NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange.

The Nasdaq Stock Market is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

The New York Stock Exchange is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$30.1 trillion as of February 2018. The average daily trading value was approximately US$169 billion in 2013. The NYSE trading floor is at the New York Stock Exchange Building on 11 Wall Street and 18 Broad Street and is a National Historic Landmark. An additional trading room, at 30 Broad Street, was closed in February 2007.

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for the financial markets of the United States as a whole, the American financial services industry, New York–based financial interests, or the Financial District itself.

Speculation is the purchase of an asset with the hope that it will become more valuable in the near future. In finance, speculation is also the practice of engaging in risky financial transactions in an attempt to profit from short term fluctuations in the market value of a tradable financial instrument—rather than attempting to profit from the underlying financial attributes embodied in the instrument such as value addition, return on investment, or dividends.

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed.

The Black Friday gold panic of September 24, 1869 was caused by a conspiracy between two investors, Jay Gould and his partner James Fisk, and Abel Corbin, a small time speculator who had married Virginia (Jennie) Grant, the younger sister of President Grant. They formed the Gold Ring to corner the gold market and force up the price of that metal on the New York Gold Exchange. The scandal took place during the Presidency of Ulysses S. Grant, whose policy was to sell Treasury gold at weekly intervals to pay off the national debt, stabilize the dollar, and boost the economy. The country had gone through tremendous upheaval during the Civil War and was not yet fully restored.

Day trading is a form of speculation in securities in which a trader buys and sells a financial instrument within the same trading day, so that all positions are closed before the market closes for the trading day to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Traders who trade in this capacity are generally classified as speculators. Day trading contrasts with the long-term trades underlying buy and hold and value investing strategies. Day trading can be considered a form of gambling. It is made easier using day trading software.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

In finance, cornering the market consists of obtaining sufficient control of a particular stock, commodity, or other asset in an attempt to manipulate the market price. One definition of cornering a market is "having the greatest market share in a particular industry without having a monopoly".

Front running, also known as tailgating, is the prohibited practice of entering into an equity (stock) trade, option, futures contract, derivative, or security-based swap to capitalize on advance, nonpublic knowledge of a large ("block") pending transaction that will influence the price of the underlying security. In essence, it means the practice of engaging in a Personal Securities Transaction in advance of a transaction in the same security for a client's account. Front running is considered a form of market manipulation in many markets. Cases typically involve individual brokers or brokerage firms trading stock in and out of undisclosed, unmonitored accounts of relatives or confederates. Institutional and individual investors may also commit a front running violation when they are privy to inside information. A front running firm either buys for its own account before filling customer buy orders that drive up the price, or sells for its own account before filling customer sell orders that drive down the price. Front running is prohibited since the front-runner profits from nonpublic information, at the expense of its own customers, the block trade, or the public market.

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, or stockbroker. Such equity trading in large publicly traded companies may be through a stock exchange. Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets.

Robert Sobel was an American professor of history at Hofstra University and a well-known and prolific writer of business histories.

The New Board was an organization of curb-stone brokers established in 1836 in New York City to compete with the New York Stock and Exchange Board. It folded in 1848.

A bucket shop is a business that allows gambling based on the prices of stocks or commodities. A 1906 U.S. Supreme Court ruling defined a bucket shop as "an establishment, nominally for the transaction of a stock exchange business, or business of similar character, but really for the registration of bets, or wagers, usually for small amounts, on the rise or fall of the prices of stocks, grain, oil, etc., there being no transfer or delivery of the stock or commodities nominally dealt in".

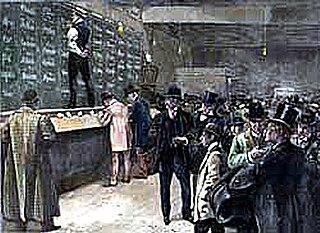

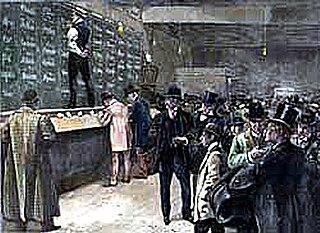

The phrase curbstone broker or curb-stone broker refers to a broker who conducts trading on the literal curbs of a financial district. Such brokers were prevalent in the 1800s and early 1900s, and the most famous curb market existed on Broad Street in the financial district of Manhattan. Curbstone brokers often traded stocks that were speculative in nature, as well as stocks in small industrial companies such as iron, textiles and chemicals. Efforts to organize and standardize the market started early in the 20th century under notable curb-stone brokers such as Emanuel S. Mendels.

Investors Exchange (IEX) is a stock exchange based in the United States. It was founded in 2012 in order to mitigate the effects of high-frequency trading. IEX was launched as a national securities exchange in September 2016. On October 24, 2017, IEX received regulatory approval from the SEC to list companies. IEX listed its first public company, Interactive Brokers, on October 5, 2018. The exchange said that companies would be able to list for free for the first five years, before a flat annual rate of $50,000. On September 23, 2019 it announced it was exiting its listing business.

The American Stock Exchange Building, formerly known as the New York Curb Exchange Building and also known as 86 Trinity Place or 123 Greenwich Street, is the former headquarters of the American Stock Exchange. Designed in two sections by Starrett & van Vleck, it is located between Greenwich Street and Trinity Place in the Financial District of Lower Manhattan in New York City, with its main entrance at Trinity Place. The building represents a link to the historical practices of stock trading outside the strictures of the New York Stock Exchange (NYSE), which took place outdoors "on the curb" prior to the construction of the structure.

Interactive Brokers LLC (IB) is an American multinational brokerage firm. It operates the largest electronic trading platform in the U.S. by number of daily average revenue trades. The company brokers stocks, options, futures, EFPs, futures options, forex, bonds, and funds.