Petroleum is a naturally occurring yellowish-black liquid mixture. It consists mainly of hydrocarbons, and is found in geological formations. The term petroleum refers both to naturally occurring unprocessed crude oil, as well as to petroleum products that consist of refined crude oil.

Oil shale is an organic-rich fine-grained sedimentary rock containing kerogen from which liquid hydrocarbons can be produced. In addition to kerogen, general composition of oil shales constitutes inorganic substance and bitumens. Based on their deposition environment, oil shales are classified as marine, lacustrine and terrestrial oil shales. Oil shales differ from oil-bearing shales, shale deposits that contain petroleum that is sometimes produced from drilled wells. Examples of oil-bearing shales are the Bakken Formation, Pierre Shale, Niobrara Formation, and Eagle Ford Formation. Accordingly, shale oil produced from oil shale should not be confused with tight oil, which is also frequently called shale oil.

The Hubbert peak theory says that for any given geographical area, from an individual oil-producing region to the planet as a whole, the rate of petroleum production tends to follow a bell-shaped curve. It is one of the primary theories on peak oil.

Peak oil is the point when global oil production reaches its maximum rate, after which it will begin to decline irreversibly. The main concern is that global transportation relies heavily on gasoline and diesel. Transitioning to electric vehicles, biofuels, or more efficient transport could help reduce oil demand.

Michael T. Klare is a Five Colleges professor of Peace and World Security Studies, whose department is located at Hampshire College, defense correspondent of The Nation magazine and author of Resource Wars and Blood and Oil: The Dangers and Consequences of America's Growing Petroleum Dependency (Metropolitan). His 2019 book is, All Hell Breaking Loose: the Pentagon's Perspective on Climate Change (Metropolitan). Klare also teaches at Amherst College, Smith College, Mount Holyoke College and the University of Massachusetts Amherst.

Eni S.p.A., acronym for and formerly legally known as Ente nazionale idrocarburi, is an Italian multinational energy company headquartered in Rome. It is considered one of the "supermajor" oil companies in the world, with a market capitalization of €50 billion, as of 31 December 2023. The Italian government owns a 30.5% golden share in the company, 1.99% held through the Ministry of Economy and Finance and 28.5% through the Cassa Depositi e Prestiti. The company is a component of the Euro Stoxx 50 stock market index.

While the local use of oil goes back many centuries, the modern petroleum industry along with its outputs and modern applications are of a recent origin. Petroleum's status as a key component of politics, society, and technology has its roots in the coal and kerosene industry of the late nineteenth century. One of the earliest instances of this is the refining of paraffin from crude oil. Abraham Gesner developed a process to refine a liquid fuel from coal, bitumen and oil shale; it burned more cleanly and was cheaper than whale oil. James Young in 1847 noticed a natural petroleum seepage when he distilled a light thin oil suitable for use as lamp oil, at the same time obtaining a thicker oil suitable for lubricating machinery. The world's first refineries and modern oil wells were established in the mid-nineteenth century. While petroleum industries developed in several countries during the nineteenth century, the two giants were the United States and the Russian Empire, specifically that part of it that today forms the territory of independent Azerbaijan. Together, these two countries produced 97% of the world's oil over the course of the nineteenth century.

Shale oil extraction is an industrial process for unconventional oil production. This process converts kerogen in oil shale into shale oil by pyrolysis, hydrogenation, or thermal dissolution. The resultant shale oil is used as fuel oil or upgraded to meet refinery feedstock specifications by adding hydrogen and removing sulfur and nitrogen impurities.

Predicting the timing of peak oil involves estimation of future production from existing oil fields as well as future discoveries. The initial production model was Hubbert peak theory, first proposed in the 1950s. Since then, many experts have tried to forecast peak oil.

The Robert and Renée Belfer Center for Science and International Affairs, also known as the Belfer Center, is a research center located at the Harvard Kennedy School at Harvard University in Cambridge, Massachusetts, in the United States.

The Age of Oil, also known as the Oil Age, the Petroleum Age, or the Oil Boom, refers to the era in human history characterised by an increased use of petroleum in products and as fuel. Though unrefined petroleum has been used for various purposes since ancient times, it was during the 19th century that refinement techniques were developed and gasoline engines were created.

Petroleum has been a major industry in the United States since the 1859 Pennsylvania oil rush around Titusville, Pennsylvania. Commonly characterized as "Big Oil", the industry includes exploration, production, refining, transportation, and marketing of oil and natural gas products. The leading crude oil-producing areas in the United States in 2023 were Texas, followed by the offshore federal zone of the Gulf of Mexico, North Dakota and New Mexico.

This article describes the energy and electricity production, consumption and import in Egypt.

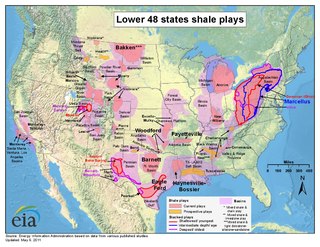

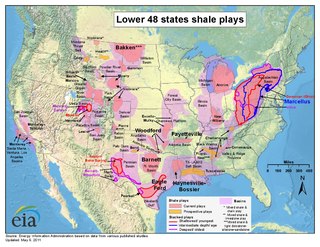

Shale gas in the United States is an available source of unconventional natural gas. Led by new applications of hydraulic fracturing technology and horizontal drilling, development of new sources of shale gas has offset declines in production from conventional gas reservoirs, and has led to major increases in reserves of U.S. natural gas. Largely due to shale gas discoveries, estimated reserves of natural gas in the United States in 2008 were 35% higher than in 2006.

Tight oil is light crude oil contained in unconventional petroleum-bearing formations of low permeability, often shale or tight sandstone. Economic production from tight oil formations requires the same hydraulic fracturing and often uses the same horizontal well technology used in the production of shale gas. While sometimes called "shale oil", tight oil should not be confused with oil shale or shale oil. Therefore, the International Energy Agency recommends using the term "light tight oil" for oil produced from shales or other very low permeability formations, while the World Energy Resources 2013 report by the World Energy Council uses the terms "tight oil" and "shale-hosted oil".

Shale gas is an unconventional natural gas produced from shale, a type of sedimentary rock. Shale gas has become an increasingly important source of natural gas in the United States over the past decade, and interest has spread to potential gas shales in Canada, Europe, Asia, and Australia. One analyst expects shale gas to supply as much as half the natural gas production in North America by 2020.

Versalis is a wholly owned subsidiary of Italian oil supermajor Eni specializing in the production of chemicals. With more than 7,000 employees and a production of about 5.6 million tons of chemical products in 2023, it is by far the largest chemical company in Italy and one of the largest in Europe.

A petrostate, oil state, or petrocracy is a country whose economy is heavily dependent on the extraction and export of oil or natural gas. The presence alone of large oil and gas industries does not define a petrostate: major oil producers that also have diversified economies are not classified as petrostates due to their ability to generate income from various industries and sectors beyond the oil industry. Petrostates also have highly concentrated political and economic power, resting in the hands of an elite, as well as unaccountable political institutions which are susceptible to corruption.

Fracking in Canada was first used in Alberta in 1953 to extract hydrocarbons from the giant Pembina oil field, the biggest conventional oil field in Alberta, which would have produced very little oil without fracturing. Since then, over 170,000 oil and gas wells have been fractured in Western Canada. Fracking is a process that stimulates natural gas or oil in wellbores to flow more easily by subjecting hydrocarbon reservoirs to pressure through the injection of fluids or gas at depth causing the rock to fracture or to widen existing cracks.

Robert Alexander Belfer is an American businessman and philanthropist. He is the namesake of Belfer Center for Science and International Affairs at Harvard Kennedy School.