The Federal Housing Administration (FHA),also known as the Office of Housing within the Department of Housing and Urban Development (HUD),is a United States government agency founded by President Franklin Delano Roosevelt,established in part by the National Housing Act of 1934. Its primary function is to provide insurance for mortgages originated by private lenders for various types of properties,including single-family homes,multifamily rental properties,hospitals,and residential care facilities. FHA mortgage insurance serves to safeguard these private lenders from financial losses. In the event that a property owner defaults on their mortgage,FHA steps in to compensate the lender for the outstanding principal balance.

The United States Department of Housing and Urban Development (HUD) is one of the executive departments of the U.S. federal government. It administers federal housing and urban development laws. It is headed by the secretary of housing and urban development,who reports directly to the president of the United States and is a member of the president's Cabinet.

The Government National Mortgage Association (GNMA),or Ginnie Mae,is a government-owned corporation of the United States Federal Government within the Department of Housing and Urban Development (HUD). It was founded in 1968 and works to expand affordable housing by guaranteeing housing loans (mortgages) thereby lowering financing costs such as interest rates for those loans. It does that through guaranteeing to investors the on-time payment of mortgage-backed securities (MBS) even if homeowners default on the underlying mortgages and the homes are foreclosed upon.

The Federal National Mortgage Association (FNMA),commonly known as Fannie Mae,is a United States government-sponsored enterprise (GSE) and,since 1968,a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal,the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS),allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations. Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC),better known as Freddie Mac.

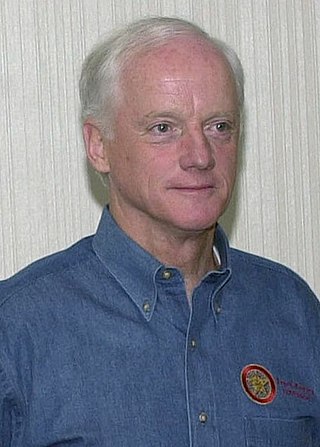

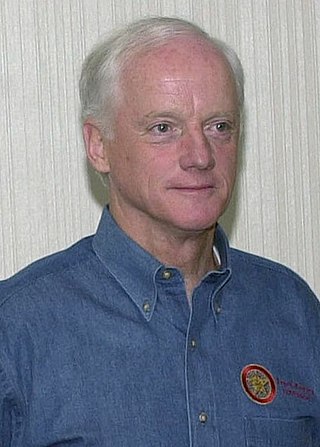

Francis Anthony Keating II is an American attorney and politician who served as the 25th governor of Oklahoma from 1995 to 2003.

The Federal Home Loan Mortgage Corporation (FHLMC),commonly known as Freddie Mac,is a publicly traded,government-sponsored enterprise (GSE),headquartered in Tysons,Virginia. The FHLMC was created in 1970 to expand the secondary market for mortgages in the US. Along with its sister organization,the Federal National Mortgage Association,Freddie Mac buys mortgages,pools them,and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purchases. The name "Freddie Mac" is a variant of the FHLMC initialism of the company's full name that was adopted officially for ease of identification.

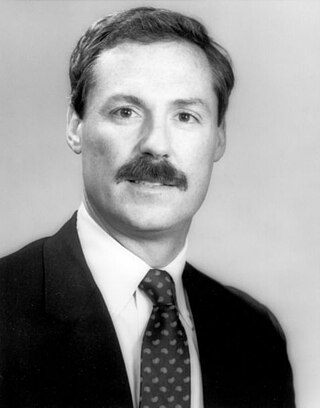

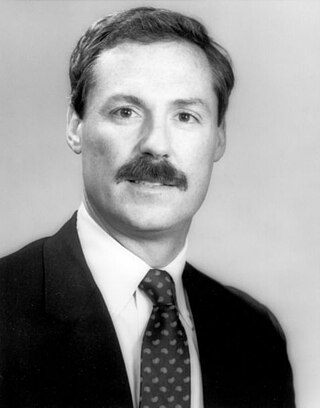

David Kemp Karnes was an American politician,businessman,and attorney. He was a United States Senator from Nebraska from 1987 to 1989,and was president and chief executive officer of The Fairmont Group Incorporated,a merchant banking/consulting company with offices in Omaha and the District of Columbia. Karnes also served in an "of counsel" capacity to the national law firm of Kutak Rock and practiced out of the firm's Omaha,Nebraska and Washington,D.C. offices. Karnes was also involved in numerous civic,educational,and charitable organizations both in Nebraska and nationally.

The Federal Housing Finance Board (FHFB) was an independent agency of the United States government established in 1989 in the aftermath of the savings and loan crisis to take over management of the Federal Home Loan Banks from the Federal Home Loan Bank Board (FHLBB),and was superseded by the Federal Housing Finance Agency (FHFA) in 2008.

The Assistant Secretary for Housing,who also carries the title Federal Housing Commissioner,is a position within the United States Department of Housing and Urban Development. The Assistant Secretary is responsible for overseeing the $400 billion Federal Housing Administration insurance portfolio and the Department of Housing and Urban Development's regulatory responsibilities in the area of the Real Estate Settlement Procedures Act,the housing mission of Fannie Mae and Freddie Mac,and the manufactured housing industry.

Brian Darrell Montgomery is an American government official who served as the United States Deputy Secretary of Housing and Urban Development from 2020 to 2021. Montgomery previously served as Assistant Secretary of Housing and Urban Development for Housing and Federal Housing Commissioner from 2005 to 2009 and from 2018 to 2020. Montgomery is the only individual to serve as FHA Commissioner twice and under three U.S. Presidents.

The United States Housing and Economic Recovery Act of 2008 was designed primarily to address the subprime mortgage crisis. It authorized the Federal Housing Administration to guarantee up to $300 billion in new 30-year fixed rate mortgages for subprime borrowers if lenders wrote down principal loan balances to 90 percent of current appraisal value. It was intended to restore confidence in Fannie Mae and Freddie Mac by strengthening regulations and injecting capital into the two large U.S. suppliers of mortgage funding. States are authorized to refinance subprime loans using mortgage revenue bonds. Enactment of the Act led to the government conservatorship of Fannie Mae and Freddie Mac.

The Federal Housing Finance Agency (FHFA) is an independent federal agency in the United States created as the successor regulatory agency of the Federal Housing Finance Board (FHFB),the Office of Federal Housing Enterprise Oversight (OFHEO),and the U.S. Department of Housing and Urban Development government-sponsored enterprise mission team,absorbing the powers and regulatory authority of both entities,with expanded legal and regulatory authority,including the ability to place government-sponsored enterprises (GSEs) into receivership or conservatorship.

Russell M. Perry is an American businessman,banker,publisher,and broadcaster from Oklahoma. Perry served as the Oklahoma Secretary of Commerce from 1999 to 2000,having been appointed by governor of Oklahoma Frank Keating. Perry was the first African American to hold that position. After being nominated by Keating,Perry was never confirmed by the Oklahoma Senate. Perry's appointment became a central issue in the 2001 Oklahoma Supreme Court case Keating v. Edmondson.

Howard G. Barnett Jr. is an American businessman and politician from Oklahoma who is currently serving as the President of Oklahoma State University-Tulsa. Barnett previously served as the Oklahoma Secretary of Commerce under Governor of Oklahoma Frank Keating from 1998 to 1999. Keating appointed Barnett to serve concurrently as the Director of Oklahoma Department of Commerce.

E. Dean Werries (1926–2012) was an American businessman from Oklahoma. Werries previously served as the Oklahoma Secretary of Commerce under Governor of Oklahoma Frank Keating from 1995 to 1997. Prior to his service as Secretary,Werries served as chairman of Sonic and as chairman and chief executive officer of the Fleming Companies,Inc.

Neal A. "Chief" McCaleb is an American civil engineer and Republican politician from Oklahoma. A member of the Chickasaw Nation,McCaleb served in several positions in the Oklahoma state government and then as the Assistant Secretary of the Interior for Indian Affairs under President George W. Bush.

Guy T. O. Hollyday (1893–1991) was an American proponent of urban housing renewal.

Michael Bright served as interim president of Ginnie Mae from July 2017 to January 2019 and is CEO of the Structured Finance Association (SFA),the securitization industry's largest trade association. President Donald Trump nominated Bright to serve as Ginnie Mae's permanent president in May 2018 but the nomination was never confirmed despite being voted out of the Committee on Banking,Housing,and Urban Affairs by a unanimous voice vote.

Arthur J. Hill was an American banker who served as Assistant Secretary of Housing and Urban Development for Housing during the presidency of George H.W. Bush.