Related Research Articles

Behavioral economics is the study of the psychological, cognitive, emotional, cultural and social factors involved in the decisions of individuals or institutions, and how these decisions deviate from those implied by classical economic theory.

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome.

Prospect theory is a theory of behavioral economics, judgment and decision making that was developed by Daniel Kahneman and Amos Tversky in 1979. The theory was cited in the decision to award Kahneman the 2002 Nobel Memorial Prize in Economics.

A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. It is used widely in finance and economics, the general definition being the expected risky return less the risk-free return, as demonstrated by the formula below.

Loss aversion is a psychological and economic concept which refers to how outcomes are interpreted as gains and losses where losses are subject to more sensitivity in people's responses compared to equivalent gains acquired. Kahneman and Tversky (1992) have suggested that losses can be twice as powerful, psychologically, as gains. When defined in terms of the utility function shape as in the Cumulative Prospect Theory (CPT), losses have a steeper utility than gains, thus being more "painful" than the satisfaction from a comparable gain as shown in Figure 1. Loss aversion was first proposed by Amos Tversky and Daniel Kahneman as an important framework for Prospect Theory - an analysis of decision under risk.

The expected utility hypothesis is a foundational assumption in mathematical economics concerning decision making under uncertainty. It postulates that rational agents maximize utility, meaning the subjective desirability of their actions. Rational choice theory, a cornerstone of microeconomics, builds this postulate to model aggregate social behaviour.

Status quo bias is an emotional bias; a preference for the maintenance of one's current or previous state of affairs, or a preference to not undertake any action to change this current or previous state. The current baseline is taken as a reference point, and any change from that baseline is perceived as a loss or gain. Corresponding to different alternatives, this current baseline or default option is perceived and evaluated by individuals as a positive.

The dictator game is a popular experimental instrument in social psychology and economics, a derivative of the ultimatum game. The term "game" is a misnomer because it captures a decision by a single player: to send money to another or not. Thus, the dictator has the most power and holds the preferred position in this “game.” Although the “dictator” has the most power and presents a take it or leave it offer, the game has mixed results based on different behavioral attributes. The results – where most "dictators" choose to send money – evidence the role of fairness and norms in economic behavior, and undermine the assumption of narrow self-interest when given the opportunity to maximise one's own profits.

Robert Osher Schlaifer was an American statistician who was a pioneer of Bayesian decision theory. At the time of his death he was William Ziegler Professor of Business Administration Emeritus of the Harvard Business School. In 1961 he was elected as a Fellow of the American Statistical Association.

Inequity aversion (IA) is the preference for fairness and resistance to incidental inequalities. The social sciences that study inequity aversion include sociology, economics, psychology, anthropology, and ethology. Researches on inequity aversion aim to explain behaviors that are not purely driven by self-interests but fairness considerations.

In decision theory, the Ellsberg paradox is a paradox in which people's decisions are inconsistent with subjective expected utility theory. Daniel Ellsberg popularized the paradox in his 1961 paper, "Risk, Ambiguity, and the Savage Axioms". John Maynard Keynes published a version of the paradox in 1921. It is generally taken to be evidence of ambiguity aversion, in which a person tends to prefer choices with quantifiable risks over those with unknown, incalculable risks.

Howard Raiffa was an American academic who was the Frank P. Ramsey Professor (Emeritus) of Managerial Economics, a joint chair held by the Business School and Harvard Kennedy School at Harvard University. He was an influential Bayesian decision theorist and pioneer in the field of decision analysis, with works in statistical decision theory, game theory, behavioral decision theory, risk analysis, and negotiation analysis. He helped found and was the first director of the International Institute for Applied Systems Analysis.

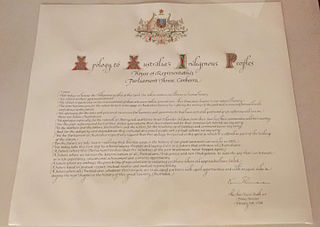

An apology is an expression of regret or remorse for actions, while apologizing is the act of expressing regret or remorse. In informal situations, it may be called saying sorry. The goal of apologizing is generally forgiveness, reconciliation and restoration of the relationship between the people involved in a dispute.

In decision theory and economics, ambiguity aversion is a preference for known risks over unknown risks. An ambiguity-averse individual would rather choose an alternative where the probability distribution of the outcomes is known over one where the probabilities are unknown. This behavior was first introduced through the Ellsberg paradox.

Richard Jay Zeckhauser is an American economist and the Frank P. Ramsey Professor of Political Economy at Harvard Kennedy School at Harvard University.

Disappointment is the feeling of dissatisfaction that follows the failure of expectations or hopes to manifest. Similar to regret, it differs in that a person who feels regret focuses primarily on the personal choices that contributed to a poor outcome, while a person feeling disappointment focuses on the outcome itself. It is a source of psychological stress. The study of disappointment—its causes, impact, and the degree to which individual decisions are motivated by a desire to avoid it—is a focus in the field of decision analysis, as disappointment is, along with regret, one of two primary emotions involved in decision-making.

Alvin Eliot Roth is an American academic. He is the Craig and Susan McCaw professor of economics at Stanford University and the Gund professor of economics and business administration emeritus at Harvard University. He was President of the American Economic Association in 2017.

Edi Karni is an Israeli born American economist and decision theorist. Karni is the Scott and Barbara Black Professor of Economics at Johns Hopkins University. He is a Fellow of the Econometric Society and an Economic Theory Fellow of the Society for the Advancement of Economic Theory.

Reference dependence is a central principle in prospect theory and behavioral economics generally. It holds that people evaluate outcomes and express preferences relative to an existing reference point, or status quo. It is related to loss aversion and the endowment effect.

The uncertainty effect, also known as direct risk aversion, is a phenomenon from economics and psychology which suggests that individuals may be prone to expressing such an extreme distaste for risk that they ascribe a lower value to a risky prospect than its worst possible realization.

References

- 1 2 3 "John W. Pratt – Faculty – Harvard Business School". www.hbs.edu. Retrieved 2019-04-23.

- ↑ Pratt, J. W. (1964). "Risk Aversion in the Small and in the Large". Econometrica . The Econometric Society. 32 (1/2): 122–136. doi:10.2307/1913738. JSTOR 1913738.

- ↑ "John W. Pratt: William Ziegler Professor of Business Administration, Emeritus". Archived from the original on 12 May 2012. Retrieved 25 November 2011.

- ↑ View/Search Fellows of the ASA Archived 2016-06-16 at the Wayback Machine , accessed 2016-07-23.

- ↑ Schervish, Mark J.; Pratt, John W.; Raiffa, Howard; Schlaifer, Robert (September 1996). "Introduction to Statistical Decision Theory". Journal of the American Statistical Association. 91 (435): 1376. doi:10.2307/2291759. ISSN 0162-1459. JSTOR 2291759.

- ↑ Pratt, John W. and Richard Zeckhauser (1991). Principals and Agents: The Structure of Business. Harvard Business School Press.

- ↑ Pratt, John W. (1961). "Length of Confidence Intervals". Journal of the American Statistical Association. 56 (295): 549–567. doi:10.1080/01621459.1961.10480644. ISSN 0162-1459.

- ↑ Pratt, John W. (2007-11-20). "Fair (and not so fair) division". Journal of Risk and Uncertainty. 35 (3): 203–236. doi:10.1007/s11166-007-9025-6. ISSN 0895-5646. S2CID 154871522.

- ↑ Pratt, John W. (September 2005). "How Many Balance Functions Does it Take to Determine a Utility Function?". Journal of Risk and Uncertainty. 31 (2): 109–127. doi:10.1007/s11166-005-3551-x. ISSN 0895-5646. S2CID 121088670.

- ↑ Pratt, John W. (December 2000). "Efficient Risk Sharing: The Last Frontier". Management Science. 46 (12): 1545–1553. doi:10.1287/mnsc.46.12.1545.12075. ISSN 0025-1909.

- ↑ Pratt, John W.; Schlaifer, Robert (May 1998). "A New Interpretation of the F Statistic". The American Statistician. 52 (2): 141. doi:10.2307/2685472. ISSN 0003-1305. JSTOR 2685472.

- ↑ MACHINA, MARK; PRATT, JOHN (1997). "Increasing risk: some direct constructions". Journal of Risk and Uncertainty. 14 (2): 103–127. doi:10.1023/a:1007719626543. ISSN 0895-5646. S2CID 153628899.

- ↑ Pratt, John W.; Zeckhauser, Richard J. (August 1996). "Willingness to Pay and the Distribution of Risk and Wealth". Journal of Political Economy. 104 (4): 747–763. doi:10.1086/262041. ISSN 0022-3808. S2CID 153478355.

- ↑ Kohlberg, Elon; Pratt, John W. (May 1982). "The Contraction Mapping Approach to the Perron-Frobenius Theory: Why Hilbert's Metric?". Mathematics of Operations Research . 7 (2): 198–210. doi:10.1287/moor.7.2.198. ISSN 0364-765X.

- ↑ PRATT, JOHN W.; HAMMOND, JOHN S. (December 1979). "Evaluating and Comparing Projects: Simple Detection of False Alarms". The Journal of Finance. 34 (5): 1231–1242. doi:10.1111/j.1540-6261.1979.tb00068.x. ISSN 0022-1082.

- ↑ Pratt, John W. (2008). "Some Neglected Axioms in Fair Division" (PDF). SSRN Working Paper Series. doi:10.2139/ssrn.1129248. ISSN 1556-5068. S2CID 23745363.

- ↑ KOHLBERG, ELON (1990), "Refinement of Nash Equilibrium: The Main Ideas", Game Theory and Applications, Elsevier, pp. 3–45, doi:10.1016/b978-0-12-370182-4.50006-4, ISBN 9780123701824