inheritance tax, corporation tax, petroleum revenue tax and stamp duty. More recently, the Inland Revenue also administered the Tax Credits schemes, whereby monies, such as Working Tax Credit (WTC) and Child Tax Credit (CTC), are paid by the Government into a recipient's bank account or as part of their wages. The Inland Revenue was also responsible for the payment of child benefit.

His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the Tudor Crown enclosed within a circle.

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

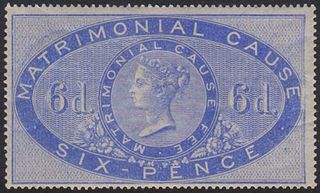

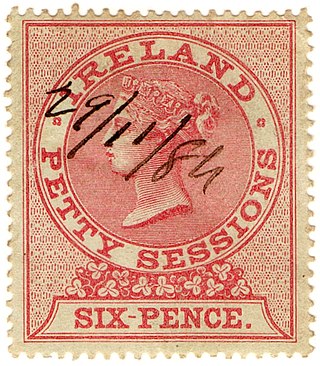

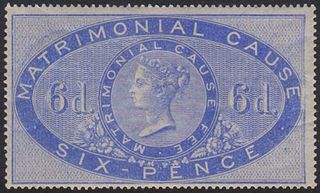

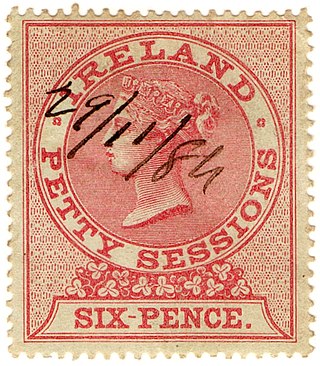

A stamp act is any legislation that requires a tax to be paid on the transfer of certain documents. Those who pay the tax receive an official stamp on their documents, making them legal documents. A variety of products have been covered by stamp acts including playing cards, dice, patent medicines, cheques, mortgages, contracts, marriage licenses and newspapers. The items may have to be physically stamped at approved government offices following payment of the duty, although methods involving annual payment of a fixed sum or purchase of adhesive stamps are more practical and common.

Customs and Excise refers to customs duty and excise duty.

A revenue stamp, tax stamp, duty stamp or fiscal stamp is a (usually) adhesive label used to designate collected taxes or fees on documents, tobacco, alcoholic drinks, drugs and medicines, playing cards, hunting licenses, firearm registration, and many other things. Typically, businesses purchase the stamps from the government, and attach them to taxed items as part of putting the items on sale, or in the case of documents, as part of filling out the form.

Stamp duty in the United Kingdom is a form of tax charged on legal instruments, and historically required a physical stamp to be attached to or impressed upon the document in question. The more modern versions of the tax no longer require a physical stamp.

The Waterguard was a division of HM Customs and Excise (HMCE) responsible for the control of vessels, aircraft, vehicles and persons arriving into and departing from the United Kingdom. This included crew members and passengers, as well as persons travelling on foot. Waterguard officers were responsible for applying the allowances provided for in law and for collection of customs and excise revenue on the excess. The officers were also responsible for the enforcement of the prohibitions and restrictions, including controlled drugs and plant and animal health. With the reorganization of HM Customs and Excise in 1972 the Waterguard was renamed the 'Preventive Service' and the functions of the Waterguard continued to be carried out as part of the HMCE until the establishment of the UK Border Agency in 2008.

HM Customs was the national Customs service of England until a merger with the Department of Excise in 1909. The phrase 'HM Customs', in use since the Middle Ages, referred both to the customs dues themselves and to the office of state established for their collection, assessment and administration.

His or Her Majesty's Excise refers to 'inland' duties levied on articles at the time of their manufacture. Excise duty was first raised in England in 1643. Like HM Customs, the Excise was administered by a Board of Commissioners who were accountable to the Lords Commissioners of the Treasury. While 'HM Revenue of Excise' was a phrase used in early legislation to refer to this form of duty, the body tasked with its collection and general administration was usually known as the Excise Office.

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. It is therefore a fee that must be paid in order to consume certain products. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the border, while excise is levied on goods that came into existence inland.

The biofuel sector in the United Kingdom, under the auspices of the government's Renewable Transport Fuel Obligation (RTFO), has been progressing towards enhanced sustainable energy solutions. Marking a significant stride in this direction was the government's endorsement and introduction of E10 biofuel in late 2021. This fuel blend, consisting of 90% regular unleaded gasoline and 10% ethanol, was introduced as part of an initiative to reduce greenhouse gas emissions (GHG) from transport fuels. The introduction of E10 led to a shift in the renewable fuel landscape in the UK, particularly influencing an increase in the utilization of non-waste feedstocks. In the year 2022, the biofuel sector, as per government reports, achieved a reduction in GHG emissions by 82% in comparison to traditional fossil fuels.

An excise stamp is a type of revenue stamp affixed to some exciseable goods to indicate that the required excise tax has been paid by the manufacturer. They are securities printed by the finance ministry of the relevant country.

The Board of Inland Revenue Stamping Department Archive in the British Library contains artefacts from 1710 onwards, and has come into existence through amendments in United Kingdom legislation.

The H.M. Stationery Office Collection is a collection of British excise revenue material including National Savings and National Insurance stamps that forms part of the British Library Philatelic Collections. It was received from H.M.S.O. between 1982 and 1992.

The Treasury Excise Correspondence Collection is a collection of correspondence between the United Kingdom Treasury and Excise, dated between 1826 and the 1840s, that forms part of the British Library Philatelic Collections. The collection shows a wide variety of postal marks and rates and was transferred from Her Majesty's Customs & Excise in 1992.

Revenue stamps of the United Kingdom refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which were issued by and used in the Kingdom of England, the Kingdom of Great Britain, the United Kingdom of Great Britain and Ireland and the United Kingdom of Great Britain and Northern Ireland, from the late 17th century to the present day.

Revenue stamps of Ireland refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which have been used on the island of Ireland since 1774. These include issues by the Kingdom of Ireland, issues by the United Kingdom specifically for use in Ireland or briefly Southern Ireland, and issues of an independent southern Ireland since 1922. Revenue stamps of Northern Ireland were also issued from 1921 to the 1980s, but they are not covered in this article.

Tobacco Duty or Tobacco Products Duty, is a tax levied on tobacco products manufactured in or imported into the United Kingdom.