Microcredit is the extension of very small loans (microloans) to impoverished borrowers who typically lack collateral, steady employment, and a verifiable credit history. It is designed to support entrepreneurship and alleviate poverty. Many recipients are illiterate, and therefore unable to complete paperwork required to get conventional loans. As of 2009 an estimated 74 million people held microloans that totaled US$38 billion. Grameen Bank reports that repayment success rates are between 95 and 98 percent. The first economist who had invented the idea of micro loans was Jonathan Swift I the 1720’s Microcredit is part of microfinance, which provides a wider range of financial services, especially savings accounts, to the poor. Modern microcredit is generally considered to have originated with the Grameen Bank founded in Bangladesh in 1983. Many traditional banks subsequently introduced microcredit despite initial misgivings. The United Nations declared 2005 the International Year of Microcredit. As of 2012, microcredit is widely used in developing countries and is presented as having "enormous potential as a tool for poverty alleviation." Microcredit is a tool that can possibly be helpful to reduce feminization of poverty in developing countries.

Grameen Bank is a microfinance specialized community development bank founded in Bangladesh. It makes small loans to the impoverished without requiring collateral.

Muhammad Yunus is a Bangladeshi social entrepreneur, banker, economist and civil society leader who was awarded the Nobel Peace Prize in 2006 for founding the Grameen Bank and pioneering the concepts of microcredit and microfinance. These loans are given to entrepreneurs that are too poor to qualify for traditional bank loans. Yunus and the Grameen Bank were jointly awarded the Nobel Peace Prize "for their efforts through microcredit to create economic and social development from below". The Norwegian Nobel Committee said that "lasting peace cannot be achieved unless large population groups find ways in which to break out of poverty" and that "across cultures and civilizations, Yunus and Grameen Bank have shown that even the poorest of the poor can work to bring about their own development". Yunus has received several other national and international honours. He received the United States Presidential Medal of Freedom in 2009 and the Congressional Gold Medal in 2010.

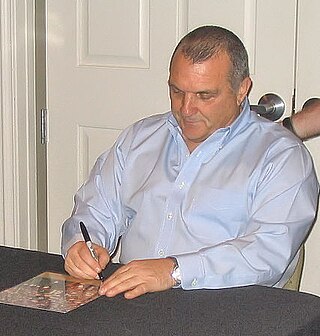

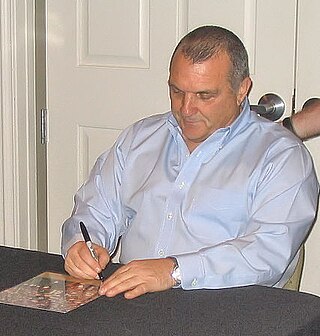

Daniel Eugene Ruettiger, is an American motivational speaker and author who played college football for the Notre Dame Fighting Irish. His early life and career at Notre Dame were the inspiration for the 1993 film Rudy.

Community development bank (CDB) or Community Development Financial Institution (CDFI) is a development bank or credit union that focus on serving people who have been locked out of the traditional financial systems such as the unbanked or underbanked in deprived local communities. They emphasize the long term development of communities and provide loans such as micro-finance or venture capital.

Holy Cross College is a private, Catholic, co-educational, residential institution of higher education administered by members of the Congregation of Holy Cross in Notre Dame, Indiana. The college was founded by the Holy Cross Brothers in 1966.

Grameen Foundation, founded as Grameen Foundation USA, also known as "GFUSA", is a global 501(c)(3) non-profit organization based in Washington, DC, that uses digital technology and data to understand very poor people, in detail, and offer them—and the entire ecosystem of agencies and actors surrounding them—empowering tools that meet and elevate their everyday realities. Its CEO is Zubaida Bai. Grameen Foundation's mission is, "To enable the poor, especially women, to create a world without poverty and hunger." According to the OECD, Grameen Foundation’s financing for 2019 development increased by 33% to US$45.5 million.

Jacqueline Novogratz is an American entrepreneur and author. She is the founder and CEO of Acumen, a nonprofit global venture capital fund whose goal is to use entrepreneurial approaches to address global poverty.

Banker to the Poor: Micro-Lending and the Battle Against World Poverty is an autobiography of 2006 Nobel Peace Prize Winner and Grameen Bank founder Muhammad Yunus. The book describes Yunus' early life, moving into his college years, and into his years as a professor at Chittagong University. While a professor at Chittagong University, Yunus began to take notice of the extreme poverty of the villagers around him. In 1976, Yunus incorporated the help of Maimuna Begum to collect data of people in Jobra who were living in poverty. Most of these impoverished people would take a loan from moneylenders to buy some raw material, using that raw material to create some product, and then selling back the good to the moneylender to repay the loan, earning a very meager profit. One woman interviewed made no more than two cents per day creating bamboo stools using this system. The list Begum brought back to Yunus named 42 women who were living on credit of 856 taka.

ShoreBank was a community development bank founded and headquartered in Chicago. At the time of its closing it was the oldest and largest such institution, and in 2008 had $2.6 billion in assets. It was owned by ShoreBank Corporation, a regulated bank holding company.

Ron Grzywinski is a community development banker from Chicago, and one of four founders of ShoreBank. In May 2010 he retired as chair of ShoreBank Corporation and took the position of Advisor to the Board of Directors of ShoreBank Corporation.

Solidarity lending is a lending practice where small groups borrow collectively and group members encourage one another to repay. It is an important building block of microfinance.

The Grameen family of organizations has grown beyond Grameen Bank into a multi-faceted group of both commercial and non-profit ventures. It was first established by Muhammad Yunus, the Nobel Peace Prize-winning founder of Grameen Bank. Most of the organizations in the Grameen group have central offices at the Grameen Bank Complex in Mirpur, Dhaka, Bangladesh. The Grameen Bank started to diversify in the late 1980s when it began attending to unutilized or underutilized fishing ponds, as well as irrigation pumps like deep tubewells. In 1989, these diversified interests started growing into separate organizations, as the fisheries project became Grameen Fisheries Foundation and the irrigation project became Grameen Krishi Foundation.

The Laetare Medal is an annual award given by the University of Notre Dame in recognition of outstanding service to the Catholic Church and society. The award is given to an American Catholic or group of Catholics "whose genius has ennobled the arts and sciences, illustrated the ideals of the church and enriched the heritage of humanity." First awarded in 1883, it is the oldest and most prestigious award for American Catholics.

Grameen Danone Foods, popularly known as Grameen Danone, is a social business enterprise, launched in 2006, which has been designed to provide children with many of the key nutrients that are typically missing from their diet in rural Bangladesh. It is run on 'No loss, No dividend' basis. Initially, Grameen Danone agreed to pay an annual dividend of one percent to shareholders, however, in December 2009, the board of Grameen Danone agreed to waive any monetary return.

Grameen America is a 501(c)(3) nonprofit microfinance organization based in New York City. It was founded by Nobel Peace Prize recipient Muhammad Yunus in 2008. Grameen America is run by former Avon Chairman and CEO Andrea Jung. The organization provides loans, savings programs, financial education, and credit establishment to women who live in poverty in the United States. All loans must be used to build small businesses.

Women's World Banking is a global nonprofit organization dedicated to women's economic empowerment through financial inclusion.

Roshaneh Zafar is a Pakistani development activist, working in the field of women's economic empowerment. She created the first specialised microfinance organisation in Pakistan, the Kashf Foundation, in 1996 which has served over 5 million women entrepreneurs across Pakistan and continues to pave the path for women's economic empowerment through its holistic financial services program.

Kashf Foundation is a non-profit organization, founded by Roshaneh Zafar in 1996. Kashf is regarded as the first microfinance institution (MFI) of Pakistan that uses village banking methodology in microcredit to alleviate poverty by providing affordable financial and non-financial services to low income households - particularly for women, to build their capacity and enhance their economic role. With headquarters in Lahore, Punjab, Kashf have regional offices in five major cities and over 200 branches across Pakistan.