In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the underlying. Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets.

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In finance, speculation is the purchase of an asset with the hope that it will become more valuable shortly. It can also refer to short sales in which the speculator hopes for a decline in value.

Australian Securities Exchange Ltd (ASX) is an Australian public company that operates Australia's primary securities exchange, the Australian Securities Exchange. The ASX was formed on 1 April 1987, through incorporation under legislation of the Australian Parliament as an amalgamation of the six state securities exchanges, and merged with the Sydney Futures Exchange in 2006.

The derivatives market is the financial market for derivatives, financial instruments like futures contracts or options, which are derived from other forms of assets.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. For most of its history, the exchange was in the then common form of a non-profit organization, owned by members of the exchange. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

The Commodity Futures Trading Commission (CFTC) is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures, swaps, and certain kinds of options.

National Stock Exchange of India Limited (NSE) is one of the leading stock exchanges in India, based in Mumbai. NSE is under the ownership of various financial institutions such as banks and insurance companies. It is the world's largest derivatives exchange by number of contracts traded and the third largest in cash equities by number of trades for the calendar year 2022. It is the 7th largest stock exchange in the world by total market capitalization, as of January 2024. NSE's flagship index, the NIFTY 50, a 50 stock index is used extensively by investors in India and around the world as a barometer of the Indian capital market. The NIFTY 50 index was launched in 1996 by NSE.

In finance, a contract for difference (CFD) is a legally binding agreement that creates, defines, and governs mutual rights and obligations between two parties, typically described as "buyer" and "seller", stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time. If the closing trade price is higher than the opening price, then the seller will pay the buyer the difference, and that will be the buyer's profit. The opposite is also true. That is, if the current asset price is lower at the exit price than the value at the contract's opening, then the seller, rather than the buyer, will benefit from the difference.

An energy derivative is a derivative contract based on an underlying energy asset, such as natural gas, crude oil, or electricity. Energy derivatives are exotic derivatives and include exchange-traded contracts such as futures and options, and over-the-counter derivatives such as forwards, swaps and options. Major players in the energy derivative markets include major trading houses, oil companies, utilities, and financial institutions.

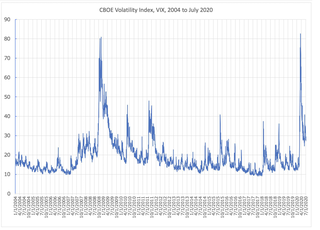

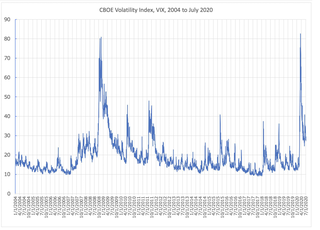

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. It is calculated and disseminated on a real-time basis by the CBOE, and is often referred to as the fear index or fear gauge.

Basis risk in finance is the risk associated with imperfect hedging due to the variables or characteristics that affect the difference between the futures contract and the underlying "cash" position. It arises because of the difference between the price of the asset to be hedged and the price of the asset serving as the hedge before expiration, namely b = S - F. Barring idiosyncratic influence by the other aspects to be enumerated just below, by the time of expiration this simple difference will be eliminated by arbitrage. The other aspects that give rise to basis risk include

A trader is a person, firm, or entity in finance who buys and sells financial instruments, such as forex, cryptocurrencies, stocks, bonds, commodities, derivatives, and mutual funds in the capacity of agent, hedger, arbitrager, or speculator.

CME Group Inc. is a financial services company. Headquartered in Chicago, the company operates financial derivatives exchanges including the Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, and The Commodity Exchange. The company also owns 27% of S&P Dow Jones Indices. It is the world's largest operator of financial derivatives exchanges. Its exchanges are platforms for trading in agricultural products, currencies, energy, interest rates, metals, futures contracts, options, stock indexes, and cryptocurrencies futures.

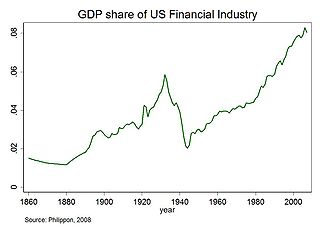

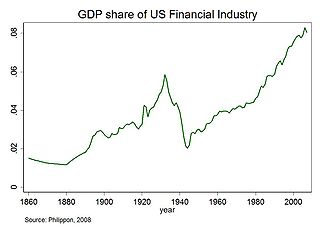

Financialization is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors.

In finance, a dividend future is an exchange-traded derivative contract that allows investors to take positions on future dividend payments. Dividend futures can be on a single company, a basket of companies, or on an Equity index. They settle on the amount of dividend paid by the company, the basket of companies, or the index during the period of the contract.

In finance, a perpetual futures contract, also known as a perpetual swap, is an agreement to non-optionally buy or sell an asset at an unspecified point in the future. Perpetual futures are cash-settled, and differ from regular futures in that they lack a pre-specified delivery date, and can thus be held indefinitely without the need to roll over contracts as they approach expiration. Payments are periodically exchanged between holders of the two sides of the contracts, long and short, with the direction and magnitude of the settlement based on the difference between the contract price and that of the underlying asset, as well as, if applicable, the difference in leverage between the two sides.