Related Research Articles

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: asset pricing and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance.

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

In economics, a transaction cost is a cost incurred when making an economic trade when participating in a market.

Energy economics is a broad scientific subject area which includes topics related to supply and use of energy in societies. Considering the cost of energy services and associated value gives economic meaning to the efficiency at which energy can be produced. Energy services can be defined as functions that generate and provide energy to the “desired end services or states”. The efficiency of energy services is dependent on the engineered technology used to produce and supply energy. The goal is to minimise energy input required to produce the energy service, such as lighting (lumens), heating (temperature) and fuel. The main sectors considered in energy economics are transportation and building, although it is relevant to a broad scale of human activities, including households and businesses at a microeconomic level and resource management and environmental impacts at a macroeconomic level.

Cost–benefit analysis (CBA), sometimes also called benefit–cost analysis, is a systematic approach to estimating the strengths and weaknesses of alternatives. It is used to determine options which provide the best approach to achieving benefits while preserving savings in, for example, transactions, activities, and functional business requirements. A CBA may be used to compare completed or potential courses of action, and to estimate or evaluate the value against the cost of a decision, project, or policy. It is commonly used to evaluate business or policy decisions, commercial transactions, and project investments. For example, the U.S. Securities and Exchange Commission must conduct cost-benefit analyses before instituting regulations or deregulations.

In economics, the term sunspots refers to an extrinsic random variable, that is, a random variable that does not affect economic fundamentals. Sunspots can also refer to the related concept of extrinsic uncertainty, that is, economic uncertainty that does not come from variation in economic fundamentals. David Cass and Karl Shell coined the term sunspots as a suggestive and less technical way of saying "extrinsic random variable".

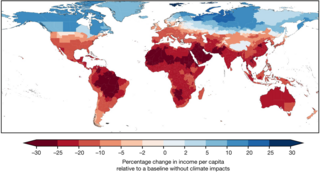

An economic analysis of climate change uses economic tools and models to calculate the magnitude and distribution of damages caused by climate change. It can also give guidance for the best policies for mitigation and adaptation to climate change from an economic perspective. There are many economic models and frameworks. For example, in a cost–benefit analysis, the trade offs between climate change impacts, adaptation, and mitigation are made explicit. For this kind of analysis, integrated assessment models (IAMs) are useful. Those models link main features of society and economy with the biosphere and atmosphere into one modelling framework. The total economic impacts from climate change are difficult to estimate. In general, they increase the more the global surface temperature increases.

Sanford "Sandy" Jay Grossman is an American economist and hedge fund manager specializing in quantitative finance. Grossman’s research has spanned the analysis of information in securities markets, corporate structure, property rights, and optimal dynamic risk management. He has published widely in leading economic and business journals, including American Economic Review, Journal of Econometrics, Econometrica, and Journal of Finance. His research in macroeconomics, finance, and risk management has earned numerous awards. Grossman is currently Chairman and CEO of QFS Asset Management, an affiliate of which he founded in 1988. QFS Asset Management shut down its sole remaining hedge fund in January 2014.

William Dawbney Nordhaus is an American economist. He was a Sterling Professor of Economics at Yale University, best known for his work in economic modeling and climate change, and a co-recipient of the 2018 Nobel Memorial Prize in Economic Sciences. Nordhaus received the prize "for integrating climate change into long-run macroeconomic analysis".

Ricardo Jorge Caballero is a Chilean macroeconomist who is the Ford International Professor of Economics at the Massachusetts Institute of Technology. He also served as the Chairman of MIT's Economic Department from 2008 to 2011. He is a director of the World Economic Laboratory at MIT and an NBER Research Associate. Caballero received his PhD from MIT in 1988, and he taught at Columbia University before returning to the MIT faculty.

Martin Lawrence Weitzman was an economist and a professor of economics at Harvard University. He was among the most influential economists in the world according to Research Papers in Economics (RePEc). His latest research was largely focused on environmental economics, specifically climate change and the economics of catastrophes.

Integrated assessment modelling (IAM) or integrated modelling (IM) is a term used for a type of scientific modelling that tries to link main features of society and economy with the biosphere and atmosphere into one modelling framework. The goal of integrated assessment modelling is to accommodate informed policy-making, usually in the context of climate change though also in other areas of human and social development. While the detail and extent of integrated disciplines varies strongly per model, all climatic integrated assessment modelling includes economic processes as well as processes producing greenhouse gases. Other integrated assessment models also integrate other aspects of human development such as education, health, infrastructure, and governance.

Financial innovation is the act of creating new financial instruments as well as new financial technologies, institutions, and markets. Recent financial innovations include hedge funds, private equity, weather derivatives, retail-structured products, exchange-traded funds, multi-family offices, and Islamic bonds (Sukuk). The shadow banking system has spawned an array of financial innovations including mortgage-backed securities products and collateralized debt obligations (CDOs).

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

Jacques H. Drèze was a Belgian economist noted for his contributions to economic theory, econometrics, and economic policy as well as for his leadership in the economics profession. Drèze was the first President of the European Economic Association in 1986 and was the President of the Econometric Society in 1970.

Dennis J. Snower is an American-German economist, specialising in macroeconomic theory and policy, labor economics, digital governance, social economics, and the psychology of economic decisions in "caring economics".

In economics, non-convexity refers to violations of the convexity assumptions of elementary economics. Basic economics textbooks concentrate on consumers with convex preferences and convex budget sets and on producers with convex production sets; for convex models, the predicted economic behavior is well understood. When convexity assumptions are violated, then many of the good properties of competitive markets need not hold: Thus, non-convexity is associated with market failures, where supply and demand differ or where market equilibria can be inefficient. Non-convex economies are studied with nonsmooth analysis, which is a generalization of convex analysis.

Factor investing is an investment approach that involves targeting quantifiable firm characteristics or "factors" that can explain differences in stock returns. Security characteristics that may be included in a factor-based approach include size, low-volatility, value, momentum, asset growth, profitability, leverage, term and carry.

Gilbert E. Metcalf is the John DiBiaggio Professor of Citizenship and Public Service, emeritus, at Tufts University, where he was a professor of economics. Currently, he is a visiting professor at the MIT Sloan School as well as a research associate at the National Bureau of Economic Research and a University Fellow at Resources For The Future. Under the Obama administration, he served as the deputy assistant secretary for environment and energy at the U.S. Department of Treasury where he was the founding U.S. Board Member for the UN based Green Climate Fund. His research interests are in the areas of energy, environmental, and climate policy.

Pasquale Lucio Scandizzo is an Italian economist, academic and author. He is a Senior Economic Consultant for the World Bank, Senior Advisor of the International Renewable Energy Agency (IRENA), Senior Fellow of The Tor Vergata Foundation of the University of Rome Tor Vergata, Member of the Expert Committee of the Council of the Economy and Labor (CNEL), Scientific Director of OpenEconomics, and President of OpenEconomics International. He was a Senior Economic Advisor at the Ministry of Economics and Finance in Italy, in addition to holding positions as Professor of Economic and Financial Policy and Research Center Director at the University of Rome Tor Vergata and President of the Salerno Savings Bank Foundation.

References

- ↑ http://web.mit.edu/rpindyck/www/resume.pdf [ bare URL PDF ]

- ↑ Pindyck, Robert S. (May 1973). "Optimal Policies for Economic Stabilization". Econometrica. 41 (3): 529–560. doi:10.2307/1913374. ISSN 0012-9682. JSTOR 1913374.

- ↑ Pindyck, Robert (1973). Optimal Planning for Economic Stabilization. North-Holland Publishing Company.

- ↑ Pindyck, Robert S.; Roberts, Steven M. (October 1976). "Instruments, Intermediate Targets, and Monetary Controllability". International Economic Review. 17 (3): 627. doi:10.2307/2525793. ISSN 0020-6598. JSTOR 2525793.

- ↑ Pindyck, Robert, and Paul MacAvoy (1975). The Economics of the Natural Gas Shortage: 1960-1980. North-Holland Publishing Company.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ↑ Pindyck, Robert S. (1974). "The Regulatory Implications of Three Alternative Econometric Supply Models of Natural Gas". The Bell Journal of Economics and Management Science. 5 (2): 633–645. doi:10.2307/3003125. ISSN 0005-8556. JSTOR 3003125.

- ↑ Pindyck, Robert (1979). The Structure of World Energy Demand. M.I.T. Press.

- ↑ Pindyck, Robert S. (May 1979). "Interfuel Substitution and the Industrial Demand for Energy: An International Comparison". The Review of Economics and Statistics. 61 (2): 169–179. doi:10.2307/1924584. hdl: 1721.1/31258 . ISSN 0034-6535. JSTOR 1924584.

- ↑ Pindyck, Robert S. (January 1980). "International comparisons of the residential demand for energy". European Economic Review. 13 (1): 1–24. doi:10.1016/0014-2921(80)90044-6. hdl: 1721.1/31264 . ISSN 0014-2921.

- ↑ Pindyck, Robert S. (April 1978). "Gains to Producers from the Cartelization of Exhaustible Resources". The Review of Economics and Statistics. 60 (2): 238–251. doi:10.2307/1924977. hdl: 1721.1/27836 . ISSN 0034-6535. JSTOR 1924977.

- ↑ Pindyck, Robert S. (1977). "Cartel Pricing and the Structure of the World Bauxite Market". The Bell Journal of Economics. 8 (2): 343–360. doi:10.2307/3003291. hdl: 1721.1/31244 . ISSN 0361-915X. JSTOR 3003291.

- ↑ Hnyilicza, Esteban; Pindyck, Robert S. (August 1976). "Pricing policies for a two-part exhaustible resource cartel". European Economic Review. 8 (2): 139–154. doi:10.1016/0014-2921(76)90009-x. ISSN 0014-2921.

- ↑ Pindyck, Robert S. (October 1978). "The Optimal Exploration and Production of Nonrenewable Resources". Journal of Political Economy. 86 (5): 841–861. doi:10.1086/260714. ISSN 0022-3808. S2CID 153378297.

- ↑ Pindyck, Robert S. (December 1980). "Uncertainty and Exhaustible Resource Markets". Journal of Political Economy. 88 (6): 1203–1225. doi:10.1086/260935. ISSN 0022-3808. S2CID 9401352.

- ↑ Pindyck, Robert S. (April 1984). "Uncertainty in the Theory of Renewable Resource Markets". The Review of Economic Studies. 51 (2): 289–303. doi:10.2307/2297693. ISSN 0034-6527. JSTOR 2297693.

- ↑ Pindyck, Robert S. (May 1993). "The Present Value Model of Rational Commodity Pricing". The Economic Journal. 103 (418): 511–530. doi:10.2307/2234529. hdl: 1721.1/2378 . ISSN 0013-0133. JSTOR 2234529. S2CID 5245800.

- ↑ Pindyck, Robert S. (1994). "Inventories and the Short-Run Dynamics of Commodity Prices". The RAND Journal of Economics. 25 (1): 141–159. hdl: 1721.1/2297 . ISSN 0741-6261. JSTOR 2555858. S2CID 12913470.

- ↑ Pindyck, Robert S.; Rotemberg, Julio J. (December 1990). "The Excess Co-Movement of Commodity Prices". The Economic Journal. 100 (403): 1173. doi:10.2307/2233966. hdl: 1721.1/2193 . ISSN 0013-0133. JSTOR 2233966. S2CID 1108056.

- ↑ Pindyck, Robert S. (2004). "Volatility and commodity price dynamics". Journal of Futures Markets. 24 (11): 1029–1047. doi:10.1002/fut.20120. hdl: 1721.1/44979 . ISSN 0270-7314.

- ↑ Pindyck, Robert S. (2001-07-01). "The Dynamics of Commodity Spot and Futures Markets: A Primer". The Energy Journal. 22 (3): 1–29. doi:10.5547/issn0195-6574-ej-vol22-no3-1. ISSN 0195-6574. S2CID 3201269.

- ↑ Knittel, Christopher R.; Pindyck, Robert S. (2016-04-01). "The Simple Economics of Commodity Price Speculation". American Economic Journal: Macroeconomics. 8 (2): 85–110. doi:10.1257/mac.20140033. hdl: 1721.1/108833 . ISSN 1945-7707. S2CID 8557775.

- ↑ Pindyck, Robert (December 1988). "Irreversible Investment, Capacity Choice, and the Value of the Firm". American Economic Review.

- ↑ Pindyck, Robert (September 1991). "Irreversibility, Uncertainty, and Investment". Journal of Economic Literature.

- ↑ Majd, Saman; Pindyck, Robert S. (March 1987). "Time to build, option value, and investment decisions". Journal of Financial Economics. 18 (1): 7–27. doi:10.1016/0304-405x(87)90059-6. ISSN 0304-405X.

- ↑ Pindyck, Robert (March 1993). "A Note on Competitive Investment under Uncertainty". American Economic Review.

- ↑ Pindyck, Robert S. (August 1993). "Investments of uncertain cost". Journal of Financial Economics. 34 (1): 53–76. doi:10.1016/0304-405x(93)90040-i. hdl: 1721.1/50176 . ISSN 0304-405X. S2CID 6518142.

- ↑ Pindyck, Robert S.; Solimano, Andrés (January 1993). "Economic Instability and Aggregate Investment". NBER Macroeconomics Annual. 8: 259–303. doi:10.1086/654223. hdl: 1721.1/2462 . ISSN 0889-3365. S2CID 6110809.

- ↑ Caballero, Ricardo J.; Pindyck, Robert S. (August 1996). "Uncertainty, Investment, and Industry Evolution". International Economic Review. 37 (3): 641. doi:10.2307/2527445. hdl: 1721.1/2433 . ISSN 0020-6598. JSTOR 2527445. S2CID 13859679.

- ↑ Pindyck, Robert S. (2007-01-01). "Mandatory Unbundling and Irreversible Investment in Telecom Networks". Review of Network Economics. 6 (3). doi: 10.2202/1446-9022.1121 . ISSN 1446-9022. S2CID 201100689.

- ↑ Pindyck, Robert S (July 2000). "Irreversibilities and the timing of environmental policy". Resource and Energy Economics. 22 (3): 233–259. Bibcode:2000REEco..22..233P. doi:10.1016/s0928-7655(00)00033-6. hdl: 1721.1/2737 . ISSN 0928-7655.

- ↑ Pindyck, Robert S. (August 2002). "Optimal timing problems in environmental economics". Journal of Economic Dynamics and Control. 26 (9–10): 1677–1697. doi:10.1016/s0165-1889(01)00090-2. hdl: 1721.1/44973 . ISSN 0165-1889.

- ↑ Pindyck, Robert S. (2007-01-01). "Uncertainty in Environmental Economics". Review of Environmental Economics and Policy. 1 (1): 45–65. doi:10.1093/reep/rem002. hdl: 1721.1/45063 . ISSN 1750-6816.

- ↑ Pindyck, Robert S. (May 2012). "Uncertain outcomes and climate change policy". Journal of Environmental Economics and Management. 63 (3): 289–303. Bibcode:2012JEEM...63..289P. doi:10.1016/j.jeem.2011.12.001. hdl: 1721.1/66946 . ISSN 0095-0696.

- ↑ Pindyck, Robert S. (2017-05-30). "Coase Lecture-Taxes, Targets and the Social Cost of Carbon". Economica. 84 (335): 345–364. doi: 10.1111/ecca.12243 . ISSN 0013-0427.

- ↑ Pindyck, Robert (March 2021). "What We Know and Don't Know about Climate Change, and Implications for Policy". Environmental and Energy Policy and the Economy, University of Chicago Press. 2.

- ↑ Pindyck, Robert (September 2013). "Climate Change Policy: What Do the Models Tell Us?" (PDF). Journal of Economic Literature. 51 (3): 860–872. doi:10.1257/jel.51.3.860. S2CID 10182480.

- ↑ Pindyck, Robert S. (2017-01-01). "The Use and Misuse of Models for Climate Policy". Review of Environmental Economics and Policy. 11 (1): 100–114. doi:10.1093/reep/rew012. hdl: 1721.1/120585 . ISSN 1750-6816.

- ↑ Pindyck, Robert (2022). Climate Future: Averting and Adapting to Climate Change. New York: Oxford University Press.

- ↑ Martin, Ian W.R. and Robert Pindyck (October 2015). "Averting Catastrophes: The Strange Economics of Scylla and Charybdis". American Economic Review. 105 (10): 2947–2985. doi:10.1257/aer.20140806. hdl: 1721.1/109147 . S2CID 14778466.

- ↑ Martin, Ian W.R. and Robert Pindyck (February 2021). "Welfare Costs of Catastrophes: Lost Consumption and Lost Lives". The Economic Journal. 131 (634): 946–969. doi:10.1093/ej/ueaa099. hdl: 1721.1/133700 .

- ↑ "Real Options Selected Bibliography: The Dixit & Pindyck Book".