Related Research Articles

The Isle of Man or Mann, is a self-governing British Crown Dependency in the Irish Sea, between Great Britain and Ireland. It is recognised as one of the Celtic nations and is the homeland of the Manx people, a Celtic ethnic group. As head of state, Charles III holds the title Lord of Mann and is represented by a Lieutenant Governor. The government of the United Kingdom is responsible for the isle's military defence and represents it abroad.

The Isle of Man had become physically separated from Great Britain and Ireland by 6500 BC. It appears that colonisation took place by sea sometime during the Mesolithic era. The island has been visited by various raiders and trading peoples over the years. After being settled by people from Ireland in the first millennium AD, the Isle of Man was converted to Christianity and then suffered raids by Vikings from Norway. After becoming subject to Norwegian suzerainty as part of the Kingdom of Mann and the Isles, the Isle of Man later became a possession of the Scottish and then the English crowns.

The economy of the Isle of Man is a low-tax economy with insurance, online gambling operators and developers, information and communications technology (ICT), and offshore banking forming key sectors of the island's economy.

The Bank of Scotland plc is a commercial and clearing bank based in Edinburgh, Scotland, and is part of the Lloyds Banking Group. The bank was established by the Parliament of Scotland in 1695 to develop Scotland's trade with other countries, and aimed to create a stable banking system in the Kingdom of Scotland. The bank is the ninth oldest bank in continuous operation.

Banking in Australia is dominated by four major banks: Commonwealth Bank, Westpac, Australia & New Zealand Banking Group and National Australia Bank. There are several smaller banks with a presence throughout the country which includes Bendigo and Adelaide Bank, Suncorp Bank, and a large number of other financial institutions, such as credit unions, building societies and mutual banks, which provide limited banking-type services and are described as authorised deposit-taking institutions (ADIs). Many large foreign banks have a presence, but few have a retail banking presence. The central bank is the Reserve Bank of Australia (RBA). The Australian government’s Financial Claims Scheme guarantees deposits up to $250,000 per account-holder per ADI in the event of the ADI failing.

Thomas Tooke was an English economist known for writing on money and economic statistics. After Tooke's death the Statistical Society endowed the Tooke Chair of economics at King's College London, and a Tooke Prize.

The pound is the currency of the Isle of Man, at parity with sterling. The Manx pound is divided into 100 pence. Notes and coins, denominated in pounds and pence, are issued by the Isle of Man Government.

National Provincial Bank was a retail bank which operated in England and Wales. It was created in 1833 as National Provincial Bank of England, and expanded largely by taking over a number of other banks. Following the transformative acquisition of Union Bank of London in 1918, it changed its name to National Provincial and Union Bank of England, then in 1924 shortened its name again to National Provincial Bank. It further acquired Coutts Bank in 1920, Grindlays Bank in 1924, Isle of Man Bank in 1961, District Bank in 1962, thus becoming one of the "Big Five" that dominated the UK banking sector for much of the 20th century, together with Barclays Bank, Lloyds Bank, Midland Bank and Westminster Bank. On 1 January 1970, it completed its merger with Westminster Bank to form National Westminster Bank.

The Catholic Church in the Isle of Man is part of the worldwide Catholic Church, under the spiritual leadership of the Pope in Rome.

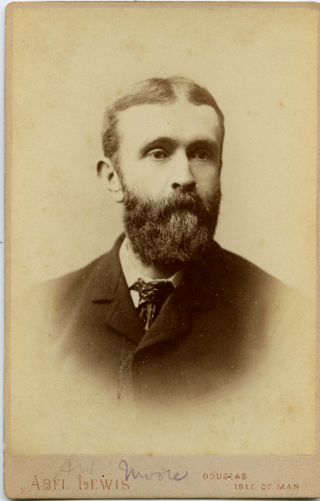

Arthur William Moore, CVO, SHK, JP, MA was a Manx antiquarian, historian, linguist, folklorist, and former Speaker of the House of Keys in the Isle of Man. He published under the sobriquet A. W. Moore.

SS (RMS) Ellan Vannin was built as an iron paddle steamer in 1860 at Meadowside, Glasgow for the Isle of Man Steam Packet Company. She was originally named Mona's Isle - the second ship in the company's history to be so named. She served for 23 years under that name before being rebuilt, re-engined and renamed in 1883. As Ellan Vannin she served for a further 26 years before being lost in a storm on 3 December 1909 in Liverpool Bay.

The Old House of Keys is the former meeting place of the House of Keys, the lower house of Tynwald, the Isle of Man's parliament. It is located across the street from Castle Rushen in Castletown, the former capital of the Isle of Man, in the south of the island. The building was used as the House of Keys from 1821 until 1874, when the parliament was moved to Douglas.

The Isle of Man Bank is a bank in the British Crown dependency of the Isle of Man, providing retail, private and business banking services to the local population. Incorporated in 1865, it has operated as a trading name of RBS International since 2019. It is licensed by the Isle of Man Financial Services Authority in respect of deposit taking and investment business and registered as a general insurance intermediary.

Douglas Harbour is located near Douglas Head at the southern end of Douglas, the capital of the Isle of Man. It is the island's main commercial shipping port. The Port of Douglas was the first in the world to be equipped with radar.

Northern Bank Limited, trading as Danske Bank, is a retail bank in Northern Ireland. Northern Banking Company Limited was formed from a private bank, with the Deed of Partnership being signed on 1 August 1824. It is one of the oldest banks in Ireland with its private banking history dating back to 1809, and forms part of one of the Big Four banks in Ireland. Northern Bank took on the name of its parent company Danske Bank as its trading name in November 2012. It is a leading bank in Northern Ireland and a growing bank in Great Britain. In Northern Ireland, the Bank issues its own banknotes.

George William Dumbell QC was a British advocate, businessman and philanthropist who was invited to become a Member of the House of Keys serving two different terms. He is also remembered on the Isle of Man as being involved in two banking ventures of questionable reputation; the Joint Stock Bank and Dumbell's Bank.

Dumbell's Bank was a bank in the Isle of Man. The bank's insolvency in 1900, known as Black Saturday and referred to in the Isle of Man as the Dumbell's Bank Crash, resulted in a run on the bank with many individuals losing their life savings and the ruin of numerous local businesses causing poverty, depression and bankruptcy. The effects were profound and lasted for a considerable number of years.

Forbes Bank was a bank in the British Crown dependency of the Isle of Man, providing private and business banking services to the local population. The bank operated from 1826 until it crashed spectacularly in 1843 resulting in hardship, unemployment, bankruptcy and destitution for many of the inhabitants of the Island.

The Isle of Man and Liverpool Bank was a bank in the British Crown dependency of the Isle of Man, providing private and business banking services to the local population. The bank traded from 1836 until it was wound up in 1838.

Henry Bloom Noble JP was a Cumbrian-born philanthropist and businessman who at the time of his death was the richest resident of the Isle of Man. Noble bequeathed a large amount of his vast fortune to the people of the Isle of Man, resulting in numerous civic amenities such as recreation grounds, swimming baths, a library and a hospital.