A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual, without reference to income or resources. Poll is an archaic term for "head" or "top of the head". The sense of "counting heads" is found in phrases like polling place and opinion poll.

A tax is a mandatory financial charge or levy imposed on a taxpayer by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent.

The manorial system of New France, known as the seigneurial system, was the semi-feudal system of land tenure used in the North American French colonial empire. Economic historians have attributed the wealth gap between Quebec and other parts of Canada in the 19th and early 20th century to the persistent adverse impact of the seigneurial system.

In English law, a fee simple or fee simple absolute is an estate in land, a form of freehold ownership. A "fee" is a vested, inheritable, present possessory interest in land. A "fee simple" is real property held without limit of time under common law, whereas the highest possible form of ownership is a "fee simple absolute", which is without limitations on the land's use.

A property tax is an ad valorem tax on the value of a property.

A lease is a contractual arrangement calling for the user to pay the owner for the use of an asset. Property, buildings and vehicles are common assets that are leased. Industrial or business equipment are also leased. In essence, a lease agreement is a contract between two parties: the lessor and the lessee. The lessor is the legal owner of the asset, while the lessee obtains the right to use the asset in return for regular rental payments. The lessee also agrees to abide by various conditions regarding their use of the property or equipment. For example, a person leasing a car may agree to the condition that the car will only be used for personal use.

One of the central events of the French Revolution was the abolition of feudalism, and the old rules, taxes, and privileges left over from the ancien régime. The National Constituent Assembly, after deliberating on the night of 4 August 1789, announced, "The National Assembly abolishes the feudal system entirely." It abolished both the seigneurial rights of the Second Estate and the tithes gathered by the First Estate. The old judicial system, founded on the 13 regional parlements, was suspended in November 1789, and finally abolished in 1790.

Allodial title constitutes ownership of real property that is independent of any superior landlord. Allodial title is related to the concept of land held in allodium, or land ownership by occupancy and defence of the land.

Thangata is a word deriving from the Chewa language of Malawi which has changed its meaning several times, although all meanings relate to agriculture. Its original, pre-colonial usage related to reciprocal help given in neighbours' fields or freely-given agricultural labour as thanks for a benefit. In colonial times, between 1891 and 1962, it generally meant agricultural labour given in lieu of a cash rent, and generally without any payment, by a tenant on an estate owned by a European. Thangata was often exploited, and tenants could be forced to work on the owners' crops for four to six months annually when they could have cultivated their own crops. From the 1920s, the name thangata was extended to situations where tenants were given seeds to grow set quotas of designated crops instead of providing cash or labour. Both forms of thangata were abolished in 1962, but both before and after independence and up to the present, the term has been used for short-term rural casual work, often on tobacco estates, which is considered by workers to be exploitative.

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common.

A heritor was a privileged person in a parish in Scots law. In its original acceptation, it signified the proprietor of a heritable subject, but, in the law relating to parish government, the term was confined to such proprietors of lands or houses as were liable, as written in their title deeds, for the payment of public burdens, such as the minister's stipend, manse and glebe assessments, schoolmaster's salary, poor rates, rogue-money as well as road and bridge assessments, and others like public and county burdens or, more generally, cess, a land tax. A liferenter might be liable to cess and so be entitled to vote as an heritor in the appointment of the minister, schoolmaster, etc. The occasional female landholder so liable was known as a heritrix.

Taxation in the British Virgin Islands is relatively simple by comparative standards; photocopies of all of the tax laws of the British Virgin Islands (BVI) would together amount to about 200 pages of paper.

Carucage was a medieval English land tax enacted by King Richard I in 1194, based on the size—variously calculated—of the taxpayer's estate. It was a replacement for the danegeld, last imposed in 1162, which had become difficult to collect because of an increasing number of exemptions. Carucage was levied just six times: by Richard in 1194 and 1198; by John, his brother and successor, in 1200; and by John's son, Henry III, in 1217, 1220, and 1224, after which it was replaced by taxes on income and personal property.

Feudal aid is the legal term for one of the financial duties required of a feudal tenant or vassal to his lord. Variations on the feudal aid were collected in England, France, Germany and Italy during the Middle Ages, although the exact circumstances varied.

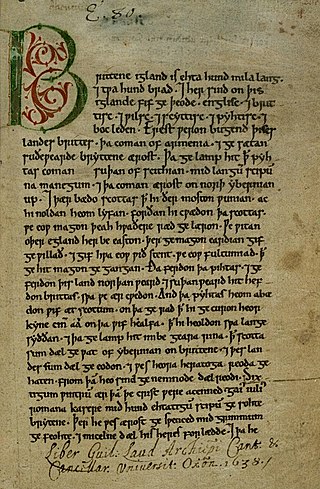

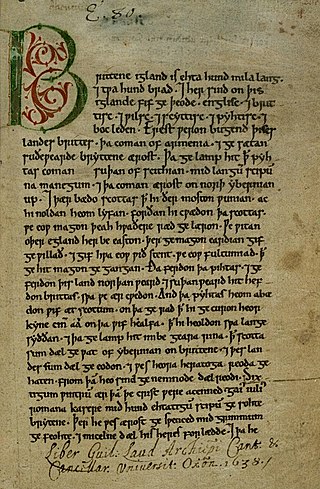

Taxation in medieval England was the system of raising money for royal and governmental expenses. During the Anglo-Saxon period, the main forms of taxation were land taxes, although custom duties and fees to mint coins were also imposed. The most important tax of the late Anglo-Saxon period was the geld, a land tax first regularly collected in 1012 to pay for mercenaries. After the Norman Conquest of England in 1066, the geld continued to be collected until 1162, but it was eventually replaced with taxes on personal property and income.

Government revenue or national revenue is money received by a government from taxes and non-tax sources to enable it, assuming full resource employment, to undertake non-inflationary public expenditure. Government revenue as well as government spending are components of the government budget and important tools of the government's fiscal policy. The collection of revenue is the most basic task of a government, as the resources released via the collection of revenue are necessary for the operation of government, provision of the common good and enforcement of its laws; this necessity of revenue was a major factor in the development of the modern bureaucratic state.

Most local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on real estate or personal property. The tax is nearly always computed as the fair market value of the property, multiplied by an assessment ratio, multiplied by a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. For the taxing authority, one advantage of the property tax over the sales tax or income tax is that the revenue always equals the tax levy, unlike the other types of taxes. The property tax typically produces the required revenue for municipalities' tax levies. One disadvantage to the taxpayer is that the tax liability is fixed, while the taxpayer's income is not.

Feudalism as practiced in the Kingdoms of England during the medieval period was a state of human society that organized political and military leadership and force around a stratified formal structure based on land tenure. As a military defence and socio-economic paradigm designed to direct the wealth of the land to the king while it levied military troops to his causes, feudal society was ordered around relationships derived from the holding of land. Such landholdings are termed fiefdoms, traders, fiefs, or fees.

Taxation in the Ottoman Empire changed drastically over time, and was a complex patchwork of different taxes, exemptions, and local customs.

The Kelantan Rebellion, also known as the Tok Janggut Uprising, was an anti-colonial uprising in 1915 in the British Protectorate of Kelantan in northeastern Malay Peninsula, now a state of Malaysia.