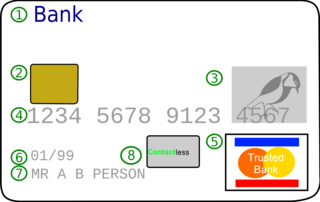

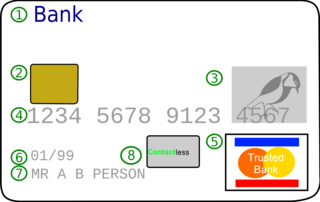

A debit card, also known as a check card or bank card is a payment card that can be used in place of cash to make purchases. The term plastic card includes the above and as an identity document. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of a purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

A loyalty program is a marketing strategy designed to encourage customers to continue to shop at or use the services of a business associated with the program. Today, such programs cover most types of commerce, each having varying features and rewards schemes, including in banking, entertainment, hospitality, retailing and travel. The market approach has shifted from product-centric to a customer-centric one due to a highly competitive market and a wide array of services offered to customers, therefore, it's important that marketing strategies prioritize growing a sustainable business and increasing customer satisfaction.

American Express Company (Amex) is an American multinational financial services corporation specialized in payment cards headquartered in New York City. It is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. It is based in the American Express Tower in the Battery Park City neighborhood of Lower Manhattan where it maintains its corporate offices. They are the largest provider of traveler's cheques worldwide.

Mastercard Inc. is the second-largest payment-processing corporation worldwide. It offers a range of financial services. Its headquarters are in Purchase, New York. Throughout the world, its principal business is to process payments between the banks of merchants and the card-issuing banks or credit unions of the purchasers who use the Mastercard-brand debit, credit and prepaid cards to make purchases. Mastercard has been publicly traded since 2006.

Financial services are economic services provided by the finance industry, which together encompass a broad range of service sector firms that provide financial management, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual asset managers, and some government-sponsored enterprises.

A gift card also known as gift certificate in North America, or gift voucher or gift token in the UK is a prepaid stored-value money card, usually issued by a retailer or bank, to be used as an alternative to cash for purchases within a particular store or related businesses. Gift cards are also given out by employers or organizations as rewards or gifts. They may also be distributed by retailers and marketers as part of a promotion strategy, to entice the recipient to come in or return to the store, and at times such cards are called cash cards. Gift cards are generally redeemable only for purchases at the relevant retail premises and cannot be cashed out, and in some situations may be subject to an expiry date or fees. American Express, MasterCard, and Visa offer generic gift cards which need not be redeemed at particular stores, and which are widely used for cashback marketing strategies. A feature of these cards is that they are generally anonymous and are disposed of when the stored value on a card is exhausted.

A prepaid mobile device, also known as a, pay-as-you-go (PAYG), pay-as-you-talk, pay and go, go-phone, prepay or burner phone, is a mobile device such as a phone for which credit is purchased in advance of service use. The purchased credit is used to pay for telecommunications services at the point the service is accessed or consumed. If there is no credit, then access is denied by the cellular network or Intelligent Network. Users can top up their credit at any time using a variety of payment mechanisms.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer and access automated teller machines (ATMs). Such cards are known by a variety of names including bank cards, ATM cards, client cards, key cards or cash cards.

Gemalto was an international digital security company providing software applications, secure personal devices such as smart cards and tokens, e-wallets and managed services. It was formed in June 2006 by the merger of two companies, Axalto and Gemplus International. Gemalto N.V.'s revenue in 2018 was €2.969 billion.

Loyalty marketing is an approach to marketing, based on strategic management, in which a company focuses on growing and retaining existing customers through incentives. Branding, product marketing, and loyalty marketing all form part of the customer proposition – the subjective assessment by the customer of whether to purchase a brand or not based on the integrated combination of the value they receive from each of these marketing disciplines.

The Green Dot Corporation is an American financial technology and bank holding company headquartered in Austin. It is the world's largest prepaid debit card company by market capitalization. Green Dot is also a payments platform company and is the technology platform used by Apple Pay Cash, Uber, and Intuit. The company was founded in 1999 by Steve Streit as a prepaid debit card for teenagers to shop online. In 2001, the company pivoted to serving the "unbanked" and "underbanked" communities. In 2010, Green Dot Corporation went public with a valuation of $2 billion. Since its inception, Green Dot has acquired a number of companies in the mobile, financial, and tax industries including Loopt, AccountNow, AchieveCard, UniRush Financial Services, and Santa Barbara Tax Products Group.

Fidelity National Information Services, Inc. (FIS) is an American multinational corporation which offers a wide range of financial products and services. FIS is most known for its development of Financial Technology, or FinTech, and as of Q2 2020 it offers its solutions in three primary segments: Merchant Solutions, Banking Solutions, and Capital Market Solutions. Annually, FIS facilitates the movement of roughly $9 trillion through the processing of approximately 75 billion transactions in service to more than 20,000 clients around the globe.

A controlled payment number, disposable credit card or virtual credit card is an alias for a credit card number, with a limited number of transactions, and an expiration date between two and twelve months from the issue date. This "alias" number is indistinguishable from an ordinary credit card number, and the user's actual credit card number is never revealed to the merchant.

SVM, originally known as Stored Value Marketing, is a provider of gasoline, restaurant, and other retail gift cards also known as stored value cards based in Des Plaines, Illinois.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards, and a few gemstone-encrusted metal cards.

Cantaloupe, Inc., previously known as USA Technologies Inc., is an American company known for its work with ePort cashless acceptance technology running on its patented ePort Connect service, a PCI compliant, comprehensive suite of services designed for the self serve, unattended market. ePort Connect wirelessly facilitates electronic payment options to consumers while providing operators with both telemetry and machine-to-machine (M2M) services. ePort technology is primarily found in vending machines, kiosks and point-of-sale (POS) terminals, but the ePort Online and ePort Mobile products have extended the network to accept recurring payments from a PC or retail outlets and the taxi industry through smartphone devices.

Seaoil Philippines, Inc., stylized as SEAOIL Philippines, is a fuel company that started in 1978. The Filipino-owned company offers fuel products ranging from automobile gasoline to industry-specific lubricants and services such as storage and shipping.

Edenred, formerly known as Accor Services, is an international company that specialises in specific-purpose payment solutions for companies, employees and merchants. Edenred is the inventor of Ticket Restaurant, created in 1962.

Blackhawk Network Holdings Inc. is an American privately held company that operates in the prepaid, gift card and payments industries. It sells branded physical and digital gifts, phones, prepaid debit, and incentives cards online and through a network of global retailers. Blackhawk's network reaches people through a number of different channels including in-store, online, mobile, and incentive. Blackhawk headquarters are in Pleasanton, California and the company was incorporated in 2006.

Hawk Incentives, is a rewards-based incentives company that design, implement and manage programs for other companies. Hawk Incentives is based in Texas.