JPMorgan Chase & Co. is an American multinational finance company headquartered in New York City and incorporated in Delaware. It is the largest bank in the United States and the world's largest bank by market capitalization as of 2023. As the largest of Big Four banks, the firm is considered systemically important by the Financial Stability Board. Its size and scale have often led to enhanced regulatory oversight as well as the maintenance of an internal "Fortress Balance Sheet". The firm is headquartered at 383 Madison Avenue in Midtown Manhattan and is set to move into the under-construction JPMorgan Chase Building at 270 Park Avenue in 2025.

JPMorgan Chase Bank, N.A., doing business as Chase, is an American national bank headquartered in New York City that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and financial services holding company, JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and the Manhattan Company in 1955. The bank merged with Chemical Bank New York in 1996 and later merged with Bank One Corporation in 2004 and in 2008 acquired the deposits and most assets of Washington Mutual. In May 2023, it acquired the assets of First Republic Bank.

The Bear Stearns Companies, Inc. was an American investment bank, securities trading, and brokerage firm that failed in 2008 as part of the global financial crisis and recession. After its closure it was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis.

Intuit Inc. is an American multinational business software company that specializes in financial software. The company is headquartered in Mountain View, California, and the CEO is Sasan Goodarzi. Intuit's products include the tax preparation application TurboTax, personal finance app Mint, the small business accounting program QuickBooks, the credit monitoring service Credit Karma, and email marketing platform Mailchimp. As of 2019, more than 95% of its revenues and earnings come from its activities within the United States.

Daniel Gilbert is an American billionaire, businessman, and philanthropist. He is the co-founder and majority owner of Rocket Mortgage, founder of Rock Ventures, and owner of the National Basketball Association's Cleveland Cavaliers. Gilbert owns several sports franchises, including the American Hockey League's Cleveland Monsters, and the NBA G League's Cleveland Charge. He operates the Rocket Mortgage FieldHouse in Cleveland, Ohio, home to the Cavaliers and Monsters. As of January 2023, Forbes estimated his net worth at US$18.3 billion.

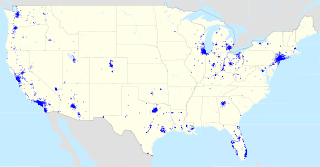

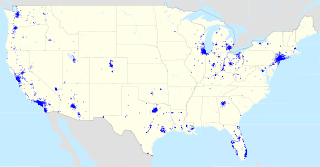

Rocket Mortgage, LLC, formerly Quicken Loans, LLC, is an American mortgage lender, headquartered in Detroit, Michigan. In January 2018, the company became the largest overall retail lender in the U.S., it was also the largest online retail mortgage lender in 2018. In the third quarter of 2022, the title of largest overall lender was relinquished to United Wholesale Mortgage Company. Rocket Mortgage relies on wholesale funding to make its loans and uses online applications rather than a branch system. Amrock and One Reverse Mortgage are also part of the Rocket Mortgage Family of Companies. The company closed more than $400 billion of mortgage volume across all 50 states from 2013 through 2017.

E-Loan, Inc. is a financial services company that offers its users access to partners that may be able to assist them in obtaining loans.

First Republic Bank was a commercial bank and provider of wealth management services headquartered in San Francisco, California. It catered to high-net-worth individuals and operated 93 offices in 11 states, primarily in New York, California, Massachusetts, and Florida. On May 1, 2023, as part of the 2023 United States banking crisis, the FDIC announced that First Republic had been closed and sold to JPMorgan Chase.

Mint, also known as Intuit Mint and formerly known as Mint.com, was a personal financial management website and mobile app for the US and Canada produced by Intuit, Inc..

LendingClub is a financial services company headquartered in San Francisco, California. It was the first peer-to-peer lender to register its offerings as securities with the Securities and Exchange Commission (SEC), and to offer loan trading on a secondary market. At its height, LendingClub was the world's largest peer-to-peer lending platform. The company reported that $15.98 billion in loans had been originated through its platform up to December 31, 2015.

CCMP Capital Advisors, LP is an American private equity investment firm that focuses on leveraged buyout and growth capital transactions. Formerly known as JP Morgan Partners, the investment professionals of JP Morgan Partners separated from JPMorgan Chase on July 31, 2006. CCMP has invested approximately $12 billion in leveraged buyout and growth capital transactions since inception. In 2007, CCMP was ranked #17 among the world's largest private equity funds.

Highbridge Capital Management, LLC is a multi-strategy alternative investment management firm founded by Glenn Dubin and Henry Swieca in 1992. In 2004, it was purchased by JPMorgan Chase; as of 2019, it had about $3.9 billion in assets under management, out of $150 billion in JPMorgan's global alternatives division.

WePay is an online payment service provider based in the United States. It provides an integrated and customizable payment solution, through its APIs, to platform businesses such as crowdfunding sites, marketplaces and small business software companies. It also offers partners fraud and risk protection.

Base CRM is an enterprise software company based in Mountain View, California with R&D offices located in Kraków, Poland. It provides a web-based all-in-one sales platform that features tools for email, phone dialing, pipeline management, forecasting, reporting and more. Base's platform is available on iOS and Android, and was the first full native CRM Android app available. On September 10, 2018 Base was acquired by Zendesk and later rebranded as Zendesk Sell.

SoFi Technologies, Inc. is an American online personal finance company and online bank. Based in San Francisco, SoFi provides financial products including student loan refinancing, mortgages, personal loans, credit card, investing, and banking through both mobile app and desktop interfaces.

Avant, LLC, formerly AvantCredit, is a private Chicago, Illinois-based company in the financial technology industry. The company was established in 2012 by serial entrepreneur Albert "Al" Goldstein, John Sun, and Paul Zhang. Initially structured as a mid-prime lender, the company issued its first personal unsecured loan in early 2013 using its proprietary technology to determine an individual's creditworthiness.

StreetShares, Inc. is a financial technology company and small business funding marketplace based outside of Washington, D.C.

Biz2Credit is an online financing platform for small businesses. The company provides direct funding to small businesses across the United States. The company is known for its financing products, educational resources for business such as the BizAnalyzer, and research that it publishes periodically, including the Small Business Lending Index, and its subsidiary SaaS business lending platform Biz2X.

Lighter Capital is a revenue-based financing lender that specializes in providing financial capital to small technology companies.

Vishal Garg is an Indian-American entrepreneur. He is the chief executive officer of mortgage lending company Better.com and previously co-founded the student loan company MyRichUncle.