A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. Debit cards are similar to a credit card, but the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

A telephone card, calling card or phone card for short, is a credit card-size plastic or paper card used to pay for telephone services. It is not necessary to have the physical card except with a stored-value system; knowledge of the access telephone number to dial and the PIN is sufficient. Standard cards which can be purchased and used without any sort of account facility give a fixed amount of credit and are discarded when used up; rechargeable cards can be topped up, or collect payment in arrears. The system for payment and the way in which the card is used to place a telephone call vary from card to card.

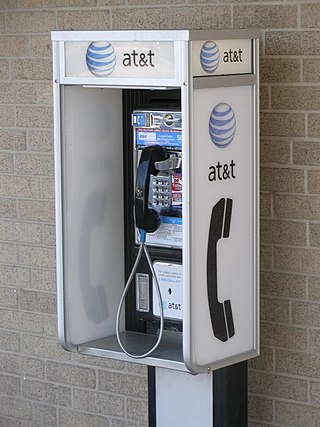

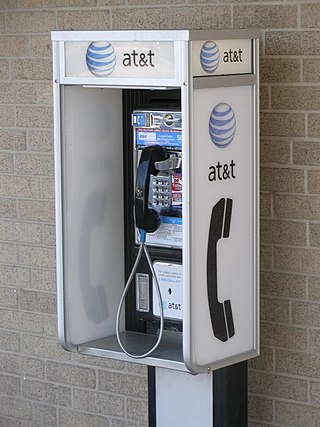

A payphone is typically a coin-operated public telephone, often located in a telephone booth or in high-traffic public areas. Prepayment is required by inserting coins or telephone tokens, swiping a credit or debit card, or using a telephone card.

A SIM lock, simlock, network lock, carrier lock or (master) subsidy lock is a technical restriction built into GSM and CDMA mobile phones by mobile phone manufacturers for use by service providers to restrict the use of these phones to specific countries and/or networks. This is in contrast to a phone that does not impose any SIM restrictions.

A toll-free telephone number or freephone number is a telephone number that is billed for all arriving calls. For the calling party, a call to a toll-free number from a landline is free of charge. A toll-free number is identified by a dialing prefix similar to an area code. The specific service access varies by country.

A conference call is a telephone call in which someone talks to several people at the same time. The conference call may be designed to allow the called party to participate during the call or set up so that the called party merely listens into the call and cannot speak.

PayPoint plc is a British business offering a system for paying bills in United Kingdom, Ireland and Romania. It is listed on the London Stock Exchange.

President's Choice Financial, commonly shortened to PC Financial, is the financial service brand of the Canadian supermarket chain Loblaw Companies.

Fido Solutions Inc. is a Canadian mobile network operator owned by Rogers Communications. Since its acquisition by Rogers in 2004, it has operated as a Mobile virtual network operator (MVNO) using the Rogers Wireless network.

GSM services are a standard collection of applications and features available over the Global System for Mobile Communications (GSM) to mobile phone subscribers all over the world. The GSM standards are defined by the 3GPP collaboration and implemented in hardware and software by equipment manufacturers and mobile phone operators. The common standard makes it possible to use the same phones with different companies' services, or even roam into different countries. GSM is the world's most dominant mobile phone standard.

A prepaid mobile device, also known as a pay-as-you-go (PAYG), pay-as-you-talk, pay and go, go-phone, prepay, or burner phone, is a mobile device such as a phone for which credit is purchased in advance of service use. The purchased credit is used to pay for telecommunications services at the point the service is accessed or consumed. If there is no credit, then access is denied by the cellular network or Intelligent Network. Users can top up their credit at any time using a variety of payment mechanisms.

Prepaid telephone calls are a popular way of making telephone calls which allow the caller to control spending without making a commitment with the telephone company.

A voucher is a bond of the redeemable transaction type which is worth a certain monetary value and which may be spent only for specific reasons or on specific goods. Examples include housing, travel, and food vouchers. The term voucher is also a synonym for receipt and is often used to refer to receipts used as evidence of, for example, the declaration that a service has been performed or that an expenditure has been made. Voucher is a tourist guide for using services with a guarantee of payment by the agency.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names, including bank cards, ATM cards, client cards, key cards or cash cards.

The Green Dot Corporation is an American financial technology and bank holding company headquartered in Austin, Texas. It is the world's largest prepaid debit card company by market capitalization. Green Dot is also a payment platform company and is the technology platform used by Apple Cash, Uber, and Intuit. The company was founded in 1999 by Steve Streit as a prepaid debit card for teenagers to shop online. In 2001, the company pivoted to serving the "unbanked" and "underbanked" communities. In 2010, Green Dot Corporation went public with a valuation of $2 billion. Since its inception, Green Dot has acquired a number of companies in the mobile, financial, and tax industries including Loopt, AccountNow, AchieveCard, UniRush Financial Services, and Santa Barbara Tax Products Group.

Euronet Worldwide is an American provider of global electronic payment services with headquarters in Leawood, Kansas. It offers automated teller machines (ATM), point of sale (POS) services, credit/debit card services, currency exchange and other electronic financial services and payments software. Among others, it provides the prepaid subsidiaries Transact, PaySpot, epay, Movilcarga, TeleRecarga and ATX.

A credit card is a payment card, usually issued by a bank, allowing its users to purchase goods or services, or withdraw cash, on credit. Using the card thus accrues debt that has to be repaid later. Credit cards are one of the most widely used forms of payment across the world.

A rechargeable calling card or a recharge card is a type of telephone card that the user can "recharge" or "top up" by adding money when the balance gets below a nominated amount. In reality, the rechargeable calling card is a specialised form of a prepaid or debit account.

The history of the prepaid mobile phones began in the 1990s when mobile phone operators sought to expand their market reach. Up until this point, mobile phone services were exclusively offered on a postpaid basis (contract-based), which excluded individuals with poor credit ratings and minors under the age of 18 In early 1991, Kenneth Johnson of Queens, New York along with Mark Feldman, Pedro Diaz and Kevin Lambright of Alicomm Mobile, was the first to successfully create a prepaid cellular phone and Network. His company expanded to a Sales force from Maine to Florida. Two years later others would come out with similar systems.

OneSimCard is a pay-as-you-go international cell phone service provider, offering a single GSM international SIM card granting service in nearly every country in the world.