Related Research Articles

The Defense Advanced Research Projects Agency (DARPA) is a research and development agency of the United States Department of Defense responsible for the development of emerging technologies for use by the military. Originally known as the Advanced Research Projects Agency (ARPA), the agency was created on February 7, 1958, by President Dwight D. Eisenhower in response to the Soviet launching of Sputnik 1 in 1957. By collaborating with academia, industry, and government partners, DARPA formulates and executes research and development projects to expand the frontiers of technology and science, often beyond immediate U.S. military requirements. The name of the organization first changed from its founding name, ARPA, to DARPA, in March 1972, changing back to ARPA in February 1993, then reverted to DARPA in March 1996.

In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, currency, or interest rate, and is often simply called the underlying. Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets.

John Marlan Poindexter is a retired United States naval officer and Department of Defense official. He was Deputy National Security Advisor and National Security Advisor during the Reagan administration. He was convicted in April 1990 of multiple felonies as a result of his actions in the Iran–Contra affair, but his convictions were reversed on appeal in 1991. During the George W. Bush administration, he served a brief stint as the director of the DARPA Information Awareness Office. He is the father of NASA astronaut and U.S. Navy Captain Alan G. Poindexter.

The Information Awareness Office (IAO) was established by the United States Defense Advanced Research Projects Agency (DARPA) in January 2002 to bring together several DARPA projects focused on applying surveillance and information technology to track and monitor terrorists and other asymmetric threats to U.S. national security by achieving "Total Information Awareness" (TIA).

Total Information Awareness (TIA) was a mass detection program by the United States Information Awareness Office. It operated under this title from February to May 2003 before being renamed Terrorism Information Awareness.

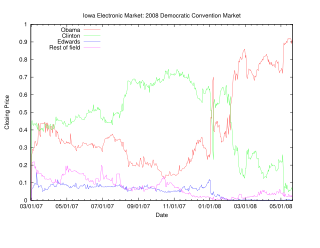

Prediction markets, also known as betting markets, information markets, decision markets, idea futures or event derivatives, are open markets that enable the prediction of specific outcomes using financial incentives. They are exchange-traded markets established for trading bets in the outcome of various events. The market prices can indicate what the crowd thinks the probability of the event is. A typical prediction market contract is set up to trade between 0 and 100%. The most common form of a prediction market is a binary option market, which will expire at the price of 0 or 100%. Prediction markets can be thought of as belonging to the more general concept of crowdsourcing which is specially designed to aggregate information on particular topics of interest. The main purposes of prediction markets are eliciting aggregating beliefs over an unknown future outcome. Traders with different beliefs trade on contracts whose payoffs are related to the unknown future outcome and the market prices of the contracts are considered as the aggregated belief.

Robin Dale Hanson is an associate professor of economics at George Mason University and a former research associate at the Future of Humanity Institute of Oxford University. He is known for his work on idea futures and markets, and he was involved in the creation of the Foresight Institute's Foresight Exchange and DARPA's FutureMAP project. He invented market scoring rules like LMSR used by prediction markets such as Consensus Point, and has conducted research on signalling. He also proposed the Great Filter hypothesis.

Thomas P. M. Barnett is an American military geostrategist and former chief analyst at Wikistrat. He developed a geopolitical theory that divided the world into "the Functioning Core" and the "Non-Integrating Gap" that made him particularly notable prior to the 2003 U.S. Invasion of Iraq when he wrote an article for Esquire in support of the military action entitled "The Pentagon's New Map". The central thesis of his geopolitical theory is that the connections the globalization brings between countries are synonymous with those countries with stable governments, rising standards of living, and "more deaths by suicide than by murder". These regions contrast with those where globalization has not yet penetrated, which is synonymous with political repression, poverty, disease, and mass-murder, and conflict. These areas make up the Non-Integrating Gap.

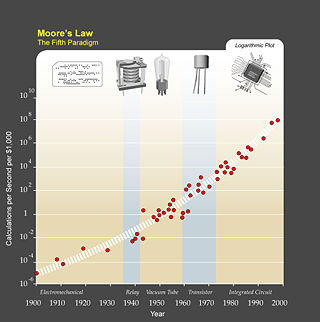

Futures studies, futures research, futurism research, futurism, or futurology is the systematic, interdisciplinary and holistic study of social/technological advancement, and other environmental trends; often for the purpose of exploring how people will live and work in the future. Predictive techniques, such as forecasting, can be applied, but contemporary futures studies scholars emphasize the importance of systematically exploring alternatives. In general, it can be considered as a branch of the social sciences and an extension to the field of history. Futures studies seeks to understand what is likely to continue and what could plausibly change. Part of the discipline thus seeks a systematic and pattern-based understanding of past and present, and to explore the possibility of future events and trends.

The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations, published in 2004, is a book written by James Surowiecki about the aggregation of information in groups, resulting in decisions that, he argues, are often better than could have been made by any single member of the group. The book presents numerous case studies and anecdotes to illustrate its argument, and touches on several fields, primarily economics and psychology.

Project Genoa was a software project commissioned by the United States' DARPA which was designed to analyze large amounts of data and metadata to help human analysts counter terrorism.

The Iowa Electronic Markets (IEM) are a group of real-money prediction markets/futures markets operated by the University of Iowa Tippie College of Business. Unlike normal futures markets, the IEM is not-for-profit; the markets are run for educational and research purposes.

Prediction markets company NewsFutures (2000-2010) evolved into Lumenogic (2010-2019), "a consulting firm that specializes in developing and customizing online systems for large organizations to use to gather so-called Collective Intelligence from their employees", which in turn became Hypermind.

Intrade.com was a web-based trading exchange whose members "traded" contracts between each other on the probabilities of various events occurring. After having been forced to exclude US traders in 2012, on 10 March 2013 Intrade suspended all trading, citing possible "financial irregularities". For a time after the suspension, the intrade.com website stated that they were working on a relaunch of the site, called "Intrade 2.0", but as of August 2014 it states that "It appears very unlikely now that Intrade will resume trading services in the way it had operated previously", and announced plans to close all accounts and refund monies by 31 December 2014.

The dumb agent theory (DAT) states that many people making individual buying and selling decisions will better reflect true value than any one individual can. In finance this theory is predicated on the efficient-market hypothesis (EMH). One of the first instances of the dumb agent theory in action was with the Policy Analysis Market (PAM); a futures exchange developed by DARPA. While this project was quickly abandoned by the Pentagon, its idea is now implemented in futures exchanges and prediction markets such as Intrade, Newsfutures and Predictify. The DAT is technically a hypothesis, not a theory.

Cyber Insider Threat, or CINDER, is a digital threat method. In 2010, DARPA initiated a program under the same name to develop novel approaches to the detection of activities within military-interest networks that are consistent with the activities of cyber espionage.

Bet2Give.com was an online prediction market company started in 2007 by Émile Servan-Schreiber and Maurice Balick, as an offshoot to their NewsFutures. Bet2Give's premise was that having the winnings going automatically to a charity of the winner's choice wouldn't seriously interfere with the efficacy of the prediction market. Servan-Schreiber had conducted research a few years earlier into whether betting with "play money" reduced prediction market accuracy, with encouraging results.

SciCast is a collaborative platform for science and technology forecasting created by George Mason University with the help of a grant from the Intelligence Advanced Research Projects Activity (IARPA) as part of its ForeST program. SciCast is currently on hiatus, after losing its main IARPA funding. It was expected to re-open in the fall of 2015 with the support of a major Science & Technology sponsor, but this had not occurred by January 2016.

PredictIt is a New Zealand-based online prediction market that offers exchanges on political and financial events. PredictIt is owned and operated by Victoria University of Wellington with support from Aristotle, Inc. The company's office is located in Washington, D.C. Only United States citizens can bet on the site.

Project Genoa II was a software project that originated with the United States Defense Advanced Research Projects Agency's Information Awareness Office and the successor to the Genoa program. Originally part of DARPA's wider Total Information Awareness project, it was later renamed Topsail and handed over to the Advanced Research and Development Activity for further development.

References

- ↑ "Programs: FutureMap". Information Awareness Office, United States Defense Advanced Research Projects Agency. 2003. Archived from the original on April 22, 2012. Retrieved October 29, 2019– via InfoWar.net. This is an archive of the official FutureMap and PAM webpage, which was eventually taken offline by DARPA.

- 1 2 3 4 Hanson, Robin (August 2007). "The Policy Analysis Market (A Thwarted Experiment in the Use of Prediction Markets for Public Policy)". Innovations: Technology, Governance, Globalization. 2 (3): 73–88. doi: 10.1162/itgg.2007.2.3.73 . S2CID 57563194.

- ↑ Hulse, Carl (July 29, 2003). "Threats and Responses: Plans and Criticisms; Pentagon Prepares a Futures Market on Terror Attacks". The New York Times . Retrieved October 29, 2019.

- 1 2 3 Lundin, Leigh (July 7, 2013). "PAM, PRISM, and Poindexter". SleuthSayers: Professional Crime-Writers and Crime-Fighters. Washington, DC. Retrieved January 4, 2014.

- ↑ "Policy Analysis Market and the Political Yuck Factor – why Americans shied away from a geopolitical futures market". SIRC.org. Social Issues Research Centre. 2004. Retrieved October 29, 2019.

- ↑ Lee, Newton (April 7, 2015). "6". Counterterrorism and Cybersecurity: Total Information Awareness (Second ed.). Springer. p. 146. ISBN 978-3-319-17244-6 . Retrieved November 17, 2022.

- ↑ "Poindexter to Leave Pentagon Research Job". The Washington Post . July 31, 2003. Archived from the original on August 5, 2012. Retrieved September 8, 2017.

- ↑ Gongloff, Mark (November 17, 2003). "Middle East futures market returns. Private firm will restart Pentagon project, but without contracts for violence, in 2004". CNN.com . Time Warner . Retrieved July 16, 2006.