This article needs additional citations for verification .(December 2014) |

Nicolas Darvas (1920–1977) was a Hungarian dancer, self-taught investor, and author. He is best known for his book, "How I Made $2,000,000 in the Stock Market."

This article needs additional citations for verification .(December 2014) |

Nicolas Darvas (1920–1977) was a Hungarian dancer, self-taught investor, and author. He is best known for his book, "How I Made $2,000,000 in the Stock Market."

Hungarian by birth, Darvas trained as an economist at the University of Budapest. Reluctant to remain in Hungary until either the Nazis or the Soviet Union took over, he fled in June 1943 at the age of 23 with a forged exit visa and fifty pounds sterling to Istanbul, Turkey. Sometime later, he met up with his half-sister Julia, who became his partner in a dancing team in Europe and the United States. [1]

In April 1953 the two appeared with Judy Garland and Bob Hope.[ citation needed ] By 1956, they were touring. [2] [3]

During his off hours as a dancer, he had read some 200 books on the market and on speculators, sometimes reading up to eight hours a day. [4] He began his studies by reading the following: [5]

The two books which he read almost every week were The Battle for Investment Survival, by Gerald M. Loeb, published in 1935, and Tape Reading and Market Tactics, by Humphrey Bancroft Neill, published in 1931. [6]

Darvas invested in a couple of stocks for which the share price had risen. The stocks continued to rise and he subsequently sold them at a profit. He subsequently came up with an approach and plan for trading stocks from which he received $2,450,000.00 in 18 months, during the 1957–58 bull market, seven years since his first trade. [7]

From the week ending December 16, 1957, through the week ending July 27, 1959, the S&P 500 rose over 53%. Market moves of that size have only happened seven times since 1950, according to Yahoo Finance weekly S&P 500 prices.[ citation needed ]

His main source of stock selection was from Barron's. [4] The magazine was usually a week-old edition, since he was traveling in his performing dance troupe. He would use cables and telegrams to send his buy and sell stop orders to his broker in New York City. From now on Darvas would select a stock when it made a good advance on strong volume, with favourable fundamental company research. [4]

Darvas claimed his method often revealed the signs of insider trading before a company's release of favourable news to the public.

His stock selection method was called "BOX theory". He considered a stock price wave as a series of boxes. When the stock price was confined in a box, he waited. He bought when the price rose out of the box. He simultaneously set a stop-loss just under this trade price.

At the age of 39, after accumulating his fortune and also being exposed in Time magazine, [6] Darvas documented his actions in the book, How I Made 2,000,000 in the Stock Market. The book describes his "Box System", which he used to buy and sell stocks.

Darvas is best-known for his book How I Made $2,000,000 in the Stock Market.

In his third book, he wrote "Later, I went on to explore and become successful in other fields, the fashion industry, theatrical producing, real estate are just a few". Here he claims "the formula for success remains essentially the same". In the book he set out what he called "the rules to be followed". [8] "But one must know the correct route". [9]

Time magazine subsequently reported that the New York Attorney General had "thrown the book" at Darvas, charging that his story was "unqualifiedly false" and that it could find "ascertainable" profits of only $216,000. [10] The action was the first to be taken under a broadened state law that banned fraud or misrepresentation in giving investment advice.

In a follow up, dated January 13, 1961, Time reported that the probe was blocked by the court, which ruled that the investigation by Attorney General Louis J. Lefkowitz was an "unwarranted invasion of the free press". Time also reported that state investigators admitted that they had not been able to track down all of the dancer's brokerage accounts.[ citation needed ]

Darvas called the charges false, a "cynically irresponsible action, book burning by publicity". [11] He stated, "I keep out in a bear market and leave such exceptional stocks to those who don't mind risking their money against the market trend". [12]

Darvas claimed to have never sold short. He said in 1977, "I have never done it myself because psychologically I am not cut out for short selling. But I think markets have now changed their character so much that all experienced investors should seriously consider it. It is not for the proverbial widows and orphans, though." [13]

Chapter 1 – Canadian Period. Chapter 2 – Entering Wall Street. Chapter 3 – My First Crisis. Chapter 4 – Developing the Box Theory. Chapter 5 – Cables Round the World. Chapter 6 – During the Baby-Bear Market. Chapter 7 – The Theory Starts to Work. Chapter 8 – My First Half-Million. Chapter 9 – My Second Crisis. Chapter 10 – Two Million Dollars. Appendix – Interview With Time Magazine

Chapter 1 – The Casino Chapter. 2 – The Dealers. Chapter 3 – The Croupiers. Chapter 4 – The Touts. Chapter 5 – Personal Protection : Hedging My Bets. Chapter 6 – Playing in the Casino – My Buying Game. Chapter 7 – Playing in the Casino – My Selling Game. Chapter 8 – Figuring My Winnings Appendix – Index of Stocks.

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though more often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business. The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets.

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks, which represent ownership claims on businesses; these may include securities listed on a public stock exchange as well as stock that is only traded privately, such as shares of private companies that are sold to investors through equity crowdfunding platforms. Investments are usually made with an investment strategy in mind.

Investment is traditionally defined as the "commitment of resources to achieve later benefits". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream.

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. As a type of active management, it stands in contradiction to much of modern portfolio theory. The efficacy of technical analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. It is distinguished from fundamental analysis, which considers a company's financial statements, health, and the overall state of the market and economy.

In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite of the more common long position, where the investor will profit if the market value of the asset rises. An investor that sells an asset short is, as to that asset, a short seller.

Day trading is a form of speculation in securities in which a trader buys and sells a financial instrument within the same trading day, so that all positions are closed before the market closes for the trading day to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Traders who trade in this capacity are generally classified as speculators. Day trading contrasts with the long-term trades underlying buy-and-hold and value investing strategies. Day trading may require fast trade execution, sometimes as fast as milli-seconds in scalping, therefore direct-access day trading software is often needed.

Value investing is an investment paradigm that involves buying securities that appear underpriced by some form of fundamental analysis. Modern value investing derives from the investment philosophy taught by Benjamin Graham and David Dodd at Columbia Business School starting in 1928 and subsequently developed in their 1934 text Security Analysis.

Peter Lynch is an American investor, mutual fund manager, author and philanthropist. As the manager of the Magellan Fund at Fidelity Investments between 1977 and 1990, Lynch averaged a 29.2% annual return, consistently more than double the S&P 500 stock market index and making it the best-performing mutual fund in the world. During his 13-year tenure, assets under management increased from US$18 million to $14 billion.

Contrarian investing is an investment strategy that is characterized by purchasing and selling in contrast to the prevailing sentiment of the time.

Jesse Lauriston Livermore was an American stock trader. He is considered a pioneer of day trading and was the basis for the main character of Reminiscences of a Stock Operator, a best-selling book by Edwin Lefèvre. At one time, Livermore was one of the richest people in the world; however, at the time of his suicide, he had liabilities greater than his assets.

James Joseph Cramer is an American television personality, author, entertainer, and former hedge fund manager. He is the host of Mad Money on CNBC, and an anchor on Squawk on the Street. After graduating from Harvard College and Harvard Law School, he worked for Goldman Sachs and then became a hedge fund manager, founder, and senior partner of Cramer Berkowitz. He co-founded TheStreet, which he wrote for from 1996 to 2021. Cramer hosted Kudlow & Cramer from 2002 to 2005. Mad Money with Jim Cramer first aired on CNBC in 2005. Cramer has written several books, including Confessions of a Street Addict (2002), Jim Cramer's Real Money: Sane Investing in an Insane World (2005), Jim Cramer's Mad Money: Watch TV, Get Rich (2006), and Jim Cramer's Get Rich Carefully (2013).

William Joseph O'Neil was an American businessman, stockbroker, and writer. He founded the stock brokerage firm William O'Neil & Co. Inc in 1963 and the financial newspaper Investor's Business Daily in 1984. O'Neil was the author of books like How to Make Money in Stocks, 24 Essential Lessons for Investment Success, and The Successful Investor, and created the CAN SLIM investment strategy.

A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting to profit from the purchase and sale of those securities. Stock traders may be an investor, agent, hedger, arbitrageur, speculator, or stockbroker. Such equity trading in large publicly traded companies may be through a stock exchange. Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets or in some instances in equity crowdfunding platforms.

Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information. The setups are generally made to result in monetary gain for the deceivers, and generally result in unfair monetary losses for the investors. They are generally violating securities laws.

Indonesia Stock Exchange (IDX) is a stock exchange based in Jakarta, Indonesia. It was previously known as the Jakarta Stock Exchange (JSX) before its name changed in 2007 after merging with the Surabaya Stock Exchange (SSX). In recent years, the Indonesian Stock Exchange has seen the fastest membership growth in Asia. As of December 2024, the Indonesia Stock Exchange had 943 listed companies, and total number of investors has already grown to 14.8 million. Indonesia Market Capitalization accounted for 45.2% of its nominal GDP in December 2020. Founded on 30 November 2007, it is ASEAN's largest market capitalization at US$881 billion as of 19 September 2024.

CAN SLIM is an acronym developed by the American investor William O'Neil, intended to represent the seven characteristics that top-performing stocks often share before making their biggest price gains.

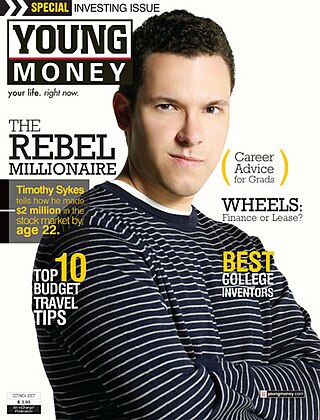

Timothy Sykes is a penny stock trader and blogger who self-reported trading profits of $1.65 million from a $12,415 Bar mitzvah gift through day trading while in college. He runs a blog and subscription platform whose aim is to teach about how to trade penny stocks. According to a Forbes editorial piece, he made up to $20 million via subscriptions to this platform in 2015 alone.

Gerald Martin Loeb was a founding partner of E.F. Hutton & Co., a renowned Wall Street trading and brokerage firm. He was the author of the books The Battle For Investment Survival and The Battle For Stock Market Profits. Loeb promoted a view of the market as too risky to hold stocks for the long term, in contrast to well-known value investors. He also created the Gerald Loeb Award, given annually for excellence in various categories of financial journalism.

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative structuring or pricing, risk management, investment management and other related finance occupations. The occupation is similar to those in industrial mathematics in other industries. The process usually consists of searching vast databases for patterns, such as correlations among liquid assets or price-movement patterns.

In finance, a bull is a speculator in a stock market who buys a holding in a stock in the expectation that, in the very short-term, it will rise in value, whereupon they will sell the stock to make a quick profit on the transaction. Strictly speaking, the term applies to speculators who borrow money to fund such a purchase, and are thus under great pressure to complete the transaction before the loan is repayable or the seller of the stock demands payment on settlement day for delivery of the bargain. If the value of the stock falls contrary to their expectation, a bull suffers a loss, frequently very large if they are trading on margin. A bull has a great incentive to "talk-up" the value of their stock or to manipulate the market of their stock, for example by spreading false rumors, to procure a buyer or to cause a temporary price increase which will provide them with the selling opportunity and profit they require.