Related Research Articles

Unemployment, according to the OECD, is people above a specified age not being in paid employment or self-employment but currently available for work during the reference period.

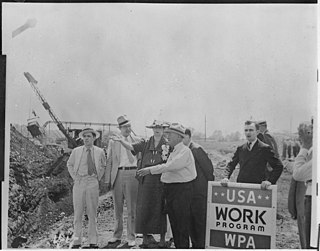

The Full Employment and Balanced Growth Act is an act of legislation by the United States government.

Full employment is a situation in which there is no cyclical or deficient-demand unemployment. Full employment does not entail the disappearance of all unemployment, as other kinds of unemployment, namely structural and frictional, may remain. For instance, workers who are "between jobs" for short periods of time as they search for better employment are not counted against full employment, as such unemployment is frictional rather than cyclical. An economy with full employment might also have unemployment or underemployment where part-time workers cannot find jobs appropriate to their skill level, as such unemployment is considered structural rather than cyclical. Full employment marks the point past which expansionary fiscal and/or monetary policy cannot reduce unemployment any further without causing inflation.

The Phillips curve is an economic model, named after Bill Phillips, that correlates reduced unemployment with increasing wages in an economy. While Phillips did not directly link employment and inflation, this was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place.

The natural rate of unemployment is the name that was given to a key concept in the study of economic activity. Milton Friedman and Edmund Phelps, tackling this 'human' problem in the 1960s, both received the Nobel Memorial Prize in Economic Sciences for their work, and the development of the concept is cited as a main motivation behind the prize. A simplistic summary of the concept is: 'The natural rate of unemployment, when an economy is in a steady state of "full employment", is the proportion of the workforce who are unemployed'. Put another way, this concept clarifies that the economic term "full employment" does not mean "zero unemployment". It represents the hypothetical unemployment rate consistent with aggregate production being at the "long-run" level. This level is consistent with aggregate production in the absence of various temporary frictions such as incomplete price adjustment in labor and goods markets. The natural rate of unemployment therefore corresponds to the unemployment rate prevailing under a classical view of determination of activity.

Employers of last resort (ELR) are employers in an economy to whom workers go for jobs when no other jobs are available; the term is by analogy with "lender of last resort". The phrase is used in two senses:

Modern monetary theory or modern money theory (MMT) is a heterodox macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires. According to MMT, governments do not need to worry about accumulating debt since they can create new money by using fiscal policy in order to pay interest. MMT argues that the primary risk once the economy reaches full employment is inflation, which acts as the only constraint on spending. MMT also argues that inflation can be addressed by increasing taxes on everyone to reduce the spending capacity of the private sector.

The White Paper Full Employment in Australia, published in 1945, was the defining document of the official economic policy in Australia until the 1970s. For the first time, the Australian government accepted an obligation to guarantee full employment and to intervene as necessary to implement that guarantee. The preparation of the paper was ordered by The Australian Labor Party Prime Minister John Curtin and his Employment Minister John Dedman and undertaken by a group of economists headed by H.C. Coombs.

A job guarantee is an economic policy proposal that aims to create full employment and price stability by having the state promise to hire unemployed workers as an employer of last resort (ELR). It aims to provide a sustainable solution to inflation and unemployment.

Non-accelerating inflation rate of unemployment (NAIRU) is a theoretical level of unemployment below which inflation would be expected to rise. It was first introduced as NIRU by Franco Modigliani and Lucas Papademos in 1975, as an improvement over the "natural rate of unemployment" concept, which was proposed earlier by Milton Friedman.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

Warren Mosler is an American hedge fund manager and entrepreneur. He is a co-founder of the Center for Full Employment And Price Stability at University of Missouri-Kansas City. and the founder of Mosler Automotive.

In economics, hysteresis consists of effects that persist after the initial causes giving rise to the effects are removed. Two of the main areas in economics where hysteresis effects are invoked to explain economic phenomena are unemployment and international trade.

William Francis Mitchell is a professor of economics at the University of Newcastle, New South Wales, Australia and Docent Professor of Global Political Economy at the University of Helsinki, Finland. He is also a guest professor at Kyoto University, Japan since 2022. He is one of the founding developers of Modern Monetary Theory.

Joan Muysken is a Dutch professor emeritus of Economics at the Maastricht University.

Larry Randall Wray is a professor of Economics at Bard College and Senior Scholar at the Levy Economics Institute. Previously, he was a professor at the University of Missouri–Kansas City in Kansas City, Missouri, USA, whose faculty he joined in August 1999, and a professor at the University of Denver, where he served from 1987 to 1999. He has served as a visiting professor at the University of Rome, Italy, the University of Paris, France, and the UNAM, in Mexico City. From 1994 to 1995 he was a Fulbright Scholar at the University of Bologna. From 2015 he is a visiting professor at the University of Bergamo, located in Italy. He was a visiting professor at Masaryk University in the Czech Republic.

In macroeconomics, chartalism is a heterodox theory of money that argues that money originated historically with states' attempts to direct economic activity rather than as a spontaneous solution to the problems with barter or as a means with which to tokenize debt, and that fiat currency has value in exchange because of sovereign power to levy taxes on economic activity payable in the currency they issue.

Full Employment Abandoned: Shifting Sands and Policy Failures is a book on macroeconomic issues written by economists Bill Mitchell and Joan Muysken and first published in 2008.

Pavlina R. Tcherneva is an American economist, of Bulgarian descent, working as associate professor of economics at Bard College. She is also a research associate at the Levy Economics Institute and expert at the Institute for New Economic Thinking.

The National Emergency Employment Defense Act, aka the NEED Act, is a monetary reform proposal submitted by Congressman Dennis Kucinich in 2011, in the United States. The bill has failed to gain any co-supporters and was not introduced to the floor of the house.

References

- Febrero, Eladio (2009), "Three difficulties with neo-chartalism" (PDF), Journal of Post Keynesian Economics, 31 (3): 523–541, CiteSeerX 10.1.1.564.8770 , doi:10.2753/PKE0160-3477310308, S2CID 154990728

- Lerner, Abba P. (1947), "Money as a Creature of the State", American Economic Review

- Minsky, H.P. (1965), The Role of Employment Policy, in M.S. Gordon (ed.), Poverty in America, San Francisco, CA: Chandler Publishing Company.

{{citation}}: CS1 maint: postscript (link) - Mitchell, Bill (2009), The fundamental principles of modern monetary economicsin "It’s Hard Being a Bear (Part Six)? Good Alternative Theory?" (PDF)

{{citation}}: External link in|postscript= - Wray, L. Randall (2000), The Neo-Chartalist Approach to Money, UMKC Center for Full Employment and Price Stability

- Wray, L. Randall (2001), The Endogenous Money Approach, UMKC Center for Full Employment and Price Stability

- Wray, L. Randall (December 2010), Money, Levy Economics Institute of Bard College