Ballot Measure 47 was an initiative in the U.S. state of Oregon that passed in 1996, affecting the assessment of property taxes and instituting a double majority provision for tax legislation. Measure 50 was a revised version of the law, which also passed, after being referred to the voters by the 1997 state legislature.

The Oregon Medical Marijuana Act, a law in the U.S. state of Oregon, was established by Oregon Ballot Measure 67 in 1998, passing with 54.6% support. It modified state law to allow the cultivation, possession, and use of marijuana by doctor recommendation for patients with certain medical conditions. The Act does not affect federal law, which still prohibits the cultivation and possession of marijuana.

The Oregon Citizens Alliance (OCA) was a conservative Christian political activist organization, founded by Lon Mabon in the U.S. state of Oregon. It was founded in 1986 as a vehicle to challenge then–U.S. Senator Bob Packwood in the Republican primaries, and was involved in Oregon politics from the late 1980s into the 1990s.

Randall Edwards is an American politician who most recently served as the state treasurer of the state of Oregon. A Democrat, Edwards was elected as treasurer in 2000, and reelected in 2004, after serving two terms in the Oregon Legislative Assembly. He served as a manager and senior advisor at the state treasury from 1992–1996, and was an International Trade Analyst for the U.S. Commerce Department.

Term limits legislation – term limits for state and federal office-holders – has been a recurring political issue in the U.S. state of Oregon since 1992. In that year's general election, Oregon voters approved Ballot Measure 3, an initiative that enacted term limits for representatives in both houses of the United States Congress and the Oregon Legislative Assembly, and statewide officeholders. It has been described as the strictest term limits law in the country.

Elections in Oregon are all held using a Vote by Mail (VBM) system. This means that all registered voters receive their ballots via postal delivery and can vote from their homes. A state Voters’ Pamphlet is mailed to every household in Oregon about three weeks before each statewide election. It includes information about each measure and candidate in the upcoming election.

The Oregon tax rebate, commonly referred to as the kicker, is a rebate calculated for both individual and corporate taxpayers in the U.S. state of Oregon when a revenue surplus exists. The Oregon Constitution mandates that the rebate be issued when the calculated revenue for a given biennium exceeds the forecast revenue by at least two percent. The law was first passed by ballot measure in 1980, and was entered into the Oregon Constitution with the passage of Ballot Measure 86 in 2000.

On November 4, 2008, the U.S. state of Oregon held statewide general elections for three statewide offices, both houses of the Oregon Legislative Assembly, and twelve state ballot measures. The primary elections were held on May 20, 2008. Both elections also included national races for President of the US, US Senator, and US House Representatives. Numerous local jurisdictions — cities, counties, and regional government entities — held elections for various local offices and ballot measures on these days as well.

The 75th Oregon Legislative Assembly convened beginning on January 12, 2009, for its biennial regular session. All of the 60 seats in the House of Representatives and half of the 30 seats in the State Senate were up for election in 2008; the general election for those seats took place on November 4.

Oregon Ballot Measure 64 was an initiated state statute ballot measure on the November 4, 2008 general election ballot in Oregon.

Oregon Ballot Measure 59 was an initiated state statute ballot measure sponsored by Bill Sizemore that appeared on the November 4, 2008 general election ballot in Oregon, United States. If it had passed, Oregon would have join Alabama, Iowa, and Louisiana as the only states to allow federal income taxes to be fully deducted on state income tax returns.

Oregon Ballot Measure 61 was an initiated state statute ballot measure that enacted law to create mandatory minimum prison sentences for certain theft, identity theft, forgery, drug, and burglary crimes.

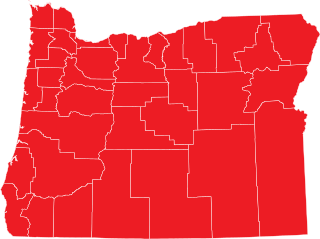

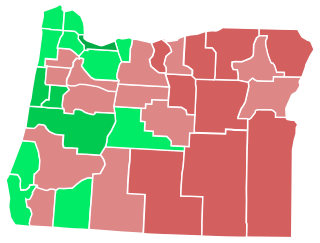

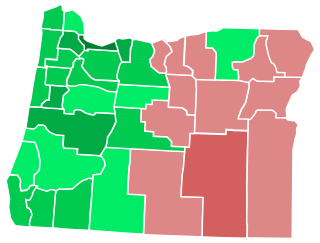

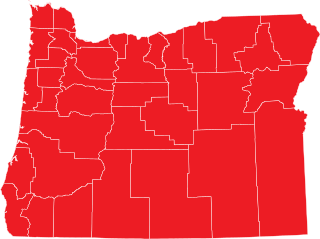

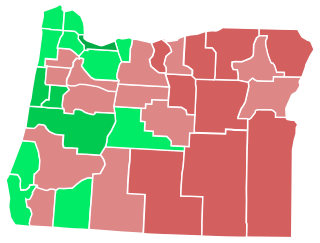

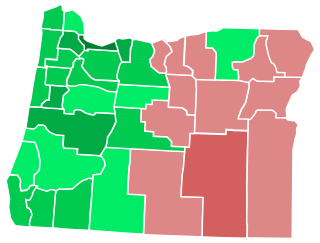

Measures 66 and 67 are two ballot referenda that were on the January 26, 2010 special election ballot in the US state of Oregon, which proposed tax increases on corporations and on households making US$250,000 and individuals making $125,000 to help balance the state's budget. The measures referred two bills passed by the Oregon state legislature on June 11, 2009, and signed by Governor Ted Kulongoski on July 20, 2009, to the voters for approval. They were approved and became effective February 25, 2010.

Oregon Ballot Measure 91 was a 2014 ballot measure in the U.S. state of Oregon. Its passage legalized the "recreational use of marijuana, based on regulation and taxation to be determined by the Oregon Liquor Control Commission".

Knute Carl Buehler is an American physician and politician who served as the Oregon State Representative for the 54th district from 2015 until January 2019. He was the Republican nominee for Governor of Oregon in the 2018 election, losing to incumbent Democrat Kate Brown.

A general election was held in the U.S. state of Oregon on November 8, 2016. Primary elections were held on May 17, 2016.

The 2018 Oregon gubernatorial election took place on November 6, 2018 to elect the Governor of Oregon who would serve a full four-year term, after the 2016 special election, where Governor Kate Brown was elected to serve the last two years of a four-year term.

Oregon Ballot Measure 100, titled the Wildlife Trafficking Prevention Act, is a ballot measure in the 2016 election in the U.S. state of Oregon. The measure prohibited the purchase, sale, or possession with intent to sell products and parts from specified nonnative wildlife species, specifically elephant, rhinoceros, whale, tiger, lion, leopard, cheetah, jaguar, pangolin, sea turtle, shark, and ray. The ballot measures created several exceptions for activities for law enforcement purposes, activities authorized by federal law, transfers of certain antiques and musical instruments, certain donations for scientific or educational purposes, and non-commercial transfers through gifts or inheritance, and well as for possession by enrolled members of federally recognized tribes. The ballot measure largely banned, among other things, the ivory trade in the state.

Oregon Ballot Measure 106 was a ballot measure on the 2018 election ballot in the U.S. state of Oregon.