A cooperative is "an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democratically-controlled enterprise". Cooperatives are democratically controlled by their members, with each member having one vote in electing the board of directors. They differ from collectives in that they are generally built from the bottom-up, rather than the top-down. Cooperatives may include:

The Co-operative Bank plc is a British retail and commercial bank based in Manchester, England. Established as a bank for co-operators and co-operatives following the principles of the Rochdale Pioneers, the business evolved in the 20th century into a mid-sized British high street bank, operating throughout the UK mainland. Transactions took place at cash desks in Co-op stores until the 1960s, when the bank set up a small network of branches that grew from six to a high of 160; in 2023 it had 50 branches.

Demutualization is the process by which a customer-owned mutual organization (mutual) or co-operative changes legal form to a joint stock company. It is sometimes called stocking or privatization. As part of the demutualization process, members of a mutual usually receive a "windfall" payout, in the form of shares in the successor company, a cash payment, or a mixture of both. Mutualization or mutualisation is the opposite process, wherein a shareholder-owned company is converted into a mutual organization, typically through takeover by an existing mutual organization. Furthermore, re-mutualization depicts the process of aligning or refreshing the interest and objectives of the members of the mutual society.

The Co-operative Group Limited, trading as Co-op and formerly known as the Co-operative Wholesale Society, is a British consumer co-operative with a group of retail businesses, including grocery retail and wholesale, legal services, funerals and insurance, and social enterprise.

The Phone Co-op was an independent consumer co-operative in the United Kingdom. It provided landline, mobile telephone and Internet services, including web hosting and broadband. In April 2018, the Phone Co-op board agreed for its operations to be transferred to the Midcounties Co-operative, with the Phone Co-op legal entity ceasing to exist. The brand continued to be operated until 1 June 2018, when it was rebranded to Your Co-op following the completion of the transfer.

A social enterprise is an organization that applies commercial strategies to maximize improvements in financial, social and environmental well-being. This may include maximizing social impact alongside profits for co-owners.

An industrial and provident society (IPS) is a body corporate registered for carrying on any industries, businesses, or trades specified in or authorised by its rules.

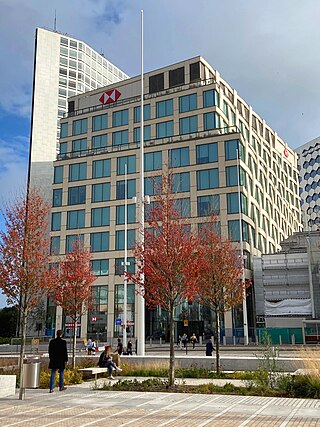

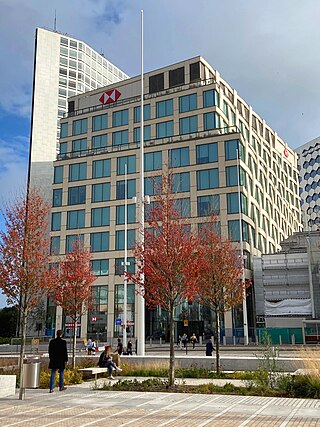

HSBC UK Bank plc is a British multinational banking and financial services organisation based in Birmingham, England. It is a wholly owned subsidiary of the global HSBC banking and financial group, which has been headquartered in London since 1993. The UK headquarters of HSBC is located at One Centenary Square in Birmingham.

United Bank Limited (UBL) is a Pakistani commercial bank headquartered in Karachi. It is a subsidiary of British multinational conglomerate, Bestway Group.

The IDBI Bank Limited is a Scheduled Commercial Bank under the ownership of Life Insurance Corporation of India (LIC) and Government of India. It was established by Government of India as a wholly owned subsidiary of Reserve Bank of India in 1964 as Industrial Development Bank of India, a Development Finance Institution, which provided financial services to industrial sector. In 2005, the institution was merged with its subsidiary commercial division, IDBI Bank, and was categorised as "Other Public Sector Bank" category. Later in March 2019, Government of India asked LIC to infuse capital in the bank due to high NPA and capital adequacy issues and also asked LIC to manage the bank to meet the regulatory norms. Consequent upon LIC acquiring 51% of the total paid-up equity share capital, the bank was categorised as a 'Private Sector Bank' for regulatory purposes by Reserve Bank of India with effect from 21 January 2019. IDBI was put under Prompt Corrective Action of the Reserve Bank of India and on 10 March 2021 IDBI came out of the same. At present direct and indirect shareholding of Government of India in IDBI Bank is approximately 95%, which Government of India (GoI) vide its communication F.No. 8/2/2019-BO-II dated 17 December 2019, has clarified and directed all Central/State Government departments to consider IDBI Bank for allocation of Government Business. Many national institutes find their roots in IDBI like SIDBI, EXIM, National Stock Exchange of India, SEBI, National Securities Depository Limited. Presently, IDBI Bank is one of the largest Commercial Banks in India.

The Midcounties Co-operative Limited, trading as Your Co-op, is a consumer co-operative in the United Kingdom with over 700,000 members. Registered in England under the Co-operative and Community Benefit Societies Act 2014, it is a member of Co-operatives UK and Federal Retail Trading Services.

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

Virgin Money UK plc is a British banking and financial services company. It has been owned by Nationwide Building Society since 1 October 2024.

Lloyds Banking Group plc is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. Lloyds Bank was founded in 1765 but the wider Group's heritage extends over 320 years, dating back to the founding of the Bank of Scotland by the Parliament of Scotland in 1695.

Social enterprise lending is a form of social finance which refers to the practice of offering loans and other financing vehicles below current market rates to social enterprises and other organisations pursuing social goals. This is often referred to as "patient lending," or financing with "soft" terms. Patient lending recognises that projects with social outcomes often reach profitability later than commercial projects. Softening the terms of a loan means that a social lender may offer provisions such as longer loan terms, lower interest rates and repayment "holidays" where capital and interest repayments are not due until the project is profitable. Social lenders might also offer small grants as part of an investment package.

Bank Australia is an Australian customer-owned bank based in Collingwood, Victoria. The organisation can trace its origins back to 1957, when the CSIRO Co-operative Credit Society was formed. Over succeeding years, mergers among 72 other credit unions and co-operative banks eventually led to the creation of the Members & Education Credit Union (mecu) in 2003, which became Bankmecu in 2011, and Bank Australia in 2015.

Co-operative Bank of Kenya is a commercial bank in Kenya, the largest economy in the East African Community. It is licensed by the Central Bank of Kenya, the central bank and national banking regulator. The bank has introduced Agency banking model and has a deep customer base in Kenya with over 7.5 million accounts as of December 2018. In 2010, the bank was awarded "Best Bank of Kenya" by the London Financial Times due to their excellent growth.

TSB Bank plc is a British retail and commercial bank based in Edinburgh, Scotland. It has been a subsidiary of Sabadell Group since 2015.

London Capital Credit Union Limited is a not-for-profit member-owned financial co-operative, based in Archway and operating across London and the South East.

Punjab & Maharashtra Co-operative Bank Limited (PMC), was a multi-state co-operative bank that began operations in 1983. It had 137 branches spread over half a dozen states of India and nearly 100 branches were in Maharashtra. It was regulated by the Reserve Bank of India and registered under the Cooperative Societies Act.