Related Research Articles

Milton Friedman was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. With George Stigler, Friedman was among the intellectual leaders of the Chicago school of economics, a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago that rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. Several students, young professors and academics who were recruited or mentored by Friedman at Chicago went on to become leading economists, including Gary Becker, Robert Fogel, and Robert Lucas Jr.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

Monetarism is a school of thought in monetary economics that emphasizes the role of policy-makers in controlling the amount of money in circulation. It gained prominence in the 1970s, but was mostly abandoned as a practical guidance to monetary policy during the following decade because the strategy was found not to work very well in practice.

Monetary economics is the branch of economics that studies the different theories of money: it provides a framework for analyzing money and considers its functions, and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

The Federal Reserve System has faced various criticisms since it was authorized in 1913. Nobel laureate economist Milton Friedman and his fellow monetarist Anna Schwartz criticized the Fed's response to the Wall Street Crash of 1929 arguing that it greatly exacerbated the Great Depression. More recent prominent critics include former Congressman Ron Paul.

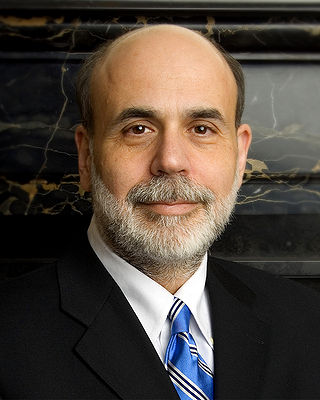

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve's response to the late-2000s financial crisis, for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the Department of Economics there from 1996 to September 2002, when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", more specifically for his analysis of the Great Depression.

Peter Bain Kenen was an American economist, who was the Walker Professor of Economics and International Finance at Princeton University, and senior fellow in international economics at the Council on Foreign Relations.

Anna Jacobson Schwartz was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for The New York Times. Paul Krugman has said that Schwartz is "one of the world's greatest monetary scholars."

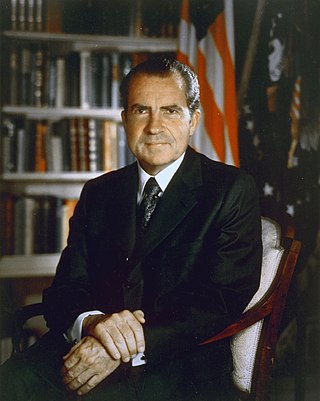

The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, in response to increasing inflation, the most significant of which were wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold.

Monetary hegemony is an economic and political concept in which a single state has decisive influence over the functions of the international monetary system. A monetary hegemon would need:

Frederic Stanley "Rick" Mishkin is an American economist and Alfred Lerner professor of Banking and Financial Institutions at the Graduate School of Business, Columbia University. He was a member of the Federal Reserve Board of Governors from 2006 to 2008.

The Shadow Open Market Committee (SOMC) is an independent group of economists, first organized in 1973 by Professors Karl Brunner, from the University of Rochester, and Allan Meltzer, from Carnegie Mellon University, to provide a monetarist alternative to the views on monetary policy and its inflation effects then prevailing at the Federal Reserve and within the economics profession.

The College National Fed Challenge is an annual team competition for undergraduate college students inspired by the working of the Federal Open Market Committee. The competition is intended to encourage students to learn more about the U.S. macro economy, the Federal Reserve System and the implementation of monetary policy. The College Fed Challenge also aims at promoting interest in economics and finance as subjects for advanced study and as the basis for a career.

A Monetary History of the United States, 1867–1960 is a book written in 1963 by Nobel Prize–winning economist Milton Friedman and Anna J. Schwartz. It uses historical time series and economic analysis to argue the then-novel proposition that changes in the money supply profoundly influenced the U.S. economy, especially the behavior of economic fluctuations. The implication they draw is that changes in the money supply had unintended adverse effects, and that sound monetary policy is necessary for economic stability. Orthodox economic historians see it as one of the most influential economics books of the century. The chapter dealing with the causes of the Great Depression was published as a stand-alone book titled The Great Contraction, 1929–1933.

The term exorbitant privilege refers to the benefits the United States has due to its own currency being the international reserve currency. For example, the US would not face a balance of payments crisis, because their imports are purchased in their own currency. Exorbitant privilege as a concept cannot refer to currencies that have a regional reserve currency role, only to global reserve currencies.

Clark Warburton was an American economist. He was described as the "first monetarist of the post-World War II period," the most uncompromising upholder of a strictly monetary theory of business fluctuations, and reviver of classic monetary-disequilibrium theory and the quantity theory of money.

Joseph Gerard Haubrich is an economist and consultant. His work focuses on financial institution and regulations research.

The Panic of 1930 was a financial crisis that occurred in the United States which led to a severe decline in the money supply during a period of declining economic activity. A series of bank failures from agricultural areas during this time period sparked panic among depositors which led to widespread bank runs across the country.

Angela Redish is a professor of economics at the Vancouver School of Economics at the University of British Columbia and the acting President of the Canadian Economics Association. From 2001 to 2006, Redish served as the Head of Department of Economics at the University of British Columbia and was awarded The President's Medal of Excellence by the University of British Columbia in 2018 for her contributions towards establishing the Vancouver School of Economics.

The United States was a founding member of the International Monetary Fund (IMF), having hosted the other countries at the IMF’s founding conference, the Bretton Woods Conference, in 1944. The US delegation played an integral role in the establishment of the basic tenets of the IMF and maintains a large presence in the workings of the organization.

References

- ↑ Motovidlak, Dave. "Department of Economics | School of Arts and Sciences - Rutgers, The State University of New Jersey". economics.rutgers.edu. Retrieved 2018-01-10.

- ↑ "Michael D. Bordo". Hoover Institution. Retrieved 2018-01-10.

- ↑ Federal Reserve Bank of St. Louis. "Economics Field Rankings: Business, Economic & Financial History | IDEAS/RePEc". ideas.repec.org. Retrieved 2018-01-10.

- ↑ "Personal page - Michael Bordo" (PDF).

- ↑ "Michael D. Bordo". www.nber.org. Retrieved 2018-01-10.

- ↑ Motovidlak, Dave. "Department of Economics | School of Arts and Sciences - Rutgers, The State University of New Jersey". economics.rutgers.edu. Retrieved 2018-01-10.

- ↑ Motovidlak, Dave. "Department of Economics | School of Arts and Sciences - Rutgers, The State University of New Jersey". economics.rutgers.edu. Retrieved 2018-01-10.