Related Research Articles

The Austrian school is a heterodox school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result primarily from the motivations and actions of individuals along with their self interest. Austrian-school theorists hold that economic theory should be exclusively derived from basic principles of human action.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive.

An economic bubble is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth, and/or by the belief that intrinsic valuation is no longer relevant when making an investment. They have appeared in most asset classes, including equities, commodities, real estate, and even esoteric assets. Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles, are attributed to central banking liquidity.

Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, government institutions, and private sector firms.

Human Action: A Treatise on Economics is a work by the Austrian economist and philosopher Ludwig von Mises. Widely considered Mises' magnum opus, it presents the case for laissez-faire capitalism based on praxeology, his method to understand the structure of human decision-making. Mises rejected positivism within economics, and defended an a priori foundation for praxeology, as well as methodological individualism and laws of self-evident certainty. Mises argues that the free-market economy not only outdistances any government-planned system, but ultimately serves as the foundation of civilization itself.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1899, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the "Great Depression" at the time, and it held that designation until the Great Depression of the 1930s. Though it marked a period of general deflation and a general contraction, it did not have the severe economic retrogression of the later Great Depression.

Underconsumption is a theory in economics that recessions and stagnation arise from an inadequate consumer demand, relative to the amount produced. In other words, there is a problem of overproduction and overinvestment during a demand crisis. The theory formed the basis for the development of Keynesian economics and the theory of aggregate demand after the 1930s.

Johan Gustaf Knut Wicksell was a Swedish economist of the Stockholm school. He was professor at Uppsala University and Lund University.

Economic collapse, also called economic meltdown, is any of a broad range of poor economic conditions, ranging from a severe, prolonged depression with high bankruptcy rates and high unemployment, to a breakdown in normal commerce caused by hyperinflation, or even an economically caused sharp rise in the death rate and perhaps even a decline in population. Often economic collapse is accompanied by social chaos, civil unrest and a breakdown of law and order.

The Austrian business cycle theory (ABCT) is an economic theory developed by the Austrian School of economics seeking to explain how business cycles occur. The theory views business cycles as the consequence of excessive growth in bank credit due to artificially low interest rates set by a central bank or fractional reserve banks. The Austrian business cycle theory originated in the work of Austrian School economists Ludwig von Mises and Friedrich Hayek. Hayek won the Nobel Prize in Economics in 1974 in part for his work on this theory.

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

Jesús Huerta de Soto Ballester is a Spanish economist of the Austrian School. He is a professor in the Department of Applied Economics at King Juan Carlos University of Madrid, Spain and a Senior Fellow at the Mises Institute.

In macroeconomics, a general glut is an excess of supply in relation to demand; specifically, when there is more production in all fields of production in comparison with what resources are available to consume (purchase) said production. This exhibits itself in a general recession or depression, with high and persistent underutilization of resources, notably unemployment and idle factories. The Great Depression is often cited as an archetypal example of a general glut.

Monetary inflation is a sustained increase in the money supply of a country. Depending on many factors, especially public expectations, the fundamental state and development of the economy, and the transmission mechanism, it is likely to result in price inflation, which is usually just called "inflation", which is a rise in the general level of prices of goods and services.

The credit cycle is the expansion and contraction of access to credit over time. Some economists, including Barry Eichengreen, Hyman Minsky, and other Post-Keynesian economists, and members of the Austrian school, regard credit cycles as the fundamental process driving the business cycle. However, mainstream economists believe that the credit cycle cannot fully explain the phenomenon of business cycles, with long term changes in national savings rates, and fiscal and monetary policy, and related multipliers also being important factors. Investor Ray Dalio has counted the credit cycle, together with the debt cycle, the wealth gap cycle and the global geopolitical cycle, among the main forces that drive worldwide shifts in wealth and power.

A credit crunch is a sudden reduction in the general availability of loans or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability. Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments.

Richard von Strigl (1891–1942) was an Austrian economist. He was considered by his colleagues one of the most brilliant Austrian economists of the interwar period. As a professor at the University of Vienna he had a decisive influence on F. A. Hayek, Fritz Machlup, Gottfried von Haberler, Oskar Morgenstern and other fourth-generation Austrian economists.

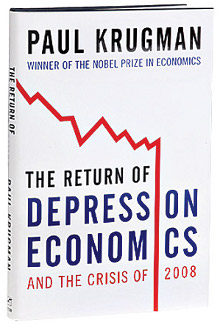

The Return of Depression Economics and the Crisis of 2008 is a non-fiction book by American economist and Nobel Prize winner Paul Krugman, written in response to growing socio-political discourse on the return of economic conditions similar to The Great Depression. The book was first published in 1999 and later updated in 2008 following his Nobel Prize of Economics. The Return of Depression Economics uses Keynesian analysis of past economics crisis, drawing parallels between the 2008 financial crisis and the Great Depression. Krugman challenges orthodox economic notions of restricted government spending, deregulation of markets and the efficient market hypothesis. Krugman offers policy recommendations for the prevention of future financial crises and suggests that policymakers "relearn the lessons our grandfathers were taught by the Great Depression" and prop up spending and enable broader access to credit.

Larry James Sechrest was an American economist who advocated the ideas of the Austrian School. He was a professor of economics at Sul Ross State University and was director of the university's Free Enterprise Institute.

References

- ↑ Larry J. Sechrest. "Explaining Malinvestment and Overinvestment" (pdf), October 2005, referenced 2010-07-01.

- ↑ Holcombe, Randall G. (2016-04-11). "Malinvestment". The Review of Austrian Economics. 30 (2): 153–167. doi : 10.1007/s11138-016-0343-2. ISSN 0889-3047.

- ↑ Sechrest, Larry J. (2006). "Explaining Malinvestment and Overinvestment". Quarterly Journal of Austrian Economics. 9 No. 4: 27–38 – via EBSCOhost.

- ↑ Erixon, Lennart (2010-06-07). "Development blocks, malinvestment and structural tensions – the Åkerman–Dahmén theory of the business cycle". Journal of Institutional Economics. 7 (1): 105–129. doi : 10.1017/s1744137410000196 ISSN 1744-1374.

- ↑ John Mills, Article read before the Manchester Statistical Society, December 11, 1867, on Credit Cycles and the Origin of Commercial Panics; As quoted in Financial crises and periods of industrial and commercial depression, Burton, T. E. (1931, first published 1902); see online version. New York and London: D. Appleton & Co; "Panics do not destroy capital; they merely reveal the extent to which it has been destroyed by its betrayal into hopelessly unproductive works."

- ↑ Ludwig von Mises, Human Action: A Treatise on Economics, 1966